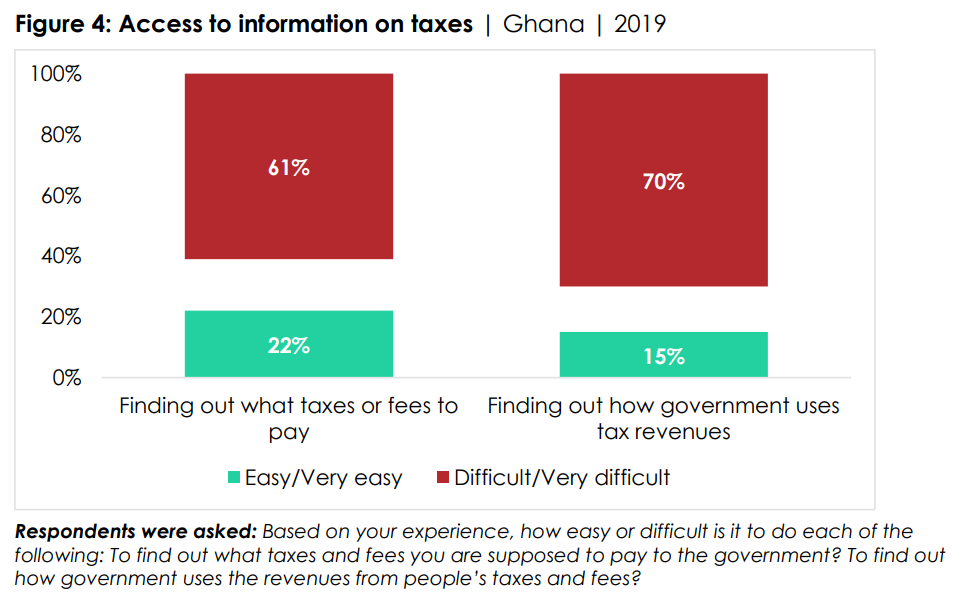

Although Ghanaians are willing to pay taxes, most do not know how the government uses the revenue generated, an Afrobarometer survey has shown.

According to the report, majority of the respondents said it was difficult to determine the taxes they were supposed to pay (61%) and how the government used tax revenues (70%).

This report comes on the back of the newly introduced taxes by the government.

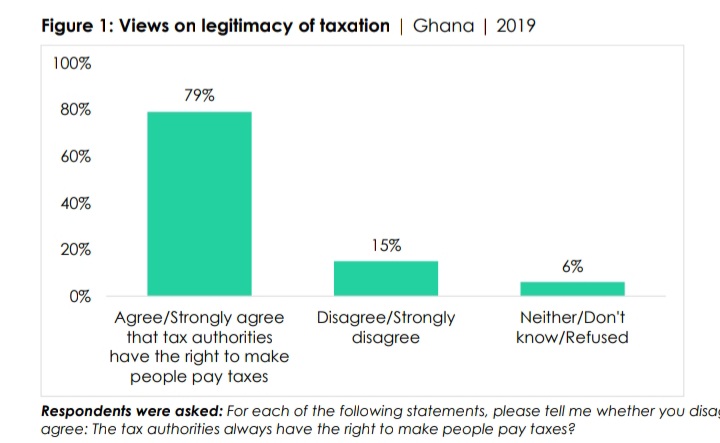

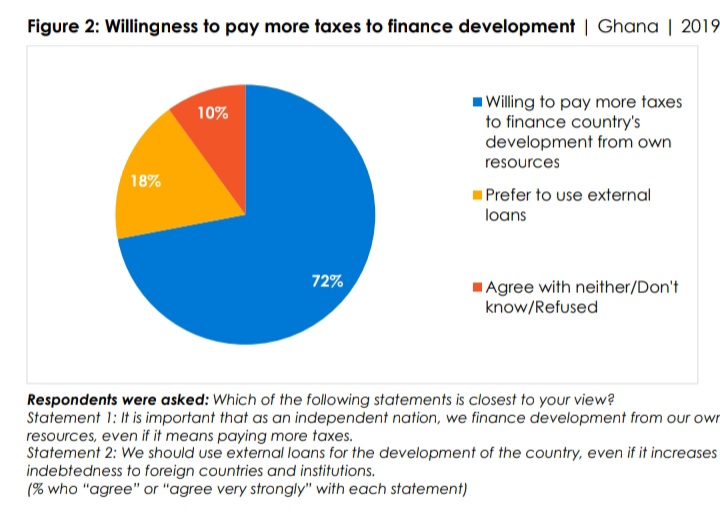

The report released by the Ghana Center for Democratic Development (CDD), dated April 9, 2021, noted that Ghanaians endorse taxation and are willing to pay to support the country’s development.

