Procurement, contracts dominate GH¢ 171m irregularities in technical universities

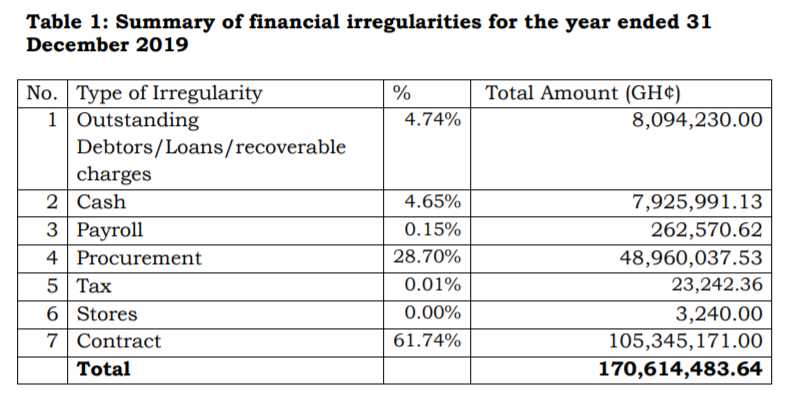

Procurement issues and dished out contracts formed a whopping 90% of financial irregularities uncovered by the Auditor-General for the year 2019.

The irregularities amounted to GH¢170,614,483.64 of which procurements and contracts accounted for GH¢48,960,037.53 and GH¢105,345,171.00 respectively.

This was contained in a report of the Auditor-General on accounts of the 10 technical universities and polytechnics across the country for the period January 1, 2019, to December 31, 2019.

The other types of irregularities involved outstanding debtors/loans/recoverable charges, cash, payroll, tax and stores.

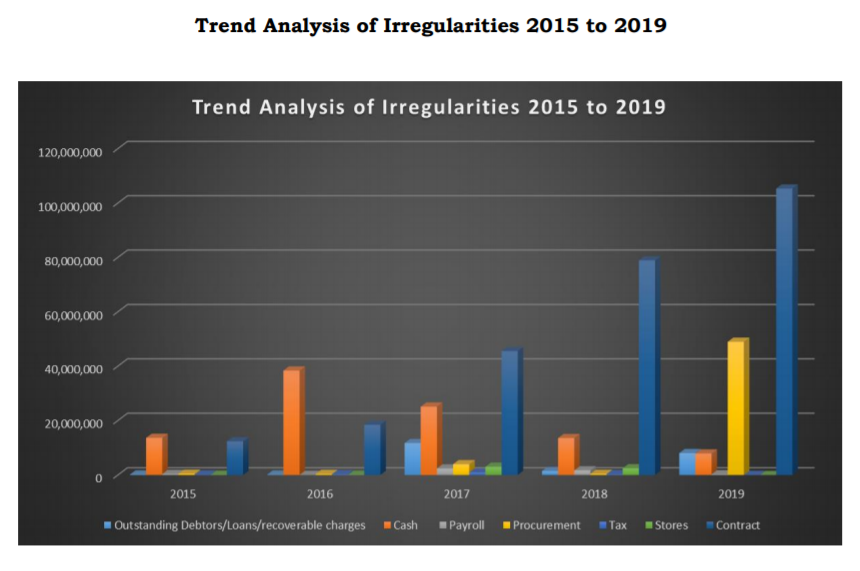

The figures had been fluctuating for the past five years but some recorded a huge jump between 2018 and 2019.

Procurement alone shot up to over 11,074% to GH¢48,960,038 just as 34%.

Outstanding debts, cash and taxes were the infringements that recorded significant decreases.

It was only Ho Technical Univerity that had no procurement issues and Cape Coast was also not part of the contract irregularities.

Outstanding Debtors/Loans/Recoverable Charges – GH¢8,094,230

These irregularities related to outstanding loans, and staff debtors.

They arose out of management’s inability to furnish the Controller and Accountant General’s Department (C&AGD) with inputs.

The irregularities were also due to the disregard for Regulations 46 of the PFMR, 2016, LI 2378, by allowing borrowers to make direct payment, or enforcing any other means feasible under the circumstances to commence the recovery process.

Other reasons were the lack of supervision and improper record-keeping for monitoring and recovery of loans.

“I recommended that management of the Technical Universities and Polytechnics should vigorously pursue recovery of the loans granted and resort to legal action where necessary. They should also improve on supervision and ensure that schedule officers update all advances in the records,” Acting Auditor-General Johnson Akuamoah Asiedu noted in his report.

Cash Irregularities – GH¢7,925,991.13

Cash Irregularities comprised misapplication of funds, non-retirement of imprest, unapproved expenditures and non-payment of Internally Generated Funds into the Consolidated Fund.

These occurred as a result of laxity in expenditure control, flagrant disregard for financial regulations pertaining to the disbursement of funds in the Public Sector, and failure of Heads of Finance to ensure that transactions were properly authenticated.

“I advised the management of the institutions to improve the control environment including the establishment and effective operations of Internal Audit Units; enhancing supervision over accounting staff to minimize these irregularities.

“I also recommended authentication of all payment vouchers; review of approved budgets, strict adherence to the provision of the Public Financial Management Regulations 2019(L.I. 2378), the efficient management of IGFs, and prompt retirement of imprest,” Mr Asiedu added.

Payroll irregularities – GH¢262,571

These irregularities mostly included payment of unearned salaries, non-deletion of separated staff after termination dates and payment of allowances without approval.

“I recommended effective coordination between the administration heads and accounts units in order to provide timely information concerning separated staff for prompt deletion of their names from the payroll.

“I also recommended that bankers of separated staff should be promptly notified to withhold salaries paid into their bank accounts for early recovery. Management should also ensure prompt recovery and payments to chest of the amounts held by the banks”.

Procurement irregularities – GH¢48,960,038

These irregularities emanated from intentional disregard for the Procurement Act, management’s inability to comply fully with the procurement law, improper procurement planning and a breakdown of the procurement process.

These include excessive variation order, absence of a system to monitor works being executed, restricted tendering, procurement order divided into lots and lack of supervision.

“I once again urged the management of the respective institutions to adhere strictly to the provisions of the Public Procurement Act, 2003 (as amended)”.

Tax irregularities – GH¢23,242

Tax irregularities were also caused by Finance Officers not diligently acting in accordance with the statutory tax laws, resulting in non-deduction of withholding tax, delay in payment of withholding tax to the Ghana Revenue Authority (Domestic Tax Division).

It also relates to purchases from non-VAT registered sources and failure to obtain VAT invoices/receipts from suppliers.

“I recommended that Finance Officers should strictly adhere to tax laws to ensure that all tax revenues are promptly collected and paid to responsible revenue agencies”.

Stores Irregularities – GH¢3,240

These lapses were caused by the absence of an effective stock control system in place, inappropriate procedures in disposing of stores as well as poor supervision over stores management.

“I recommended improved supervision over stores items, adequate stock control systems to be put in place, and strict adherence to provisions in the Public Procurement Act, 2003 (as amended) in disposing of stores”.

Contract irregularities – GH¢105,345,171

These related to unjustified review of the contract process, excessive payment of mobilisation fee, and Management’s inability to exercise due diligence in the award of contracts for project work.

They were caused by management’s inability to adhere to provisions in contract documents, improper contract budgeting and commencing many projects at the same time.

“I advised that due diligence should be exercised in the award of contracts. Management should strengthen controls over contracts and comply with tendering procedures. Officers responsible for the over-payment of contract sums may be surcharged appropriately”.

Polytechnics? Technica Universities you mean?

Technical