Data from the Finance Ministry indicates that the government missed the Electronic Transfer Levy (E-Levy) revenue target by 87 per cent for the month of June.

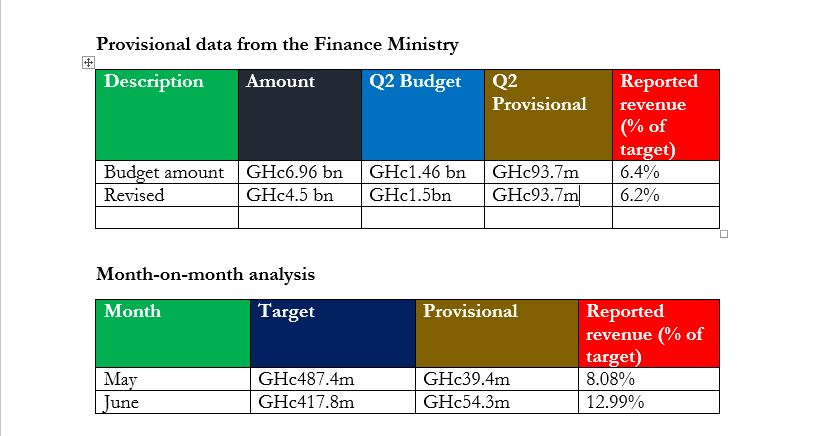

June only realized about Gh¢54.3m of the targeted Gh¢417.8m, representing just 12.99 per cent.

In May, revenue mobilized for the levy was around Gh¢39.4m of the targeted Gh¢487.4m representing 8.08 per cent.

However, there was an increase in revenue with a difference of Gh¢14.9m accrued month-on-month from May to June.

June raked in Gh¢54.3m compared to the Gh¢39.4m realized in May.

The E-levy was initially expected to rake in ¢6.9 billion by the end of 2022, of which it was revised significantly to ¢4.5 billion.

What is the E-levy?

E-levy is a tax applied on transactions made on electronic or digital platforms. The Minister of Finance announced in Parliament the intention to implement the bill during the presentation of the 2022 Budget.

The tax is one of the measures the government plans to use to increase the country’s tax to GDP ratio from 12 .5% in 2021 to 20% by 2024.

The E -Levy is charged at the rate of 1.50% on the following transactions:

•Mobile Money transfers done between accounts on the same electronic money issuer

•Mobile Money transfers from an account on one electronic money issuer to a recipient on another electronic money issuer

•Transfers from bank accounts to mobile money accounts

•Transfers from mobile money accounts to bank accounts

•Bank transfers on an instant pay digital platform or application originating from a bank account belonging to an individual are subject to a threshold to be determined by the Minister of Finance.

However, not all transfers will be affected by the E Levy.

The levy does not apply to the following types of transfers:

• A cumulative transfer of One Hundred Ghana Cedis a day made by the same person

•A transfer between accounts owned by the same person

•A transfer for payment of taxes, fees, and charges on the Ghana.Gov System or any other Government of Ghana designated payment system

•Specified merchant payments

•Transfers between principal, agent, and master agent accounts and

•Electronic clearing of cheques

The Charging Entities are:

- Electronic Money Issuers

- Payment Service Providers

- Banks

- Specialized Deposit-Taking Institutions

- Other Financial Institutions are prescribed by Regulations made under the Act.

The levy had divided Parliament, with the majority pushing for approval while the Minority kicked against it.

There was a split vote of 12 for each side at Parliament’s finance committee until the chairman cast the decisive vote favouring the proposal.

Parliament degenerated into fisticuffs at a meeting to approve the levy prompting an adjournment to 18 January 2022.

The Chamber turned chaotic as MPs pushed, shoved, and punched each other during the heated exchanges that many observers have since condemned.

This was after the Speaker of Parliament, Alban Bagbin, had left and delegated the First Deputy Speaker, Joe Osei Owusu, to take over proceedings.

The Minority had said it would do all it could to ensure that the bill did not see the light of day, insisting it was not in the best interest of Ghanaians.

But Parliament approved the policy without the participation of NDC MPs who had staged a walkout during the E-levy debate on Tuesday, 29 March 2022.

Very educative