Financial stocks to drive stock market to 12% profitability – Databank research

Despite its sluggish start to the year, the equities market is projected to close the year with a positive return of approximately 12 percent – and this will be driven by an upturn in the fortunes of financial stocks, a recently-released report by Databank indicates.

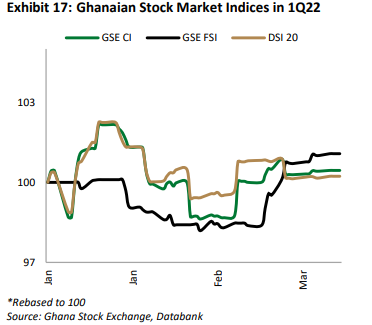

The Ghana Stock Exchange, as measured by its composite index (GSE-CI), has endured a lukewarm first quarter – as it fell by 1.67 percent during the period on the back of national economic developments, aggressive profit-taking in some quarters, and underwhelming annual results by some firms.

The performance, which translates to a 16.96 percent dip in US dollar terms, comes into sharper focus when last year’s performance – with the market returning 13.99 percent in the first quarter (14.69 percent in US$ terms) – is taken into consideration.

But in its first-quarter 2022 Ghana Markets Review and Outlook for 2Q22, dubbed ‘Cautious Investor Posture as Economic Uncertainty Clouds Market Outlook’, the research arm of Databank posits that the benchmark GSE-CI will close the year at around 3,142 points compared to the 2,789.34 points recorded at the end of 2021.

“We expect the stock market to see some recovery and close 2022 on a positive note. From our technical analysis perspective, we forecast the GSE-CI to close FY22 at around 3,142 points; translating into an annual gain of 12 percent, plus or minus 500 basis points,” Databank stated.

Banking

Banking stocks – as measured by the financial stock index (GSE-FSI), which outpaced the rest of the market in Q1 for the first time in five years – are expected to carry the market due to improved corporate earnings, rising interest rates and attractive valuations across the board.

Databank’s research indicates that the FSI has historically had a positive correlation with the Monetary Policy Rate (MPR). Furthermore, the sector’s price to book ratio (P/B) is currently less than 1 (0.88x) compared to the historical average of 1.3x.

“We expect banks to be the leading light in the market,” the report stated. “We expect banking sector stocks to perform relatively better on the market than in the first quarter of 2022, on solid earnings growth supported by the rising interest rates environment.

“Interest rates have been moving upward following a 250 basis points increase in the MPR to 17 percent in March, which is likely to benefit banks’ profitability. Our correlation analysis between the GSE-FSI and the MPR suggests that bank stocks tend to perform well historically during periods of rising interest rates.

“Moreover, the banking sector appears significantly undervalued with a P/B multiple of 0.88x compared to a historical average of 1.3x…. which could pique the interest of investors.

“However, investors will continue to closely monitor the development of inflation, FX risk and the economic uncertainties brewed by the Russia-Ukraine war to guide investment decisions,” it added.

Insurance

The upswing experienced by the insurance sector, led by the impressive performance of SIC Insurance, is projected to be maintained on the back of a strong digitalisation drive in the sector.

“The insurance sector should also witness continually strong gross premiums supported by the ongoing digitalisation of motor insurance. The digitalisation of motor insurance has enabled law enforcement agencies to quickly check motor insurance, which minimises the prevalence of fake insurance and hence supports premium growth in the sector,” Databank explained.

Additionally, the large stake of insurance companies in government securities is expected to receive a boost on account of the rising interest rates.

Tech

The usual suspect, MTN, will continue to drive market activity positively, as the dent to its mobile money earnings as a result of the impending E-levy will be offset by gains from the transition to more data-driven solutions.

“In the telecommunication sector, we expect MTN Ghana’s overall profitability to remain healthy despite the impact of E-levy on mobile money transactions. While we expect the E-levy and the 25 percent reduction in MoMo charges to adversely affect mobile money revenues, we believe the recent tariff adjustments across the product segments will provide respite to a possible revenue shock from the MoMo segment. On the back of its solid fundamentals, a generally positive outlook for the telco sector and attractive market valuation, we foresee MTN Ghana’s stock doing well.”

FMCG

Despite the better-than-expected performance of Guinness Ghana in 2021, ostensibly as a result of increased social activity during the final quarter of the year, analysts are measured in their growth estimations of the wider sector due to prevailing supply chain challenges as well as the rising cost of inputs.