Ghana’s cocoa export revenue has plunged nearly $700 million in the first half of 2024, severely impacting the sector.

Illegal mining, smuggling, and crop diseases have devastated cocoa production, placing unprecedented strain on an industry crucial to the nation’s economy.

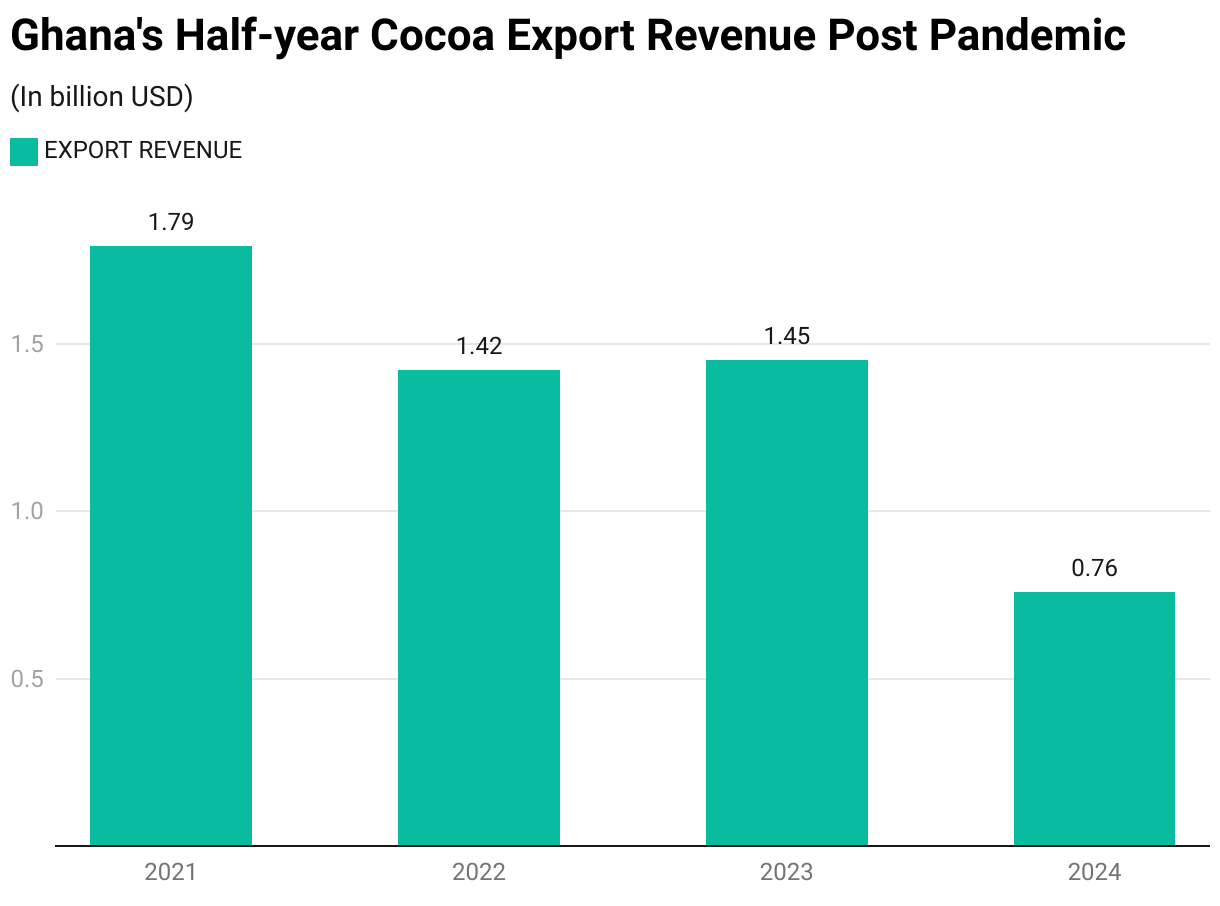

According to the latest Summary of Macroeconomic and Financial Data from the Bank of Ghana released in July 2024, cocoa export revenues have experienced a dramatic decline.

The report shows that cocoa export returns fell from $1.45 billion in the first half of 2023 to just $760 million in the same period this year, representing a staggering 47.7% drop.

This sharp decrease is part of a broader trend of declining cocoa revenues in the post-pandemic era.

Over the past three years, the industry has faced a catastrophic 134% drop in half-year inflows, leading to cumulative losses exceeding $1 billion since 2021.

These figures highlight the severe and ongoing challenges confronting Ghana’s vital cocoa sector, which is crucial to the nation’s economy.

Ghana’s cocoa harvest in the 2023-2024 season, which ended this month, is expected to be 650,000 tons to 700,000 tons versus an initial forecast of 850,000 tons, according to the Ghana Cocoa Board.

However, people familiar with the industry say adverse weather, disease, shortage of fertilizer, and galamsey in cocoa-growing areas could lead to projected yields falling below 500,000 tons.

Additionally, the increasing smuggling of cocoa beans to neighbouring countries for higher prices could result in Ghana, the world’s second-largest cocoa producer, losing around 200,000 tons of beans.

This loss threatens the country’s ability to secure crucial loans from the cocoa syndication program.

COCOBOD, Ghana’s main cocoa regulator, is acutely aware of its declining creditworthiness in the international loan market.

This decline stems from its struggle to supply enough beans and the painful debt restructuring process challenges.

In response, COCOBOD has been forced to rely on domestic self-financing as a survival strategy.

The near-collapse of Ghana’s forward cocoa sales last season has underscored the situation: a significant risk premium will now be attached to Ghana’s cocoa beans, affecting not only this season but future ones as well.