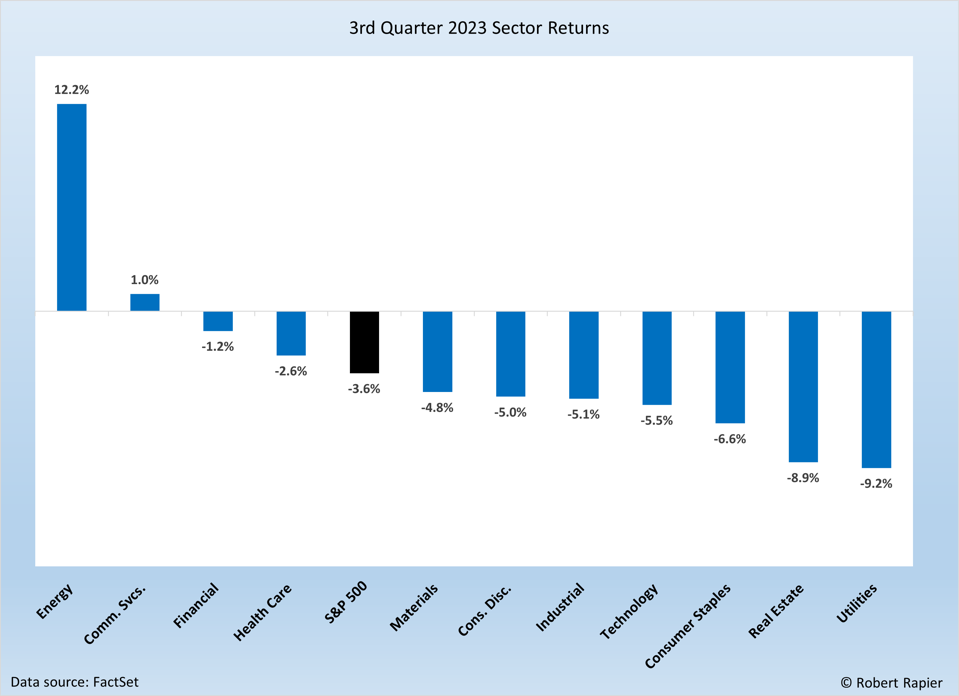

On September 29th the third quarter of 2023 came to a close. The S&P 500 lost 3.6% for the quarter, and nine of eleven S&P 500 sectors turned in a negative return in Q3.

Particularly hard hit were defensive income sectors like consumer staples, real estate, and utilities.

The clear star of the quarter was the energy sector, which returned double digits on the back of energy prices that are once again on the rise. Through Q3 the energy sector is up 6.1% year-to-date (YTD), after leading all sectors in 2021 and 2022.

Q3 2023 Sector Returns. ROBERT RAPIER

According to data provider FactSet — which I use to analyze companies — the average upstream company returned 14.3% in Q3. These are the companies that produce oil and gas. Of the 51 companies that FactSet classifies as “upstream”, only seven had a negative return in Q3. YTD the average upstream company is up 2.9%.

The top performers in Q3 in the upstream sector were mostly small companies, like BP Prudhoe Bay Royalty Trust (+56.8%) and Gran Tierra Energy (+41.3%). The best-performing large Upstream company was Cenovus Energy (+23.2%).

Among the 45 companies that FactSet classifies as “midstream”, the average return was 9.3%. KNOT Offshore Partners LP was the top performer in this category, notching a 38.9% return.

The integrated supermajors bounced back from a second quarter decline, gaining 10.5%. Among this group, the best performer in Q3 was TotalEnergies SE with a total return of 15.2%. Shell remains the top performer in its class for the year with a return of 14.8%.

The Big Three refiners — Marathon PetroleumMPC , Valero, and Phillips 66PSX — significantly outperformed the broader energy sector, gaining an average of 26.5%. After a negative Q2, Marathon was the top performer, gaining 32.4% during the quarter.

As I noted at the end of Q2, “OPEC production cuts will likely be felt before the year ends. This should prop up oil prices and provide better prospects for energy companies in the second half of the year.”

That was certainly the case in Q3, and OPEC+ supply reductions will likely continue to be the primary driver in the oil markets through next year’s presidential election. This is bullish for the oil markets but presents challenges for inflation control and economic stability as the U.S. heads into a presidential election year.