Another setback in Russia–Ukraine peace talks and persistent tensions around Venezuela failed to jolt oil markets out of their New Year’s lull.

02 January, 2026

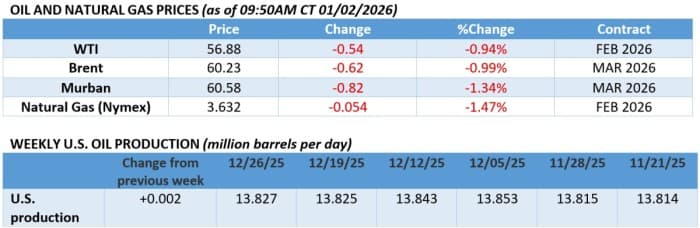

Another round of failed Russia-Ukraine peace talks and continued tensions around Venezuela have failed to wake oil prices from their New Year’s slumber, with ICE Brent staying put around the $60 per barrel mark on the first trading day of 2026. Whilst unlikely, the upcoming OPEC+ meeting on Sunday could provide some excitement as Saudi Arabia and the UAE continue to fight a covert proxy war in Yemen.

Oil Prices Post Weakest Year Since 2020. Oil prices have shed 19% in 2025 year-over-year, with ICE Brent settling on the last day of the year at $60.85/barrel, the largest annual slide in percentage terms since 2020 and their third straight year of declines, the longest negative pricing streak on record.

US Sanctions More Venezuelan Oil Tankers. The administration of Donald Trump has imposed sanctions on four oil tankers associated with Venezuelan oil deliveries, including the ultra-large crude carriers Della and Valiant, further ratcheting pressure on the government of Nicolas Maduro.

Mexico’s Largest Untapped Field Changes Hands. The UK’s leading oil producer Harbour Energy (LON:HBR) has been appointed the operator of the shallow water 750 MMbbls Zama field, Mexico’s largest untapped upstream project, after heavily indebted Pemex relinquished its operatorship.

Lebanon Seeks Waning Egyptian Gas Flows. Egypt signed a memorandum of understanding with Lebanon to supply the Levantine nation with natural gas as Beirut’s power plants continue to run on diesel; however Lebanon currently lacks any import infrastructure and Egypt’s own output keeps falling.

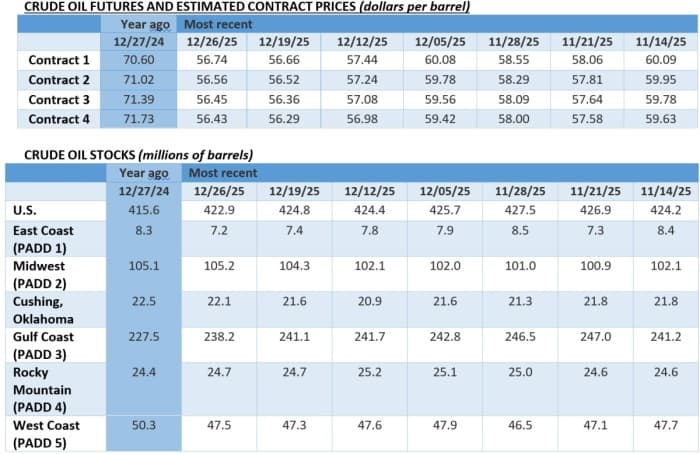

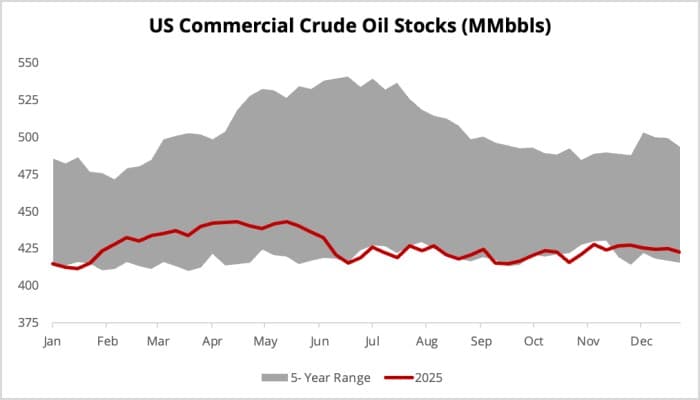

OPEC+ Expected to Keep Quotas Flat. As OPEC+ members are slated to meet on January 4 to discuss production quotas in Q1 2026, with industry participants widely expecting another roll-over as ICE Brent hovering around $60 per barrel and differentials at 5-year lows put oversupply risks at the forefront.

Serbia’s Embattled Refiner Gets Much-Needed Waiver. Serbia’s state oil company NIS has received an OFAC waiver from the US Department of the Treasury, allowing it to restart its activities until at least 23 January 2026 as it continues to search for potential buyers for Gazprom’s 11% stake in the firm.

Russian Pipeline Gas Exports to Europe Collapse. Deliveries of Russian pipeline gas by Russia’s gas major Gazprom (MCX:GAZP) to Europe fell to their lowest annual level in 50 years, a mere 18 bcm in 2025 with just TurkStream operational, marking a 90% plunge from the all-time high recorded in 2019.

Chinese Teapots Fire on All Cylinders. China’s independent refineries have ramped up their runs to a 20-month high in December, with even small teapots reaching a 58% utilization rate as margins of Shandong plants reached $8/barrel, thanks in large part to ample volumes of sanctioned feedstocks.

US Congress Not to Extend Oil Spill Tax. The US Congress has voted against extending the Oil Spill Liability Fund tax for 2026, up until now a $9 cents per barrel levy that crude exporters and refiners were obliged to pay, increasing the Superfund tax instead from $0.16/barrel to $0.18/barrel.

Turkey to Expand into Somalia’s Offshore. Turkey’s state oil firm TPAO has agreed to start exploration drilling offshore Somalia in 2026, with recently acquired ultra-deepwater drillship Cagri Bey slated to arrive in the country’s waters in February, expanding on Ankara’s large military presence in the country.

India Slaps Import Tariffs on Cheap Chinese Steel. India’s government imposed a three-year import tariff on selected steel products to safeguard its domestic producers from cheaper Chinese competitors, setting the levy in its first year at 12%, lifting shares of major Indian companies by 3-5% this week.

Beijing Blasts Europe’s CBAM Implementation. As Europe’s Carbon Border Adjustment Mechanism (CBAM) launched its final financial phase on January 1, China’s Ministry of Commerce called the EU’s measures ‘unfair and discriminatory’, pledging to take countermeasures to defend its national interests.

EU Car Ban Reversal Lifts Platinum Prices. The European Union’s scrapping of its previous 2035 deadline to ban new sales of conventional fossil-fuelled cars (and catalytic converters) has helped platinum post its biggest monthly gain in 39 years last month, up 33% month-on-month to $2,478 per ounce.