Oil sinks despite rate cuts and tanker seizures

Oil sentiment has turned sour despite a Fed rate cut and the Trump administration’s aggressive tanker seizures.

Friday, December 12, 2025

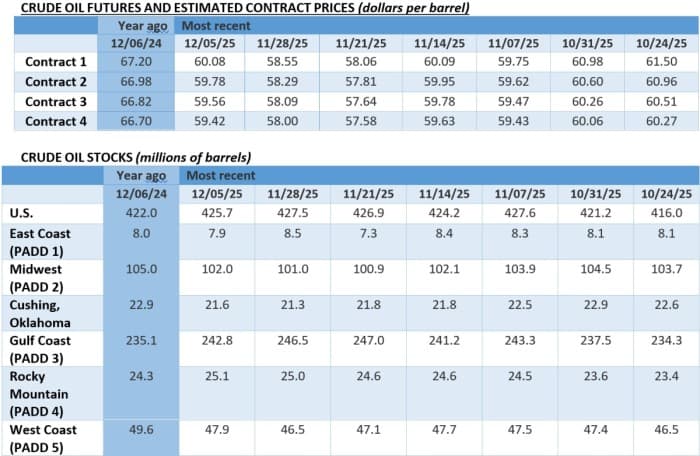

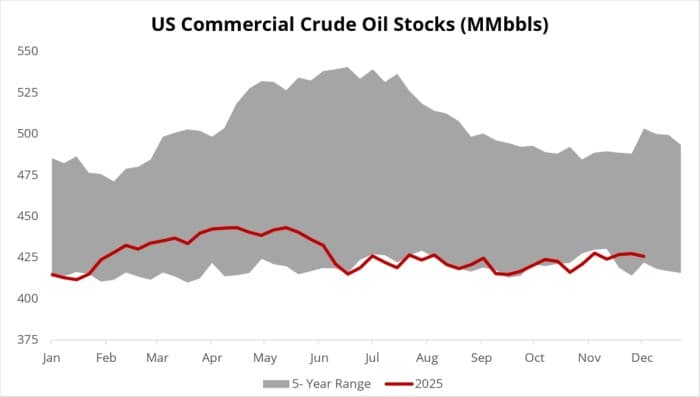

The US Federal Reserve has lowered the federal funds rate to 3.50-3.75%, the Trump administration has seized a Venezuelan VLCC and promised to take over more, yet the sentiment in the markets has soured this week, with ICE Brent trading slightly above $61 per barrel. It remains to be seen whether it’s trepidation before a potential Russia-Ukraine peace deal or another seasonal bout of depression induced by the IEA, nevertheless oil is at a two-month low and could slide even further.

IEA Lowers 2026 Oversupply Forecast. The International Energy Agency corrected its 2026 oil glut forecast to 3.84 million b/d in its latest monthly report, down 250,000 b/d from a month ago, hiking its demand growth forecast for next year to 860,000 b/d compared to 2.4 million b/d supply growth.

Chinese Buyers Mop Up Saudi Oil. Chinese term buyers have nominated 49.5 million barrels of Saudi crude, a sea change compared to 36 million barrels requested in December as the state oil firm Saudi Aramco (TADAWUL:2222) cut its Arab Light differential to its weakest in almost 5 years.

US Seizes Venezuelan Cargoes as Tensions Flare Up. The Trump administration has seized a laden Venezuelan VLCC tanker (Skipper) en route to Cuba, vowing to intercept more ships off the Latin American country’s coast as the US eyes military options to topple Nicolas Maduro.

Trump’s First Gulf Sale Sees Robust Interest. The Big Beautiful Gulf 1 lease sale garnered $300 million for the US budget as majors BP, Chevron and Woodside Energy took in the most acreage amidst 219 bids submitted overall, with Chevron’s $18.9 million bid for a Keithley Canyon block marking the auction’s highest bid.

Total Completes Its Takeover of Namibia. Portugal’s state oil firm GALP (ELI:GALP) agreed to an asset exchange deal, ceding a 40% stake to French oil major TotalEnergies (NYSE:TTE) in the giant Mopane discovery in return for 10% interest in the latter’s Venus project, sending its shares down by almost 20%.

Chinese EV Sales Soar Despite Global Headwinds. China’s new energy vehicle (NEV) sales continued their meteoric rise as they accounted for 53.2% of all sales – the highest monthly ratio ever – with 1.82 million units sold, a 21% increase compared with the same period in 2024.

Russia Produces Below OPEC+ Quota. Russian oil production increased to 9.367 million b/d last month, up by a mere 10,000 b/d compared to October, leaving the world’s third-largest producer 165,000 b/d below its OPEC+ quota as Ukraine’s drone strikes derailed crude loadings in November.

Tehran Launches Gasoline Subsidy Reform. The Iranian government has started the implementation of its new gasoline subsidy mechanism, whereby the first 60 liters used per month will be charged at the previous price of $0.35/l, however any monthly volumes sold above that would double in price.

South Sudan Moves to Protect Oil Interests. South Sudan’s army has entered Sudan after its northern neighbor’s oil fields in the Heglig area were taken over by the paramilitary Rapid Support Forces (RSF), as Heglig is a key processing facility for South Sudan’s flagship Nile Blend.

Alaska LNG Gets Key Regulatory Approval. The $44 billion Alaska LNG project has received a federal greenlight for construction in line with the National Marine Fisheries Services rule, putting developer Glenfarne on track for an FID on a supply pipeline in late December and the whole project in 2026.

Bolivia’s New President Eyes Energy Overhaul. The administration of Rodrigo Paz, the new president of Bolivia, has arrested former president Luis Arce and vowed to investigate graft at the state oil firm YPFB, as reportedly several million barrels of gasoline were misdirected and stolen.

Saudi Arabia Eyes Syria’s Upstream. Saudi Arabia might be coming out on top in the nascent battle for Syria’s upstream recovery as Damascus signed four separate exploration deals with unnamed Saudi companies to develop its oil fields, seeking to quadruple current production back to 400,000 b/d.

China to Introduce Steel Export Licensing. China, the largest steel producer globally, announced plans to roll out a license system from 2026 to regulate exports of steel as outflows jumped 7% year-over-year in January-November 2025 to 108 million tonnes, reacting to weaker domestic demand.

Teck-Anglo Merger Is Now Official. Shareholders of mining giants Anglo American (LON:AAL) and Teck Resources (TSO:TECK) approved their previously announced merger this week, with more than 99% votes cast in favour, with the new company headquartered in Vancouver and listed in London.