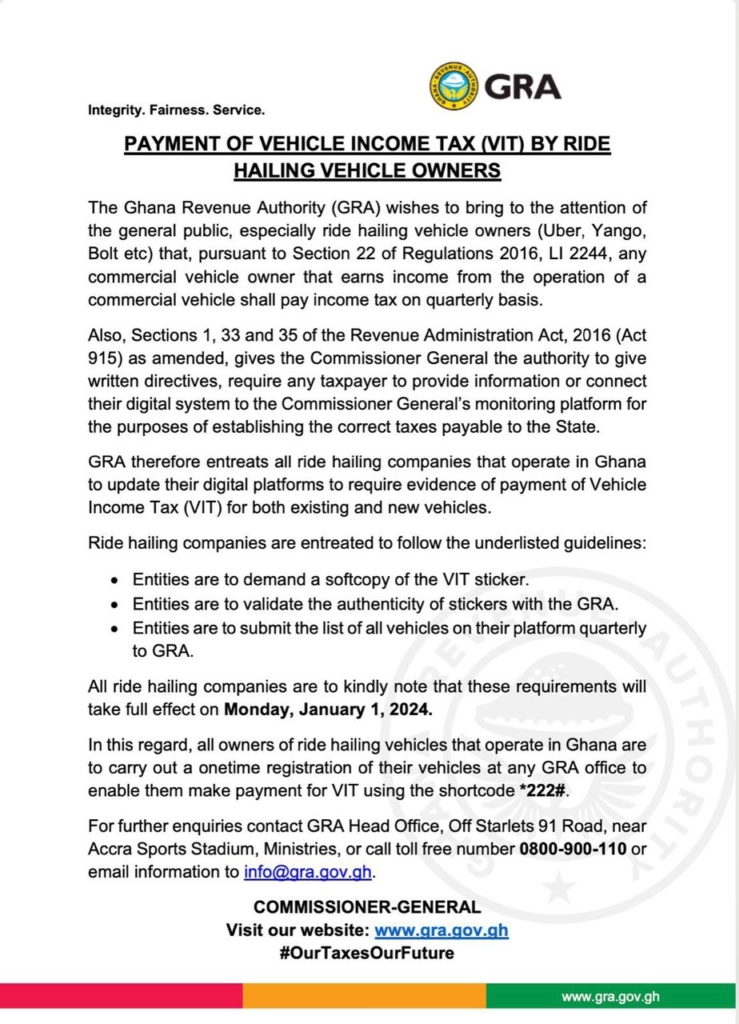

Ride-hailing operators in Ghana for Uber, Yango, Bolt, and others will start paying Value Income Tax(VIT) effective January 1, 2024, the Ghana Revenue Authority (GRA) has announced.

In a statement released on December 20, 2023, GRA announced that all commercial vehicle owners, including ride-hailing owners, must pay income tax every quarter under Section 22 of Regulations 2016, LI 2244.

GRA said, “Sections 1, 33 and 35 of the Revenue Administration Act, 2016 (Act 915) as amended, gives the Commissioner General the authority to give written directives, require any taxpayer to provide information or connect their digital system to the Commissioner General’s monitoring platform for the purpose of establishing the correct taxes payable to the state”.

GRA further entreated all ride-hailing companies operating in the country to update their digital platforms to require evidence of payment of Vehicle Income Tax(VIT) for existing and new vehicles.

Moreover, ride-hailing companies are now required to demand a digital copy of the VIT sticker to validate the authenticity of VIT stickers with the GRA and submit the list of all vehicles on their platform quarterly to GRA.

“In this regard, all owners of ride-hailing vehicles that operate in Ghana are to carry out a one-time registration of their vehicles at any GRA office to enable them to make payment for VIT using the shortcode *222#.

“Failure to comply with these regulations could result in penalties for both drivers and ride-hailing companies. The GRA encourages all drivers and companies to register their vehicles and update their platforms before the January 1 deadline,” the statement added.

Find the full statement below.