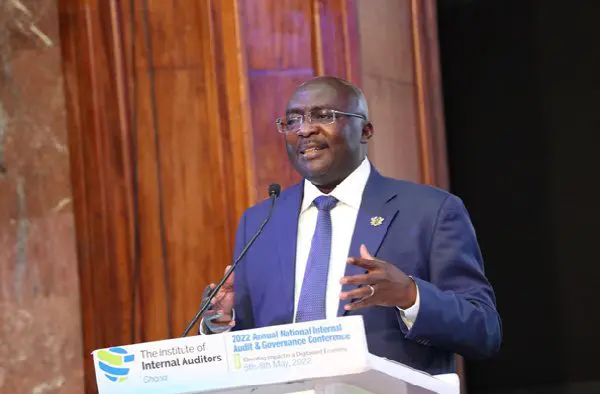

To keep looking for taxes from existing tax payers is a lazy approach-Bawumia tells GRA

Vice President Dr Mahamudu Bawumia has called on the Ghana Revenue Authority (GRA) to broaden its tax net to bring on board what he describes as the “vast majority” of non-taxpayers in the country.

“It is a very lazy approach to go and keep looking for taxes from people who are paying taxes already when you could look at those who are not paying taxes, who are the vast majority. They should be the ones that GRA should focus on, and we would get more taxes from the vast majority.”

He urged the Ghana Revenue Authority (GRA) to capitalise on the connection between the Ghana Card and Tax Identification Number (TIN) to enhance the identification and tax collection processes for individuals and businesses.

Dr Bawumia emphasised the need for a more effective strategy targeting those who are not yet tax-compliant.

“By linking the Ghana Card number and the TIN, GRA can tell who has filed and who has not filed their tax, and so it is rich data that is available to GRA, and I am asking GRA to use that data,” he stressed.

Addressing the 57th Congregation at KNUST on Friday, November 24, the Vice President advised the GRA to consider implementing a bonus system based on new taxpayers that GRA officers bring into the scheme.

Furthermore, the Vice President announced that starting from December 2023, the government will introduce a new system where every child born in Ghana will be issued a Ghana Card number.

Dr Bawumia also mentioned that from next year, a credit scoring system will be implemented based on the Ghana Card, rewarding those diligent in loan repayment with lower interest rates and increased access to loans.