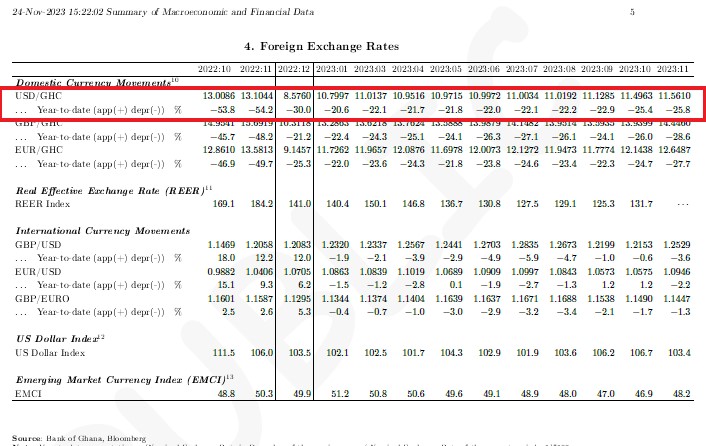

In 2022, the Ghana cedi suffered heavy knocks, with consistent year-to-date depreciation against the US dollar beyond 50 per cent for many months, attracting widespread condemnation and vile criticism of the government.

However, Ghana’s economic managers navigated the ship against a turbulent financial terrain, making significant gains against the US dollar to end 2022 with a year-to-date depreciation of 30 per cent, according to data from the Bank of Ghana (BoG).

The government managed to keep the depreciation steady and further down throughout the entire year of 2023, with a notable year-to-date depreciation of 15.57% in the retail market and 27.81% in the interbank market against the US dollar by the close of the year.

Figures from Databank, accessed by The Ghana Report on Friday, January 5, 2023, were consistent with that of Bloomberg at a 27.81% year-to-date depreciation in the interbank market.

At the end of trading on the last day of the year on December 29, 2023, Bloomberg quoted the cedi at GH¢11.95 pesewas to the American greenback compared to the forex bureaus who traded a cedi to one US dollar at GH¢12.18, while the BoG pegged the dollar at GH¢11.64.

The buoyant strength injected into the currency meant the Ghana cedi scaled over Bloomberg’s verdict of worst-performing African currencies for 2023.

This was mainly because of a 3-year International Monetary Fund (IMF) programme, which boosted Ghana’s currency.

An official release from the IMF showed that the IMF Executive Board approved, on May 17, 2023, an SDR 2.242 billion (about $3 billion) 36-month Extended Credit Facility (ECF) arrangement for Ghana.

This decision enabled an immediate disbursement of $600 million, equivalent to SDR 451.4 million. The rest is expected to be disbursed in tranches every six months, following programme reviews approved by the IMF Executive Board.

But before then, the government embarked on a Domestic Debt Exchange Programme (DDEP) to balance its books and lift the country from huge debts.

Being an import-driven economy, the government also issued a directive to slash commodity inflows into the country to reduce the high demand for dollars that place undue pressure on the cedi.

A testament to this stabilization is the current account’s notable shift from a deficit of $1.8 billion in 2022 to a surplus of $1.0 billion in 2023.

The Bank of Ghana has indicated that these positive developments across various financial accounts have had an effect on the country’s balance of payments.

Additionally, the arrival of the first tranche of the Cocoa Syndicated Loan further alleviated the demand pressure on the US dollar, fostering market expectations of strengthened cedi performance in upcoming periods.

2024 Outlook

Ghana will head to the polls this year, and the risk factor of throwing the economy out of gear due to over-expenditure by the incumbent in order to retain power becomes an issue.

However, analysts are optimistic that the trend associated with election years may not be repeated, hence the stability of the currency.

Alex Boahen, Head of Research at DataBank, believes the IMF programme will keep government expenditures in check.

He told The Ghana Report that he foresees a cedi to one US dollar hovering around GH¢12 for the year.

“Generally, we expect the cedi to remain stable this year,” he said. “The government is more likely to conclude the restructuring of external debts, which will trigger the release of further funding from IMF. The economy seems to be recovering, especially when you look at inflation, which is coming down. We are also witnessing a trend where central banks around the globe are set to ease their monetary policy, and Ghana is no exception”.

“So, there are a number of factors that will play out favourably for the economy that will trickle down to the performance of the cedi,” he added.