Foreign businesses averagely lost $75,000 due to coronavirus – GIPC study shows

A survey by the Ghana Investment Promotion Centre (GIPC) shows foreign businesses averagely lost $75,000 due to the coronavirus pandemic.

A summary of the survey indicated that “foreign investors operating in the country are estimated to have experienced an average revenue loss of $75,000 in the second quarter of the year due to the COVID-19 pandemic”.

Theghanareport.com during the early days of the coronavirus pandemic visited some foreign-owned small and medium scale businesses in Osu and found the owners struggling to stay afloat.

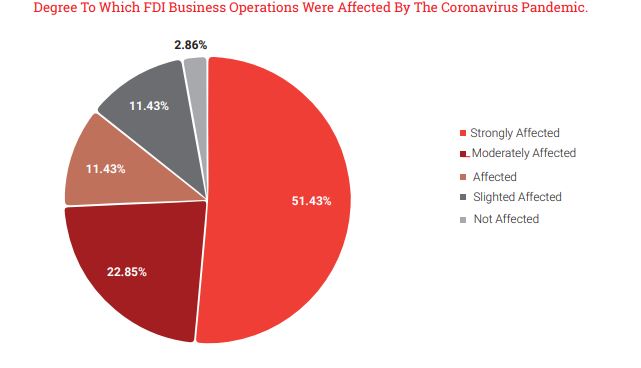

But in a detailed GIPC research work titled ‘Survey on the Impact of Coronavirus (COVID-19) on Foreign Investors in Ghana” more than half of the respondents were “severely impacted by the pandemic”.

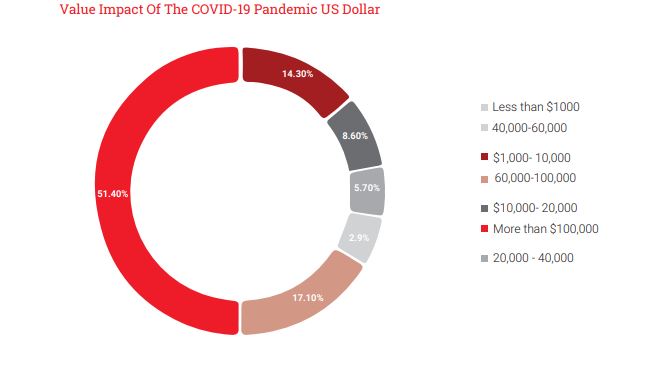

“In terms of revenue, 51.4 per cent of the respondents sampled by the Centre had experienced losses in excess of $100,000 whiles the rest pegged their losses between $100,000 less than $1,000”.

The research was conducted between April 1-June 12, 2020.

It was not all gloomy as government’s interventions mitigated the hit to the foreign businesses.

The extension of due dates for the filing of tax, reduction in tariffs on imported inputs, low-interest loans and reduction in utility bills according to most businesses had played a significant role in dealing with the adverse impact.

Following the spread of the virus, the government instituted COVID-19 protocols which included a partial lockdown. Most firms shut down or operated at half capacity and others asked staff to work from home.

Ghana was in isolation as most countries across the globe followed a similar path.

The survey identified this factor as the cause of severe disruption to demand and supply value chains.

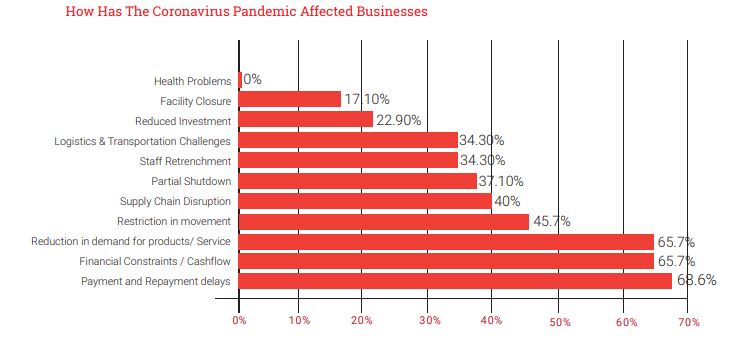

“This saw most companies experience payment and repayment delays, financial constraints and a reduction in demand for products and services which translated into revenue losses”.

The United Nations Conference on Trade and Development has projected FDI to drop by 40% due to the disruptions to Global Value Chains (GVC) influenced by the lockdowns.

In the case of Ghana, the survey revealed a downward trend in FDI flow from the month of April to June 12, 2020, when the survey was completed.

Within the period, the GIPC registered 13 projects with an FDI value of $9.29 million. Regardless of the initial slowdown in FDI values as indicated earlier, a total of 21 projects had been registered by the end of the quarter, i.e. June 30, 2020, which saw the value of FDI shoot up to 207.98 million dollars.

“The development, therefore, places a positive outlook on the flow of FDI into the country and indicative of a better trend for economic recovery post-COVID-19,” the report added.

The target population for the survey was top 150 foreign investors/companies registered with the Centre between 2015-2019.

Rise in unemployment

With regards to employment, 40% of foreign investors foresee a permanent reduction in their workforce in the ensuing months.

Meanwhile, most workers have had to stay home temporarily due the pandemic.

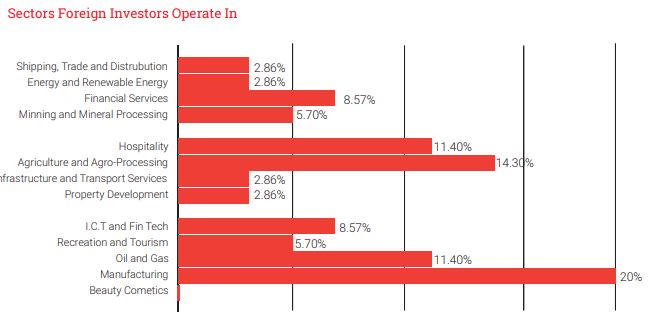

Despite the downturn in activity experienced by various industries and businesses, sectors such as manufacturing, food processing, e-commerce, agriculture and healthcare have remained resilient and present opportunity for growth and investments, the report projected.

Moving forward, more interventions such as a reduction in the cost of data, further reduction in taxes for manufacturers, tax exemptions on capital expenditure as well as the re-opening of borders will be required to cushion businesses as the detrimental effects of the pandemic unfolds, it admonished.

It would be recalled that the Trades Union Congress (TUC) estimated job losses up to 500,000 for the formal and informal sectors with the Bank of Ghana (BoG) corroborating with a similar figure of at least 100,000 for the informal sector alone.

But the government has taken steps to mitigate the impact with loans at cheaper rates to the tune of GHC 100,000 to save companies.

At the same time, the government has earmarked about GHC 2 billion guarantee fund for over 100 large-scale firms to access more capital for operations.

This was another level of support after the initial GHC 600m for small and medium scale firms being supervised by the National Board for Small-Scale Industries (NBSSI).