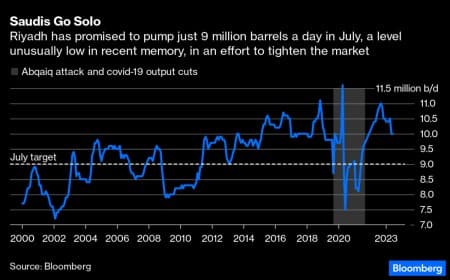

Saudi Arabia’s attempt to shock oil markets and push oil prices higher appears to have backfired, with prices falling and Saudi Arabia’s market share in Asia now under threat.

Chart of the Week

– As the only OPEC+ member to pledge further production cuts in the June 4 meeting of the oil group, Saudi Arabia will lower its oil production to 9 million b/d in July, well below its normal output range.

– Unless there is a notable rebound in oil prices, Saudi Arabia’s gambit might also backfire as others would reap the benefits of the 1 million b/d production cut, making its extension beyond July unlikely.

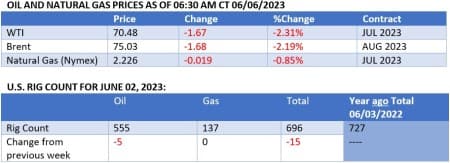

– The initial bullish sentiment stemming from Saudi Arabia’s production cut fizzled out quickly, with WTI back below $71 per barrel by Tuesday morning as weak US services PMI soured the macroeconomic outlook again.

– Right after the unilateral pledge, Saudi Aramco increased its official selling prices for Asia, prompting Asian refiners to seek cheaper alternatives from West Africa, Russia, and Iran (for Chinese buyers).

Market Movers

– Norway’s national oil firm Equinor (NYSE:EQNR) has surprised Canada’s oil industry by postponing the 200,000 b/d Bay du Nord project for three years, citing soaring costs as the main reason.

– US oil majors ExxonMobil (NYSE:XOM) and Chevron (NYSE:CVX) are nearing an exploration deal with Algeria’s national oil company Sonatrach that would allow both to tap into conventional and shale gas.

– US LNG developer New Fortress Energy (NASDAQ:NFE) received an export permit from Mexican authorities, marking a key step towards the commissioning of the 1.4mtpa Altamira Fast LNG facility.

Tuesday, June 06, 2023

Saudi Arabia’s shock and awe tactics on Sunday have so far not had the desired effect, with oil prices slumping back to their pre-OPEC+ meeting levels within one trading day. Whilst oil traders demonstrated very little worry about Saudi Arabia’s production cuts, the IEA has warned of higher prices coming soon and stock draws intensifying in the second half of 2023.

OPEC+ Reinvents Itself into 2024. Apart from Saudi Arabia’s unilateral 1 million b/d production cut pledge, the OPEC+ meeting this weekend also formalized the oil group’s 2024 production targets, lowering them by 1.4 million b/d compared to the current quota of 40.46 million b/d.

EU Winds Down Power Emergency Measures. The European Commission decided not to prolong emergency measures for the EU power generation market, in place since last May, including demand reduction mandates, revenue caps for power plants, and retail price limits.

Lightning Shutters Louisiana Refinery. The 135,000 b/d Lake Charles refinery in Louisiana may be closed for up to two months after lightning struck one of its naphtha tanks and set it ablaze, as it does not operate an FCC unit and has very limited storage for naphtha.

US Supreme Court Votes Down Offshore Fracking. The US Supreme Court struck down an industry appeal from the American Petroleum Institute to reverse a 2018 ban on hydraulic fracturing in federal waters off the Californian coast, in line with the White House’s advice not to take up the case.

Chevron Heals 50-Year-Old Wounds. US oil firm Chevron (NYSE:CVX) might come out as the winner of a protracted territorial dispute after Angola and the Democratic Republic of Congo agreed to split the offshore block 14 straddling both countries’ territorial waters and have the US major operate the project.

Saudi Aramco Starts Multi-Billion Surveying Drive. Saudi Arabia’s national oil company Saudi Aramco (TADAWUL:2222) signed a multibillion-dollar seismic surveying deal with Chinese seismic giant BGP, indicating that the NOC is increasingly looking to boost its oil reserves.

Venezuelan Exports Drop as Processing Lags. Venezuela’s oil exports have dropped 14% month-on-month on lower upgrader utilization, coming in at 606,000 b/d, but they might be slated for a rebound as a 2-million-barrel cargo of Iranian condensate, a key diluent, is discharging now.

China Invests into Polyethylene Abroad. The consortium led by Chevron (NYSE:CVX) operating Kazakhstan’s largest oil field Tengiz signed an agreement with the state-owned KazMunayGaz to build a gas separation complex for ethane, to be supplied into a new polyethylene plant built jointly by China’s Sinopec and Russia’s Sibur.

Nigerian Revolts Against Fuel Subsidy. Things are heating up in Nigeria as the country’s two main labor unions announced a strike to protest the scrapping of fuel subsidies and the tripling of gasoline costs, only for Nigeria’s Industrial Court to issue an injunction that bars industrial action.

Poland Doesn’t Want to Become EU Largest Polluter. Touted to become Europe’s most polluting nation due to its heavy reliance on coal, Poland has so far been defying expectations thanks to exceptional renewables generation, lowering the share of coal plants by 20% in January-May.

Propylene Prices Are Collapsing in Asia. As newly commissioned Chinese petrochemical plants are flooding the market, with another 600,000 mtpa propane dehydrogenation plant starting up last month, Asian propylene prices have collapsed to a three-year low of $760 per metric tonne.

Chinese Stimulus Hopes Lift Iron Ore. Iron ore prices in China have rebounded to their highest in six weeks, with Dalian prices rising to ¥760 per metric tonne ($107/mt), as market rumors began to emerge that Beijing is considering stimulus measures to support its ailing property market.

China Doubles Down on Tanker Checks. Maritime safety administrations in China’s Shandong province, a key outlet for Iranian and Venezuelan crude, are mandating that shipping agencies disclose information about their vessels to scrutinize oil tankers that are more than 15 years old.