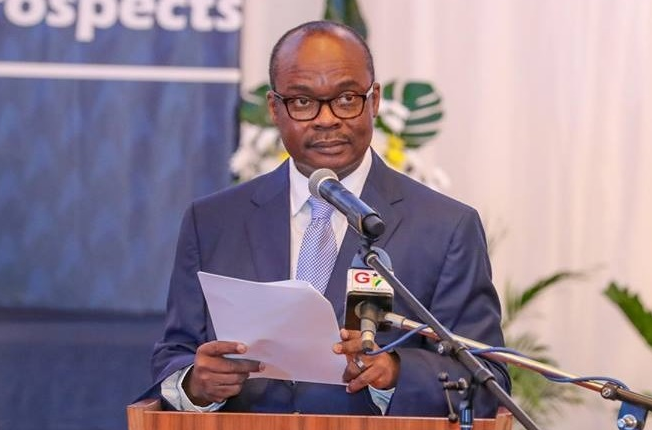

The Governor of the Bank of Ghana, Dr. Ernest Addison, has urged the International Monetary Fund to consider increasing concessional financing to the continent by modifying the access thresholds, including expanding access limits and relaxing eligibility criteria for PRGT (Poverty Reduction and Growth Trust) resources.

This, he believes, will ensure timely financing assistance to most vulnerable members.

“It is in this context we welcome the Fund’s decision to temporarily raise the annual and cumulative limits in the General Resources Account (GRA) to 200% and 600% of quota respectively for a period of 12 months. Nevertheless, we underscore the importance of aligning PRGT access limits with those of the GRA to enhance Fund support to PRGT-eligible members facing acute debt challenges, while strengthening the fundraising efforts to bolster the PRGT resource envelope”, the Governor disclosed this at the 2023 Africa Consultative Group Meeting with the Managing Director of the IMF, Kristalina Georgieva.

Again, the Governor urged the Fund to continue close engagements with other international financial institutions and creditors to strengthen the multilateral framework for dealing with Africa’s debt distress in a timely manner.

In this context, he said, “the G20 Common Framework (CF) should be enhanced to deliver swift, predictable, transparent, and equitable debt resolutions, while permitting debt service suspension during negotiation to offer instantaneous relief to debtors”.

According to him, a protracted CF process undermines overall confidence and impacts IMF’s catalytic role, in addition to its negative demonstration effect with new countries that are hesitant to request a CF debt treatment.

“We also underscore the need for the newly created Global Sovereign Debt Roundtable to remain focused on accelerating debt restructuring processes and making the G20 Common framework more efficient”, he mentioned.

The Governor also called on the Fund to continue to provide tailored capacity development and surveillance support, in conjunction with other international partners, which are indispensable in the continent’s reform agenda towards addressing debt challenges and creating fiscal space to tackle long-standing snags to sustained economic growth and development in member countries.

African countries should remain committed to credible fiscal consolidation

Furthermore, Dr. Addison, said to address the fast-deteriorating debt dynamics in the continent, African countries should remain committed to pursuing credible fiscal consolidation, anchored on efficient expenditure rationalization and robust domestic revenue mobilization measures.

This, he believes will help build buffers for critical social interventions and infrastructural development, while safeguarding medium-term debt sustainability.

“To boost fiscal resilience, members are undertaking measures to improve public financial and investment management, enhance fiscal transparency and governance, address corruption risks, and progressively phase out untargeted subsidies”, the Governor added.

He also advised African countries to recognise the need to prioritise efficient debt management practices, consolidate debt data in a centralized system, publish reliable, comprehensive, and timely debt information, and deepen domestic debt and capital markets to foster greater access to long-term finance.

According to him, domestic policy efforts alone are inadequate to sustainably address the debt burden and restore macroeconomic stability in the continent.

“For this reason, Madam Managing Director, and given the current context of fragmented global financial safety nets, much stronger support is needed from the IMF to prevent the region’s debt levels from spiraling out of control”, he concluded .