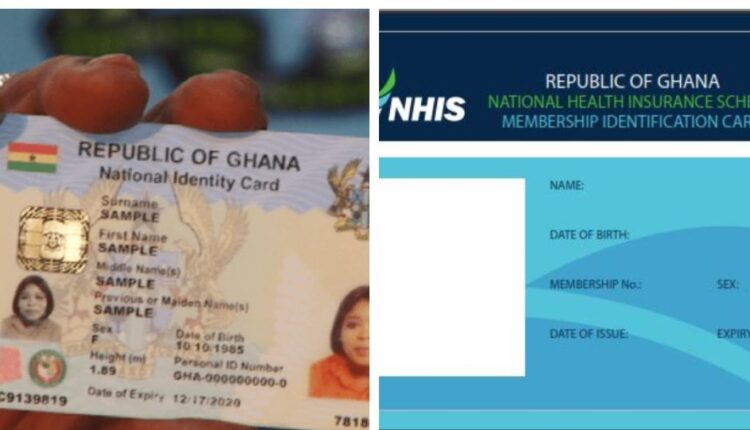

GhanaCard to replace NHIS card after December 2021

Ghana will phase out the National Health Insurance Scheme (NHIS) card used to access the subsidised healthcare programme at the end of December 2021.

Instead of the NHIS card, Ghanaians will be expected to present the cards mandated by the National Identification Authority (NIA), also known as the GhanaCard.

As a result of this switch, the National Health Insurance Authority (NHIA) is embarking on a sensitisation drive to prepare the general public for a successful transition.

The revelation was made on Thursday, September 16 in Kumasi by the Ashanti Regional Director of the NHIA, Mr Kwadwo Tweneboa-Kodua during a mid-year review meeting.

“I would, therefore, challenge management and staff of the NHIA district offices to intensify education on the use of the mobile renewal service code of *929# so that the NHIS members can easily renew their membership at their convenience and comfort,” Tweneboa-Kodua was quoted as saying.

In November 2020, the NHIA announced that it was linking the scheme’s card to the National Identification Authority’s database to allow Ghana-Card holders to access affordable healthcare services.

In August, the NHIA indicated that the annual NHIS active membership for 2020 was 16.2 million. However, there is a total of 23.8 million unique biometric identities in the NHIA’s database.

That is probably the biggest ID database in the country, according to the Chief Executive Officer of the authority, Lydia Dsane-Selby.

The NHIS is a social intervention programme introduced by the John Kufuor government to provide financial access to quality health care for residents in Ghana.

The scheme is largely funded by the National Health Insurance Levy (NHIL), which is a 2.5% levy on goods and services collected under the Value Added Tax (VAT).

2.5 percentage points of Social Security and National Insurance Trust (SSNIT) contributions per month return on National Health Insurance Fund (NHIF) investments premium are also paid by informal sector subscribers.

Government allocation complements the funding of the scheme.

NHIS subscribers fall into two broad groups, the informal and exempt groups. It is only the informal group that pays a premium. Members of the exempt group do not pay a premium.

Those exempted are formal sector employees and the self-employed who contribute to the Social Security and National Insurance Trust (SSNIT contributors); children (persons under 18 years of age); persons in need of ante-natal, delivery and post-natal health care services (pregnant women); persons classified by the ministry responsible for social welfare as indigents as well as categories of differently-abled persons determined by the ministry responsible for social welfare.

The others are persons with mental disorders, pensioners of the Social Security and National Insurance Trust (SSNIT pensioners), persons above seventy years of age (the elderly) and others in categories prescribed by the ministry responsible for social welfare.

Several categories of health care facilities have been credentialed by the National Health Insurance Authority (NHIA) to provide services to subscribers.

These are Community-based Health Planning and Services (CHPS), maternity homes, health centres, clinics, Polyclinics and primary hospitals (district hospitals, CHAG primary hospitals, quasi- Government primary hospitals and private primary hospitals).

Others include secondary hospitals, tertiary hospitals, pharmacies, licensed chemical shops and diagnostic centres.