Oil markets got some rare good news out of China this week, with Beijing loosening monetary policy and issuing new import quotas for refiners, boosting hopes that the country’s oil demand will bounce back.

Friday, June 16th, 2023

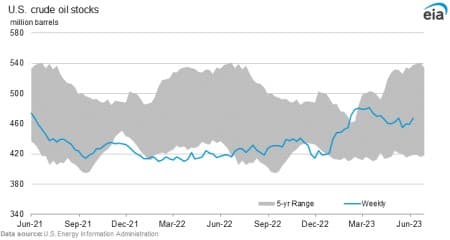

For the first time in many weeks, news coming out of China has buoyed oil prices, and the timing couldn’t have been better after the Fed hinted at further interest rate hikes and US inventories climbed. China’s issuance of higher oil import quotas and the loosening of Beijing’s monetary policy should see higher activity from Chinese refiners, providing some much-needed demand upside for oil.

IEA Sees India Becoming The Key Oil Demand Driver. According to the International Energy Agency, India will overtake China by 2027 as the largest source of global crude demand growth, with 75% of future global growth in 2023-2028 generally coming from Asian nations.

China Adds Impetus to Buying with New Quota. Giving a new boost to private refineries’ buying in China, authorities in Beijing have issued the 3rd batch of 2023 crude oil import quotas for a total volume of 62.28 million tonnes, taking this year’s total to 194.1 million tonnes, up 20% year-on-year.

Kurdish Producers Count the Losses by The Day. As Iraqi and Turkish negotiators are readying for the resumption of technical talks to restart crude exports from Turkey’s Mediterranean port of Ceyhan, the 80-day halt in loadings has already cost the Kurdish government more than $2 billion.

US Sets 12-Million-Barrel SPR Replenishment Goal. As the US Strategic Petroleum Reserve remains at the lowest level since 1983, the White House is reportedly hoping to buy back at least 12 million barrels this year, implying there will be another 6 million barrels bought in October-December 2023.

TotalEnergies Buys Into Next-Wave US LNG. The market value of US LNG developer NextDecade (NASDAQ:NEXT) soared more than 50% on Wednesday after French oil major TotalEnergies (NYSE:TTE) announced it would buy a 17.5% stake in the company for $219 million.

Russia Lands Higher OPEC+ Target. Following through with the OPEC+ meeting in early June, OPEC secondary sources have recalibrated Russia’s crude production quota for 2024 at 9.949 million b/d, up from the 9.828 million b/d initially issued to Russia at the conclusion of the meeting.

ENI Gets Closer to Plenitude Sale. Italy’s energy major ENI (BIT:ENI) is closing in on intensified talks with several private investors over a potential sale of a 5-15% stake in its renewables and retail business arm Plenitude, seeking to close the deal by August and generate at least $6 billion from the transaction.

Environmentalists Push White House on Saudi Ban. Several US environmental groups such as Friends of the Earth and WildEarth Guardians have asked the US Commerce Department to investigate if imports of Saudi oil and product present a national security threat, suggesting a ban would be necessary.

Nigeria Eyes Leaner Oil Industry. Nigeria’s new president Bola Tinubu is tempted to reduce the government’s stake in the oil industry and garner up to $17 billion by selling off non-core-assets such as stakes in NNPC’s joint ventures with Western oil majors, provided he can pass it through Parliament.

Romania Hails Major Oil Discovery. Romanian oil and gas producer OMV Petrom, controlled by the Austrian OMV (VIE:OMV), has announced the discovery of the largest oil field in several decades in southern Romania, though its recoverable reserves are meager by global standards, at 30 million barrels.

Qatar Eyes Investment in Middle Eastern Neighbour. Meeting with Iraqi top officials, Qatar’s Emir Sheikh Tamim al-Thani pledged to invest $5 billion in Iraqi energy and infrastructure projects over the coming years, building on the $27 billion oil cluster it develops jointly with TotalEnergies (NYSE:TTE).

Netherlands Nears Gas Production Cut-Off Point. Once Europe’s largest producing gas field, the Dutch government is set to permanently shut the Groningen field in northeastern Netherlands on October 1 due to seismic risks, prompting fears that TTF prices might see a spike in late 2023.

Guyana Records Another Oil Discovery. Adding to the list of Guyanese offshore discoveries, Canadian upstream firm CGX Energy (TSXV:OYL) discovered 22 meters net oil pay with its Wei-1 exploration well drilled in the Corentyne block, boosting reserves outside of the main Stabroek block.

Russia Remains Top Uranium Supplier to US. Despite Washington’s attempts to wean US nuclear customers off Russian uranium, Russia remained the top supplier of enriched reactor fuel to the United States last year, supplying approximately 25% of market needs.