Only 10% of targeted E-Levy revenue generated – Gabby supports IMF bailout

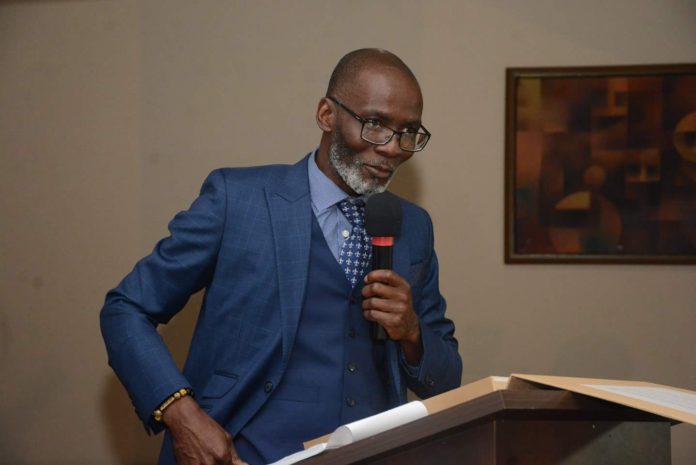

The Electronic Transaction Levy (E-Levy) is only delivering 10% of estimated revenues for the government, a leading member of the ruling New Patriotic Party (NPP), Mr. Gabby Otchere-Darko, has disclosed.

Two months after its implementation on 1 May 2022, the government is said to have missed its revenue target.

According to Mr Otchere-Darko, the E-levy, which was supposed to generate Gh¢600m by now has done less than Gh¢60m.

According to the private legal practitioner, the levy is only giving the government 10% of the projected revenue presently, as the country continues to struggle over high debt and expenditure, with low revenue to balance the books.

“After 5 months of stalemate and bashing, the e-levy, after implementation, is delivering only 10% of estimated revenues; our revenues remain very low as compared to the rest of the world; debt levels dangerously high, cedi, like most currencies, struggling against the US dollar,” Mr. Otchere-Darko said in a post on Twitter on Monday, 27 June 2o22.

He further hinted in subsequent posts that the government could be forced to return to the International Monetary Fund (IMF) to enrol on a programme.

He insists that while that is an option on the table for the government, he is all for it.

“What options are open to government? The question should rather be: what option, if adopted, will re-inject investor confidence in our economy? Even if we find the $3-5 billion required, will that help “There’s, understandably, a national aversion to an IMF program, because of the history of conditionalities which attack sacred cows like jobs and social interventions. Akufo-Addo will not sacrifice free SHS and other critical welfare policies to help the poor for any assistance.

“Am I against an IMF programme in principle? No,” other posts from Mr. Otchere-Darko read.

What options are open to government? The question should rather be: what option, if adopted, will re-inject investor confidence in our economy? Even if we find the $3-5 billion required, will that help? E-levy which was to have given us some 600m by now has done less than 60m.

— Gabby Otchere-Darko (@GabbyDarko) June 27, 2022

What is the E-levy?

The E-levy is a tax applied on transactions made on electronic or digital platforms. The Minister of Finance announced in Parliament the intention to implement the bill during the presentation of the 2022 Budget.

The tax is one of the measures the government plans to use to increase the country’s tax to GDP ratio from 12.5% in 2021 to 20% by 2024.

The government said it would use the revenue for entrepreneurship, youth employment, digital infrastructure and cyber security, and provision of road infrastructure.

The E Levy is charged at the rate of 1.50% on the following transactions:

•Mobile Money transfers done between accounts on the same electronic money issuer

•Mobile Money transfers from an account on one electronic money issuer to a recipient on another electronic money issuer

•Transfers from bank accounts to mobile money accounts

•Transfers from mobile money accounts to bank accounts

•Bank transfers on an instant pay digital platform or application originating from a bank account belonging to an individual subject to a threshold to be determined by the Minister of Finance.

However, not all transfers will be affected by the E Levy.

The Levy does not apply to the following types of transfers:

• A cumulative transfer of One Hundred Ghana Cedis a day made by the same person

•A transfer between accounts owned by the same person

•A transfer for payment of taxes, fees and charges on the Ghana.Gov System or any other Government of Ghana designated payment system

•Specified merchant payments

•Transfers between principal, agent and master agent accounts and

•Electronic clearing of cheques

The Charging Entities are:

-Electronic Money Issuers

-Payment Service Providers

-Banks

-Specialised Deposit-Taking Institutions

-Other Financial Institutions prescribed by Regulations made under the Act.

The levy had divided Parliament, with the Majority pushing for approval while the Minority kicked against it.

There was a split vote of 12 for each side at parliament’s finance committee until the chairman cast the decisive vote favouring the proposal.

Parliament degenerated into fisticuffs at a meeting to approve the levy prompting an adjournment to 18 January 2022.

The Chamber turned chaotic as MPs pushed, shoved and punched each other during the heated exchanges that many observers have since condemned.

This was after the Speaker of Parliament, Alban Bagbin, had left and delegated the First Deputy Speaker, Joe Osei Owusu, to take over proceedings.

The Minority had said it would do all it could to ensure that the bill did not see the light of day, insisting it was not in the best interest of Ghanaians.