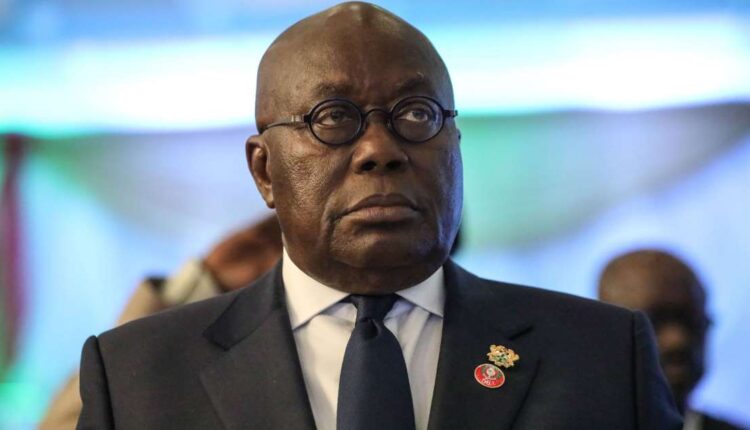

Akufo-Addo revives $1bn Agyapa Deal

Ghanaians may have to brace up again for the controversial $1bn Agyapa deal as President Akufo-Addo hints at resurrecting the transaction.

The government shelved the deal after critics punched loopholes in the plans to leverage Ghana’s mineral resources for development finance.

However, President Akufo-Addo has said in his first State of the Nation Address (SoNA) in his second term that the deal will be revisited.

“In the course of this session of parliament, government will come back to engage the House on the steps it intends to take on the future of the Agyapa transaction,” he told parliament on Tuesday, March 9, 2021.

Some Civil Society Organisations (CSOs) and the minority in parliament called for the deal’s cancellation.

It was after former Special Prosecutor Martin Amidu further described the transaction as a conduit for corruption.

Former Attorney General Gloria Akufo has also raised concerns about the transaction but later made a U-turn.

Ms Akuffo had advised the government against the deal, describing it as inimical to Ghana’s interest.

What is the Agyapa transaction?

In the deal, 75.6% of royalties of at least 16 gold mining companies will go into Agyapa Royalties Ltd.

The company will list on the London Stock Exchange and the Ghana Stock Exchange and float 49% shares valued at $1bn.

It hopes to get investors to buy shares while Agyapa Ltd collects gold royalties from future mineral resources to pay as dividend to shareholders.

Agyapa Royalties Ltd is also incorporated in a tax haven, British channel island, Jersey, where companies don’t pay corporate tax. It means the company will enjoy considerable tax reliefs.

But a wave of red flags raised by the 22 civil society organizations and the minority in Parliament compelled the government to hasten with caution.

The voices against the deal raised concerns about potential value for money, the registration of the company in a tax haven, and the lack of consultation as the minority walked out on the deal on the day majority and passed it.

With the minority raising hell while the CSOs threaten legal action, the government suspended the deal’s implementation when the Special Prosecutor’s Office stepped in to probe the deal on suspicion of allegations of corruption.

Mr Amidu, in a letter dated September 10, made a formal request to parliament to provide all the information regarding the approval of the deal by the House.

This compelled the government to temporarily suspend the deal while Mr Amidu combed through the transaction and pass it through the litmus test of anti-corruption.

What were Mr Amidu’s findings?

Weeks after he submitted the 64-page corruption assessment report and resigned, the former Special Prosecutor returned to redefine the Agyapa deal in a 68-point damning verdict.

“The Agyapa Royalties Limited Transaction contains the mother of all suspected corruption and corruption-related offences to be discovered in the first analysis of the risk of the prevention of corruption and anti-corruption assessment since Ghana attained its independence in 1957,” he stressed.

He alleged in his 27-page response that the President asked him to put the report on ice “to allow him to deal with the matter through a statement to the public”.

According to Mr Amidu, during one of his meetings with the President when he was being persuaded to shelve the report, “God (represented by the Holy Trinity in my Catholic faith) was in his own divine way revealing to me for the first time that the President of Ghana only looked like the innocent flower of the fight against corruption but was indeed the mother serpent of corruption under the innocent-looking flower of anti-corruption. And may God, encompassed in the Blessed Holy Trinity, be eternally praised for that divine revelation!”.

What Amidu’s report said

- The Special Prosecutor’s work on the Agyapa deal was not an investigation. It is an audit to ensure the agreement complied with the law. The difference is that an investigation would suggest criminality.

- The Transaction Advisor’s appointment in the Agyapa deal should have been brought to parliament for approval because it is an international economic transaction. It is international because the government engaged a South African firm, IMARA Corporate Finance Limited (Pty), as a Transaction Advisor.

- In selecting the transaction advisor, the company had to get a local partner. IMARA selected Databank, but Special Prosecutor says this is a “decoy”.

- The report wants to know how Databank is being paid as a local partner. He said this arrangement is “opaque”, which raises “reasonable suspicion of bid-rigging, and corruption activity, including the potential for illicit financial flows and money laundering.”

- There is a zero-chance that the Transaction Advisor’s advice would be neutral and impartial because of individual interests at the Ministry of Finance and IMARA/Databank.

- Chief Director of the Ministry of Finance should have signed the agreement, not the Deputy Minister of Finance, Charles Adu Boahen. This is because the Public Financial Management law gives the Chief Director that power to bind the Finance Ministry to an agreement.

- Several service providers and underwriters, including Africa Legal Associates, the legal firm owned by the president’s cousin Gabby Otchere Darko, may not have been chosen on merit. This is because they were not selected in accordance with the Public Procurement Authority.

- He believes the selection of the Minerals Income Investment Fund (MIIF) governing board members could not meet the litmus test of the prevention of corruption. The Chairman and the other Board members indicated “a real Likelihood of almost all of them being affected by partisan considerations” in the discharge of their duties.

- Parliament did not properly scrutinize the agreement, and this makes corruption attractive because “the risk is low”.