How cryptocurrencies could trigger a financial crisis

Gone are the days when bitcoin, ether and other cryptocurrencies could be thought of as a niche corner of financial markets.

What’s happening: In a new report, the Financial Stability Board — an international body that brings together regulators from 24 countries and jurisdictions — said that the “fast evolving” crypto market could quickly reach a point where it becomes a “threat to global financial stability” due to its size, structural vulnerabilities and growing ties to the traditional financial system.

“Financial stability risks could rapidly escalate,” the group said this week, adding that policymakers needed to step up.

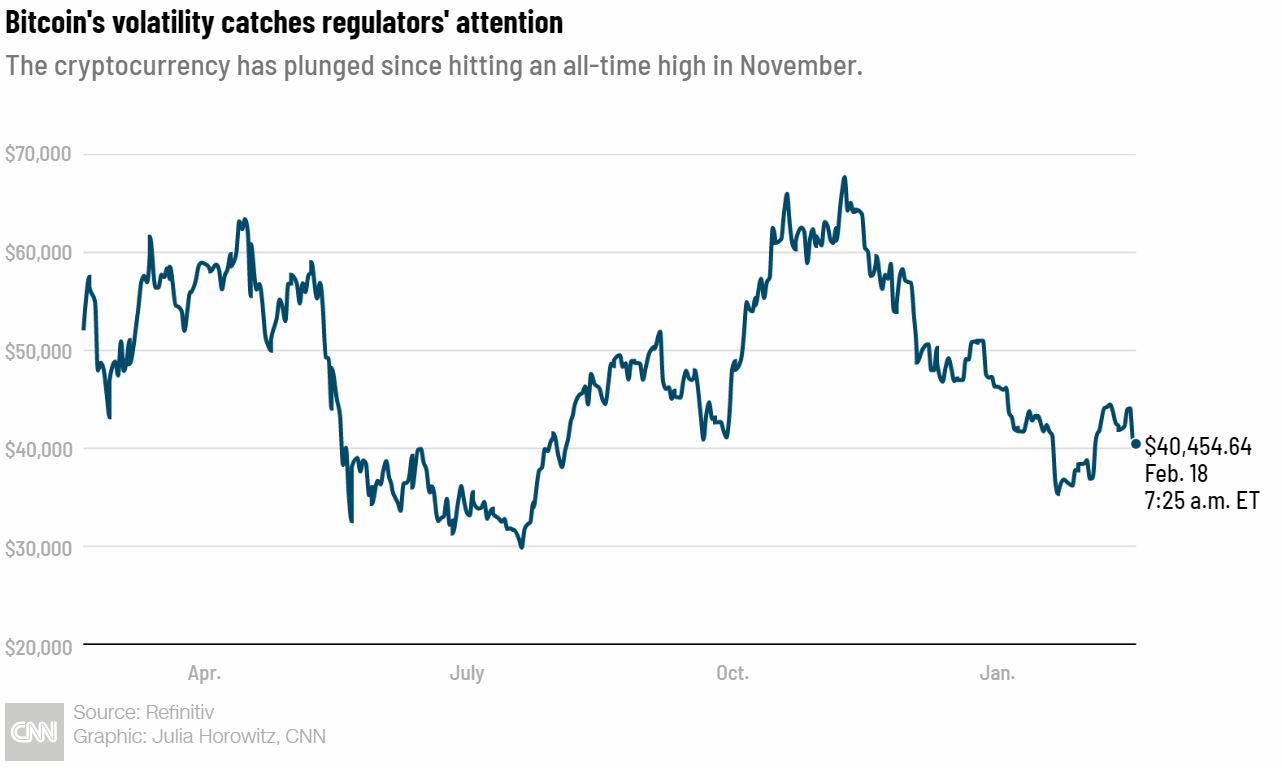

The assessment comes as banks and other big market players ramp up their exposure to crypto due to requests from clients, despite its volatility.

On Thursday, bitcoin plunged almost 8% as the broader market sold off. The same day, Sequoia Capital said it was ramping up its crypto business with a new $500 million to $600 million fund. The venture capital giant said it would be “focused primarily on liquid tokens and digital assets.”

“Systemically important banks and other financial institutions are increasingly willing to undertake activities in, and gain exposures to, crypto-assets,” the FSB said. “If the current trajectory of growth in scale and interconnectedness of crypto-assets to these institutions were to continue, this could have implications for global financial stability.”

The state of play: In 2021, the market for crypto-assets at one point more than tripled to $2.6 trillion. That’s still relatively small. Global stock markets, for comparison, were last valued at more than $120 trillion.

Why, then, is the FSB sounding the alarm? The group said that because big players are getting involved, significant swings in the crypto market could trigger a series of unexpected events. It even drew a comparison to trades tied to the housing market which helped unleash the 2008 financial crisis.

“As in the case of the US subprime mortgage crisis, a small amount of known exposure does not necessarily mean a small amount of risk, particularly if there [is] a lack of transparency and insufficient regulatory coverage,” the FSB wrote.

Watch this space: After a slow start, governments could begin to get more aggressive. Yahoo! News reported Thursday that US President Joe Biden could issue an executive order next week instructing agencies to study crypto and develop a government-wide strategy to regulate digital assets.

Earlier this month, Congress held a hearing on the regulation of stablecoins. These are digital assets whose value is pegged to other currencies or commodities.

But UBS doesn’t think investors should hold their breath for clearer guidance from lawmakers any time soon.

“Regulators could be waiting a long time for Congressional action and in the meantime will need to grapple with these issues using the limited and imperfect authorities they already have,” the Swiss bank said last week.

Investors nervously eye the Ukrainian border

Global markets stabilized on Friday after the threat of a potential Russian invasion of Ukraine propelled the Dow to its worst day of 2022.

But uncertainty over what will happen next — and what it could mean for investors — is lingering.

The latest: Biden said Thursday he believes an invasion of Ukraine could happen “within the next several days,” while his administration’s top diplomat warned that Russia has not withdrawn troops, despite Moscow’s claims.

The developments helped send the Dow down 1.8%, while the S&P 500 dropped 2.1% and the Nasdaq Composite shed 2.9%.

“Investors, wary of any bad news, have been unable to maintain positive momentum in equity markets across the globe as geopolitical risks dominate headlines,” said Peter Essele, head of portfolio management for Commonwealth Financial Network.

He added that “a further escalation of tensions in the near term could roil markets,” which are already on edge about kinks in the global supply chain as the Federal Reserve prepares to hike interest rates for the first time in years.

On the radar: The price of gold rose 1.5% on Thursday, though it’s pulled back slightly on Friday. It’s now trading near $1,890, just below its highest level since June.

The yellow metal, a common safe-haven investment, is getting a lift from uncertainty about the situation in Ukraine, along with anxiety about rising inflation that can trigger a rush for physical assets.