We will address arrears as part of external debt restructuring – Government to IPPs

Government has assured the Independent Power Producers (IPPs) that it is taking the necessary steps to address the energy sector arrears as part of its external debt restructuring.

This is to forestall the build-up of future arrears and improve on efficiency within the sector.

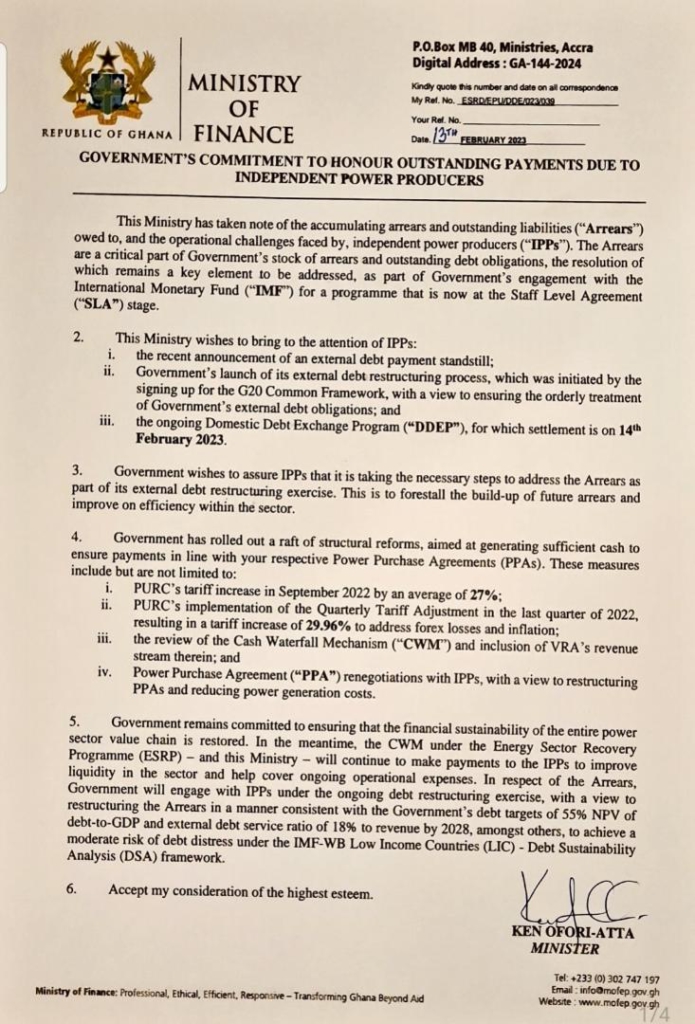

In a letter to the IPPs signed by the Finance Minister, Ken Ofori-Atta, sighted by Joy Business, government said it has rolled out a raft of structural reforms, aimed at generating sufficient cash to ensure payments in line with the respective Power Purchase Agreements (PPAs).

These measures include but are not limited to the Public Utilities and Regulatory Commission (PURCs) tariff increase in September 2022 by an average of 27%; PURC’s implementation of the Quarterly Tariff Adjustment in the last quarter of 2022, resulting in a tariff increase of 29.96% to address forex losses and inflation; the review of the Cash Waterfall Mechanism and Power Purchase Agreement renegotiations with IPPs, with a view to restructuring PPAs and reducing power generation costs.

The government stock of arrears and an outstanding debt obligations are part of conditionalities for an International Monetary Fund programme.

The letter further added that “the government remains committed to ensuring that the financial sustainability of the entire power sector value chain is restored. In the meantime, the CWM under the Energy Sector Recovery (ESRP) – and this ministry – will continue to make payments to the IPPs to improve liquidity in the sector and help cover ongoing operational expenses.”

“In respect of the arrears, government will engage with the IPPs under the ongoing debt restructuring exercise, with a view to restructuring the arrears in a manner consistent with the government debt targets of 55% NPV of debt-to-GDP and external debt service ratio of 18% to revenue by 2028, amongst others to achieve a moderate risk of debt distress under the IMF-WB [World Bank] Low Income Countries (LIC) – Debt Sustainability Analysis (DSA) framework”, it further stated.

“Accept my consideration of highest esteem”, the statement added.