How cedi depreciation impacts your pocket

Ordinary citizens, businesses, and investors who use the Ghana cedi as legal tender are super upset by recent trends.

From social media to the streets of Abossey Okai and Saume Magazine, Ghanaians are troubled about spending more than usual to acquire goods or pay for services as the currency’s value continues a steep nosedive.

Firstly, let us go down the memory lane.

Do you know that the cedi was stronger than the dollar in 2010?

In January 2010, GH₵1 was equivalent to US$0.70.

So you needed almost US$2 to buy GH₵1 when it comes to the cedi-dollar rate.

This means you needed less cedis to buy dollars for your business.

Several factors accounted for this including the redenomination of the currency in 2007.

Fast forward to June 2024, and this time the table has turned, you can only buy US$1 with GH₵15.20 (fluctuating at +1 and -1 for the past months).

This means the cedi has depreciated by over 1400% from 2014 to 2024.

In 2017, US$1 was GH₵ 4 and 2 pesewas, but seven years down the lane, the same US$1 is at an all-time high of GH₵15 and 20 pesewas as of June 20, 2024.

This implies that Ghanaians have lost so much of their purchasing power to the extent of spending four times for the same goods and services within the period, despite a bold declaration by Vice President Dr Mahamudu Bawumia, the head of the country’s Economic Management Team (EMT), in April 2017.

“When we came in, it [cedi] was running. Essentially, we have arrested it [cedi], and the IGP has the keys. He’s locked it up. We want to make sure we pursue sound policies to keep the Cedi stable. It has appreciated for this year,” he stated at a town hall meeting organised to assess the first 100 days of President Akufo-Addo’s tenure.

So what could’ve happened to sink the cedi this low nearly seven years down the lane?

One pivotal factor that has contributed to the Cedi’s instability is Ghana’s heavy reliance on imports.

The nation imports a wide range of goods, necessitating the conversion of large amounts of cedis into foreign currencies like the US dollar.

In 2024, Ghana imported the majority of the things that we could produce locally.

From chopsticks to foodstuff like tomato, onion, ginger and chicken.

This means more cedis will be needed to buy dollars so these products can be purchased on the international market to be imported into the country.

Government policy effects have also led to periods of sharp fluctuation in the cedi’s value.

For example, over the years governments haven’t been able to ban or limit the rate at which goods and products are imported into the country.

All over the world, countries only import essential products and goods that they don’t have the muscle to produce.

Unlike Ghana, our imports cut across, barring even the ones we can produce.

Policies aimed at bolstering domestic industries and encouraging local consumption could alleviate some of the stress on the cedi.

Consequently, this has directly impacted various sectors, from transportation fares to educational fees, draining the pockets as salaries remain the same or are increased disproportionately.

A big evidence of this was visible during the peak of the COVID-19 period (2020-2021) where the exchange rate was quite stable because imports slowed due to border and port closures by most countries.

Another contributing factor to the Cedi’s woes is the practice of dollarization in the Ghanaian economy.

This practice, where goods and services such as real estate, land, and education are priced in US dollars, has led to a constant scramble for dollars among citizens.

This perpetual demand for dollars exerts pressure on the cedi, weakening it further.

The influence of multinational companies and their profit retention strategies also play a significant role in the cedi’s depreciation.

Capital flight and the lack of reinvestment of profits locally deplete the nation’s foreign currency reserves.

These causes have occasioned a series of demonstrations in the country over the years.

A notable one was in 2021 when #FixTheCountry conveners took to the street to demonstrate as the cedi traded at GH₵6 to a dollar describing it as hitting an “all-time low”.

But just three years down the line in 2024, the cedi is trading at GH₵15.45 to a dollar hitting the real “all-time low”.

This means it will cost almost three times as much to purchase the same product or commodity today, compared to 2021.

However, people who have dollars in stock will be laughing and filling their bags as a US$100 will give them over GH₵1,500.

On May 26, 2024, the Ghana Federation of Traders issued a two-week ultimatum to the government to bring the cedi to GH₵10.00 or face demonstrations from business associations.

The federation maintained that depreciation of the local currency is synonymous with depletion of capital, stressing that business owners have lost about 20 per cent of their capital from year-to-date.

Businesses who bear the brunt of the weakening cedi called on the Bank of Ghana to clamp down on Forex Bureaus(FX) whom they described as the peddlers of the currency’s unabated decline.

BoG joined the bandwagon and lashed out at cedi speculators warning that they would regret betting against the battered currency.

But a section of economists fired back at the BoG indicating that cedi speculation is a legal business risk and a strategic plan.

In Ghana, cedi speculators are mostly found at currency black markets and some forex bureaus.

They acclaim themselves as the real forex exchange rate manipulators.

As they say in Ghanaian parlance, ”Bank of Ghana has the rate but abokyi get the dollar”, to wit, “It is the Bank of Ghana(commercial banks) who determines the cedi to dollar rate but it is the local foreign exchange dealer who has the dollar in stock to cause a change”.

The depreciation of the Ghana cedi has become a national concern, affecting Ghana’s economic stability and daily lives.

This has caused enormous hardship to the Ghanaian worker and their families as they grapple with the high cost of living.

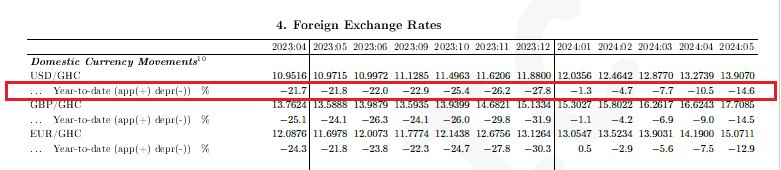

As of May 16, 2024, the Ghanaian cedi was marked as the 4th worst-performing currency among 15 top currencies in Africa, depreciating about 20% within the first five months of 2024.

Bloomberg also tipped it as the worst-performing currency in the world in 2022.

The cedi’s depreciation has created a big mess for the business community.

They have described the current situation as a crisis. But it’s not just businesses that are suffering.

The cost of living is skyrocketing, and people’s spending power is plummeting.

Every day, Ghanaians feel the pinch, having to make do with less money in their pockets.

For example, the price of tomatoes has seen a steep increase, which has exacerbated the cost of living of Ghanaians and placed a heavy burden on households across the nation.

A bucket of tomatoes, which was sold at GH¢75 at the beginning of 2024, now sells at GH¢180 in May 2024 representing an increase of 140%.

This increase in the cost of living has been caused by the high rate of cedi depreciation, high inflation, high electricity and water tariffs, high interest rates, and high taxes.

The ex-pump prices of fuel depend a lot on the exchange rate since a greater part of the refined fuel is imported.

Currently, there is increased global demand for crude oil as most industries are still recovering from the effects of COVID.

At the same time, the supply of crude oil has slowed down after the Russian invasion of Ukraine, the Israel-Gaza war and the oil production cut by OPEC in 2023.

Consequently, the international crude oil price is expected to continue increasing for some time.

The combined effect of cedi depreciation and increases in international crude oil prices means that the ex-pump price of fuel in Ghana is expected to keep rising, at least until the end of the year.

This means that transport fares will rise without any interventions, further straining the pocket of the Ghanaian.