EOCO retrieves GH¢51m in taxes from private companies,institutions, individuals

The Economic and Organised Crime Office (EOCO) has recovered GH¢51 million of taxes owed to the state by some private companies, institutions and individuals.

Recovered over a period of one-and-a-half years, the money has been lodged in the accounts of the Ghana Revenue Authority (GRA).

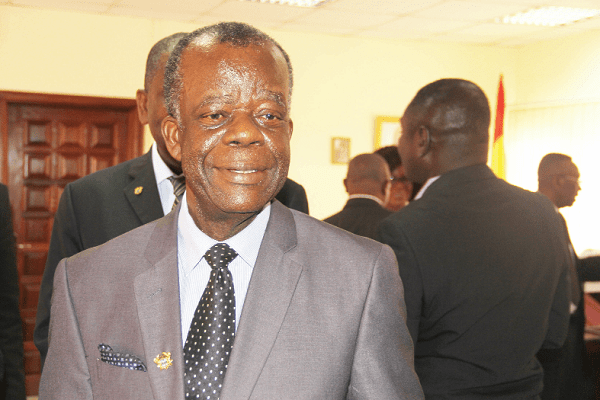

The Executive Director of EOCO, Mr K.K. Amoah, made this known at a multi-stakeholder business integrity breakfast meeting in Accra yesterday organised by the Ghana Integrity Initiative (GII) and the Private Enterprises Foundation (PEF).

The meeting, which brought together private sector businesses, civil society organisations and the public sector, discussed the role of the private sector in the fight against corruption.

Government concerns

Unpaid taxes have been a major concern to the government, as they stifle efforts to achieve development goals.

In September this year, for instance, the Finance Minister, Mr Ken Ofori-Atta, tasked the GRA to go all out to recover GH¢4.4 billion from 427 corporate tax defaulters and other entities in unpaid taxes.

He promised that the government would give the GRA the necessary support to deal with tax defaulters.

‘Do not cheat the state’

Delivering the keynote address at the breakfast meeting, Mr Amoah said EOCO would continue to collaborate with the GRA to ensure that tax defaulters were brought to book.

He indicated that the private sector was mandated to demand for accountability and transparency from the government.

However, he said, some of them were rather engaged in corrupt acts and paying their way through business transactions.

Greed, he said, had taken a good part of some companies and individuals, a development which, he said, was counter-productive.

Mr Amoah urged the private sector to do due diligence in complying with their tax obligations to avoid the EOCO and GRA going after them.

“Do not cheat the state; when you do not file your tax returns, EOCO and GRA will come after you and when we do, you will not feel comfortable at all,” he warned.

While urging the private sector to help fight corruption, Mr Amoah also admonished them to report suspicious business transactions to the security agencies to take action on them.

He indicated that most countries that had fought corruption successfully achieved their goal through effective collaboration between the security agencies and the private sector, hence the need for Ghana to travel that path.

Mr Amoah stressed the need for the country to inculcate in its children the values of truthfulness, honesty and law abiding, so that they would grow with them to become good citizens.

Succumbing to bribe

In an address, the Chief Executive Officer of the PEF, Nana Osei Bonsu, indicated that some public officials demanded bribes from the private sector during business transactions, adding: “If public officials do not demand money, the private sector players will not pay.”

He urged the private sector not to succumb to the demands but rather report public officials who demanded bribe to the law enforcement agencies to take action against them.

To reduce the level of corruption in the various sectors of the economy, he suggested the improvement of electronic transactions to reduce the human interface in business transactions.

Additionally, he said, the country needed to look at preventing corruption, instead of fighting it.

Sanctions on corruption limited

The Executive Director of the GII, Mrs Linda Ofori-Kwafo, for her part, said although most private companies had codes of conduct that guided their activities, implementation was a problem.

“Although most of these companies have beautiful codes of conduct, it is very difficult to adhere to them because of the system where public officials demand money,” she stated.

She said the country had beautiful legislation on corruption but sanctions on corruption were not forthcoming.

“We have many corruption cases which have not been investigated or whose perpetrators are not punished,” she stated.

source: Graphic Online