My paternal grandma raised me from infancy when (I am told), malnourishment nearly added me to the sad statistics on Ghanaian infant mortality. My biological parents had divorced and rendered me an unfortunate victim of parental neglect.

Now a retired banker savouring the luxury of time and health, I have the liberty to reflect on various issues in life over my 68 years. I recall with nostalgia a profound moment with my late Grandma in 1979. I had struggled as a correspondent student to study Government as part of my GCE Advanced level subjects.

Excited about my new knowledge of the concepts and theories around the subject, I visited Kwamo from my base in Accra and itched for an opportunity to demonstrate my new academic skills.

One evening, I eavesdropped on a conversation among the old ladies over how they were forced (bussed) into cars after the 1966 coup, to jubilate over the overthrow of now illustrious Dr. Kwame Nkrumah of blessed memory in the streets of Kumasi.

Discussions on the real value of independence as my grannies saw it at the time drew me into an adult-only conversation but I was not to be driven away. Grandma’s pet from the city must be heard. Evidently, my Grannies had not been enthusiastic about life after independence. One could not begrudge them as they recounted their experiences in pre- and post-colonial Ghana.

Armed with my new theories in government as a subject, I tried to defend the significance of independence to a largely disappointed generation who had witnessed (from their perspective) proper law and order, a focus on values, discipline and respect for authority, peace and relative development, under the colonial government.

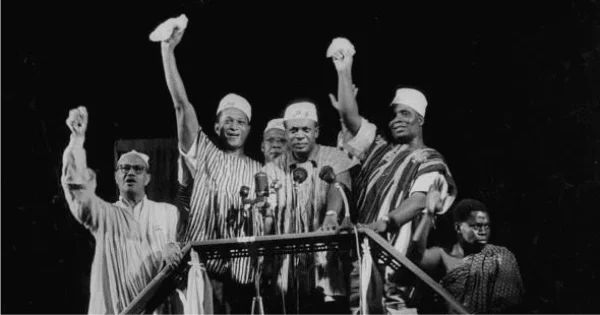

I cited the benefits of independence, the key among which was self-rule which gave Dr. Nkrumah the opportunity to become president … to make decisions that promoted our collective well-being. I lauded the many projects Dr. Nkrumah initiated between 1951-1966 as leader of government business and as a full president, optimistic of the real prospect of their own grandchild and other natives possibly becoming key public figures like the young colonial public servants.

Grandma simply looked at me with incredulity. Her utter disdain for my so-called knowledge could break the fragile walls of our mud-built house. She was completely unamused with my defence of independence. She must have mused, “Look at this boy with the audacity to coach me on the relevance of independence!”

According to her, things started falling apart soon after independence when native officers replaced the colonialists. Her rebuttal of my optimism hinged on a variety of factors, not all of which I could deny then as she had the benefit of real-life experiences that contradicted some of my theories.

Key among her regrets and the source of her pessimism was that the colonial district commissioners lived in modest bungalows and applied discipline, selflessness and dedication in their work. They were less pompous, less corrupt and were zealous in the execution of their core functions.

She regretted that most of Ghana’s forest reserves were created during the colonial era and were jealously preserved. This saved rivers, timber, flora and fauna. In fact, forestry officials would arrest anyone who entered these reserves even to cut wood used for pounding fufu. Hunting for snails and other wildlife in the reserves was so prohibited that this exercise was conducted mainly at night. This heritage, according to her had been wantonly desecrated.

Grandma reminisced about the quality of healthcare and the visible expression of humanity among healthcare givers. She bemoaned various aspects of our national life to forcefully debunk my defence of independence as the catalyst for Ghana’s development.

Perhaps the most profound of Grandma’s arguments as I see them now was her view that the advent of literate chiefs (not necessarily educated) had been the bane for the lack of respect for these holders of tradition and the custodians of our cultural heritage. She opined forcefully then that most of these rulers have done more harm than good to their communities and the nation. She was unequivocal that even truth appeared to have died within the formerly revered chieftaincy institution.

