Ghana to borrow close to GH¢20billion in 3 months

Ghana plans to borrow close to GH¢20billion through domestic instruments between January and March 2020, the Bank of Ghana has said.

The country hopes to generate revenue for expenditure through bills.

The bills include a 20-year shelf offering bill subject to re-opening based on investor’s request.

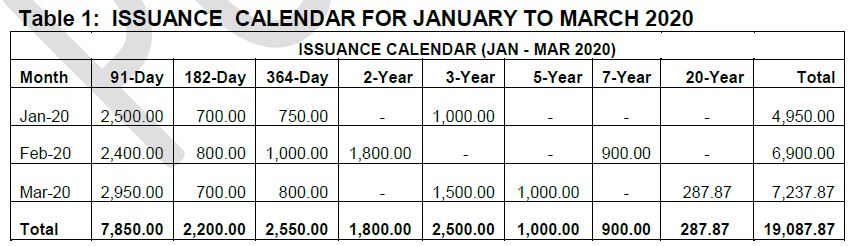

“Government plans to issue a gross amount of GH¢19,087.87 million, of which GH¢15,685.81 million is to rollover maturities and the remaining GH¢3,402.06 million is fresh to meet government’s financing,” the Bank of Ghana (BoG) stated on Friday

This implies that a whopping 82% of the borrowed funds will be used for interest payments leaving the government with a paltry amount for financing projects or consider infrastructure investment.

In announcing the calendar for the issuance of the instruments, the BoG explained that it followed the Net Domestic Financing in the 2020 Budget, the domestic maturities and the Medium-Term Debt Management Strategy (MTDS) for 2020-2023.

Below is the calendar.

Investors say no thanks to Ghana debt offering yield above 20%

Meanwhile, a recent report by the International Monetary Fund (IMF) described Ghana as getting closer to being classified as a high debt distressed country.

The public debt stock as at September 2019 was pegged at GH¢208.6 billion, equivalent to 60.3 percent of the country’s gross domestic product (GDP), data from the Bank of Ghana revealed.