The Ghana Private Road Transport Union (GPRTU) has threatened to increase transport fares by 60% due to the introduction of the Emissions Levy Bill.

Parliament, by majority decision, passed the Emissions Levy Bill, which will, among other things, charge all petrol and diesel car owners GH₵100 every year beginning in January 2024.

The government introduced this new tax bill in Parliament to promote using eco-friendly energy sources to power vehicles.

The initiative is part of the government’s drive towards more climate-positive actions and offsetting carbon output.

However, the Spokesperson of the GPRTU, Abbas Imoro, says this levy will exacerbate the woes of the already taxed vehicle owners and the transport business.

According to him, the association has already sent a letter to the Speaker of Parliament, Alban Bagbin, asking Parliament to reconsider this levy.

“In the letter we sent to Parliament, we indicated that if nothing is done about it, we will increase transport fares not less than 60%. Where we have gotten to, we are pleading with Parliament to do something about it, or we would have no choice but to increase transport fares,” he insisted.

On why there is an astronomical increase of 60% on transfer fares while the levy is GH₵100 to be paid annually, Mr Imoro outlined other components used in calculating the fare.

“Normally, we don’t run transport with only these taxes they are coming up with. We run transport with fuel, spare parts, engine oil, lubricants, etc., so if we look at the current prices of spare parts and with this extra tax on it again, that means what we are crying over today will worsen,” he explained.

Not every group is in favour of the tax in Parliament.

The Minority in Parliament opposed the passing of the bill outrightly.

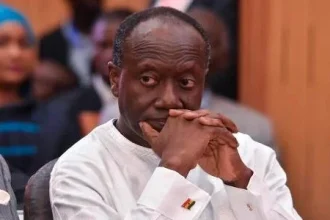

Describing the levy as ‘wusie tax’, the Minority leader, Cassiel Ato-Forson, argued that the tax, which will be imposed on all commercial vehicles, private vehicles, ambulances, ‘okadas’, ‘aboboyaas’ etc, will worsen an already dire economic situation in the country.

He added that companies will also be expected to pay GH₵100 per tonne of carbon dioxide emission.

This move follows the government’s decision to apply a zero VAT rate on imported electric vehicles in the 2024 budget.