Now, forty years after her death, here I am reflecting on the menace of galamsey, appalled by the undeniable involvement of some chiefs, parliamentarians and key public servants in the devastation of our water bodies and the environment. Even more dangerous is the subtle emergence of armed militia who will dare even the security agencies from attempts to stop galamsey.

Few can be oblivious of the increasing level of corruption, the sheer absence of nationalism among the youth; a generation who would not hesitate to get on board any massive ship that docked at any of our harbours to take them away as modern slaves. The disappointment is deep.

I can only be humble enough to salute Grandma posthumously and offer profuse apologies for my empty demonstration of knowledge some forty years ago.

When I reflect on the wanton greed of today’s youthful politicians who want to live like the late Michael Jackson or Oprah Winfrey; when public servants are acquiring properties the values of which far exceed their legitimate emoluments; when designated forest reserves are misappropriated in favour of friends and family; when newly constructed roads are certified by qualified engineers for payment only to develop potholes in three months; when with advanced technology, the quality of cement is poorer than the same product 50 years ago; when honesty and integrity have been forced to flee away from public service; when institutions set up to fight corruption appear to be more interested in drama, I can only raise my arms in desperation and say Grandma indeed won the arguments then and even now.

Grandma remains a heroine to me for providing the basis of the comparisons of the life she had lived through and my utopian view of what independence could do for this country.

What explains the propensity of corrupt politicians to steal from the state and stash funds in banks in the colonial masters’ countries, and acquire the property they hardly use? And we had boldly declared through Dr. Nkrumah that we are capable of managing our own affairs.

Is borrowing seventeen times from the IMF under strangulating terms and conditions part of the dexterity in managing our affairs?

Do we have any history of colonial public servants selling state assets to their friends and family members, or defending them even when they are palpably engaged in illicit money grabbing from the state?

The blame game and a drab circus

Just when some of us were anticipating that some legal brains would educate us pro bono on the full contours of when the state gets involved in money laundering and terrorist financing law, in comes another invitation to an uninteresting circus. “The state has no business prying into how one obtains their wealth?” The law is an ass indeed.!

In the risk management space in banking, one cannot be oblivious to the responsibility to flag and report suspicious transactions on a customer’s account. There is always a compliance obligation to screen for values of transactions that are perceived to be incompatible with the known occupation and regular income of an account holder.

This is the rationale behind the Know Your Customer (KYC) due diligence processes at the time an account is opened and during the course of the account history until closure.

Thus, when a rural farmer like this writer suddenly places GHS 10,000,000.00 or multiples of GHS 1,000,000.00 into my account that has never registered a deposit of more than GH.100,000 in a single transaction, the bank is within its mandate to ask for the source of the million.

If my explanation is tenable, like proving with appropriate documentation that I have won a lottery, or become the beneficiary of an inheritance, no further investigation will be required. Otherwise, the bank is obliged to file a Suspicious Transaction Report with the Financial Intelligence Centre for possible investigation by the Economic and Organized Crime Office.

The bank’s failure to conduct reasonable investigations, as part of the continuous KYC due diligence and what is known about the account history, may expose it to liability on the “ought to have known”, principle and may be cited as an accomplice in a money laundering or terrorist financing charge against the account holder.

That is why some of us were taken aback by the view that no one should be interested in how much money is held in the bedroom of another person. The parallels can be quite confusing.

Are we to resign ourselves to the notion that it does not matter how you earn your money? Just make the money, earn undeserved public applause, dine with the rich and powerful and you will be covered by the same law which we are told is no respecter of persons?

Deepening financial literacy across board.

Bank of Ghana could consider it a social responsibility to explain to the populace through radio and television programmes, how foreign exchange is generated and utilised in the country and how our individual and collective actions determine the rate at which the cedi is exchanged for foreign currencies.

Simple explanations on the major line items in the Balance of Payments structure on both receipts and payments could help in deepening financial literacy and hopefully add value to public discussions on banking and monetary issues.