It also established that many citizens express mistrust of tax authorities and see widespread corruption among tax officials.

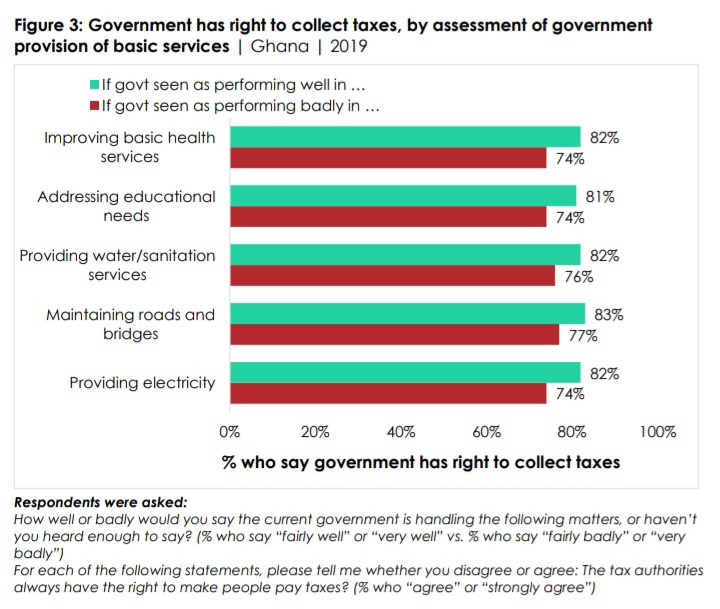

Eight out of 10 citizens, representing 79 per cent, said tax authorities have the right to collect taxes.

Other key findings of the report include:

Afrobarometer surveys

Afrobarometer is a pan-African, nonpartisan survey research network that provides reliable data on Africans’ experiences and evaluations of democracy, governance, and quality of life.

Seven rounds of surveys were completed in up to 38 countries between 1999 and 2018.

Round 8 surveys in 2019/2021 are currently underway. Afrobarometer conducts face-to-face interviews in the language of the respondent’s choice with nationally representative samples.

The Afrobarometer team in Ghana, led by the Ghana Center for Democratic Development (CDD-Ghana), interviewed 2,400 adult Ghanaians between 16 September and 3 October 2019.

2021 budget and taxes

The expenditure for 2021 is 13 per cent higher than the GHȻ 98.1 billion approved by parliament for 2020.

The 2021 budget was dominated by taxes and levies meant to shore up revenue for 2021, considering the adverse impact of the COVID-19 pandemic.

At least six taxes are on the table, which includes:

- Energy Sector Recovery Levy of 20 pesewas per litre on petrol/diesel under

- Sanitation and Pollution Levy (SPL) of 10 pesewas

- COVID-19 levy of 1% on National Health Insurance Levy (NHIL)

- COVID-19 tax of 1% on VAT

- Financial sector clean-up levy of 5% on profit-before-tax of banks

- Road tolls review

- Gaming tax

What did the Finance Minister say about the new taxes

Finance Minister Ken Ofori-Atta justified the need to introduce new taxes when Ghanaians are coping with the negative impact of the novel coronavirus.

Responding to a question from Parliament’s Appointments Committee on March 25, 2021, Mr Ofori-Atta said Ghanaians needed to learn to share the burden.

“I think the question of taxes can be an independent question. We have proposed a number of taxes that would affect petroleum which will lead to revenue for the Energy sector.

“We also have a huge sanitation problem, and I think that is a health hazard for the days. We are moving forward, and there is a battle cry for us to join hands towards growth and transformation.

“We need to create a society that we share the opportunities as we grow and also be able to share the burden,” he said referring to the “ WƆN YA WƆ HIƐƐ ” budget which the government has designed for consolidation, completion and continuation.