Hopefully, this will deepen understanding of the rather complex web of forces that affect the demand and supply of forex; why we should all obey the foreign exchange regulations to ensure stability in the forex eco-system.

To buttress the need for this structured financial literacy approach, I recall a church forum where I was one of the speakers. I was amazed at the look of incredulity on the faces of some of the participants when I stated that banks are not philanthropic organisations to indiscriminately dole out credit to every loan applicant. I thought that was obvious but I could have been lynched if this had probably been said at Kejetia or Ashaiman market, as I discovered later.

When I dropped a joke that banks are not established for poor people, in response to a questioner with very pregnant expectations of how and why banks MUST finance start-up businesses, I knew I had disturbed a beehive and should be prepared for multiple stings. That appeared to have been too much of an expensive joke for my audience, most of whom were youths expecting to find what they considered to be cheap sources for financing start-up businesses in Ghana.

Corporate social responsibility is integral to the business philosophy of many banks. But when a questioner asked me (innocently or mischievously) why banks do not liberally grant credit to poor people to demonstrate their social obligation, I quietly prayed for divine intervention, lest I fumbled with my response!

Seeing the now melancholic faces staring at me, I could easily discern that my assurances to explain other non-bank sources of financing failed to ameliorate their disappointment.

When I further explained to my audience how many mobile phone users were and are still reluctant to register their SIM cards merely to avoid repaying momo loans they had contracted, many appreciated the concept of non-performing loans and how these negatively impact credit providers and their capital.

Anytime you want to transfer funds to a friend or relative and they ask you not to send the money through their regular phone number, there is a high probability that they are afraid the Telco will seize any incoming funds to offset default on outstanding loans. Let us all help to deepen credit creation within the system by honouring debt obligations.

Some truths are hard to accept but must not be embellished with fantasies. It is easier to obtain loans in many advanced countries because the systems for personal identification and residential addresses, among other structures like prompt judicial processes, promote responsible lending and borrowing, something that is strangely resisted in this country.

The politicians are at their wits end promising us exclusive bank for women and a bank for small and medium scale operators. Until the enabling environment (high inflation, interest and exchange rates, high taxation, long court processes for loan recovery) are made conducive for lending and borrowing, these promised banks will falter like their predecessors.

Concentration risk will become their Achilles’ heel since they would lack the leveling that diversification affords in the portfolio mix. They also run the potential risk of the absence of clearly defined sources of sustainable deposits or long- term funding. Most importantly, they will be exposed to the poor culture of loan repayment among Ghanaian individuals and businesses.

Even commercial banks which depend largely on owners’ equity, customer deposits, subordinated debt and retained profits cannot sustainably grant loans below their cost of funding, the true magnitude of which is not known to many with fantastic dreams of liberal credits at lower interest rates.

King Paluta and the excited priest.

Marriage plucked me from the Catholic church to the Baptist fraternity. Expectedly, I have many mansions in my heart to accommodate and love Catholics. Thus when a Catholic priest got carried away by the euphoria generated by King Paluta’s obviously secular Aseda song in a Catholic mass, my heart melted for the excited priest who quickly and admirably apologised for the “non- cardinal sin”. But wait a minute. That song obviously has an impulsively danceable tune but bereft of a theme to me.

In one vein we hear of praising God for lifting one from the doldrums to the limelight. But why tease imaginary adversaries about jealousy, if God has indeed blessed you? Why not emphasise the forgiveness bit for those jealous souls and leave things there? Then we hear of reciprocating another’s romantic love. So what exactly is the theme for the song the euphoria of which carried my priest friend away? “Osofo, due wai.’’ The forum was just inappropriate and you know Catholic traditions better than I do.

The writer is a Fellow of the Chartered Institute of Bankers, a former adjunct Lecturer at the National Banking College, a farmer and the author of “Risk Management in Banking” textbook.

Email; koriginal59@gmail.com Tel. 0244 324181