Following news of Government of Ghana’s intention to establish a Special Purpose Vehicle (SPV) with our Gold Royalties (75% of it), to be traded on the London Stock Exchange (LSE), many concerns, or better still requests for clearer and better information, have been raised.

This is due to the lack of adequate information on the proposed transaction to inform our lawmakers, media, CSOs, other public interest groups and the general population on the merits and downsides of the proposed transaction.

From where I stand, some of the immediate clarifications that must be provided by the government to clear the current clouds of doubt hovering over the deal include, but not limited to:

a. Why only three (3) years out of the 15yrs cash flow information was provided to the people’s representatives (parliament) on the deal?

b. When will Government provide the full cash flow to stakeholders for independent analyses and by other national stakeholders?

c. Why was Parliament denied information on key terms in the prospectus for the SPV? When are they going to share that with stakeholders to ensure proper disclosure and transparency prior to using future national earnings for the said SPV?

d. Primary to stakeholders’ interest in the formation of an SPV is also the list and quantum of fees and incentives to be charged by the fund managers, types of shares on offer, purchasers, participation rights, etc. Since Ghana, hence Ghanaians, is the biggest shareholder, when will sufficient information in the prospectus be shared with the representatives of the people and other interested parties?

f. What’s the full corporate governance structure of the said SPV? Is the government going to share that information? and when?

g. Finally, since the government has flatly denied that the $1billion cited in the contract by CSOs and the Opposition in Parliament isn’t the value of the SPV, can they share with stakeholders a tentative range within which their valuation is, even if they do not want to share the precise value at this point?

Some Unsettling Clauses in The Agyapa Agreement

Before I proceed to delve into the merits or otherwise of the transaction, and while we wait for further engagement from the government on the questions raised above, let me quickly mention for emphasis some fundamentally troubling arrangements identified in the draft transaction agreements by the Attorney General(AG), which have contributed greatly to casting ample doubts on the integrity of the deal from the point of its initial proposition.

One of such was the clause seeking to hold the Republic of Ghana jointly liable with Agyapa, a body corporate on its own.

The inclusion of such a clause in the draft agreement only hints of prior involvement of external interests’ in putting together the deal, who in the quest to overprotect their stakes will advocate such overreaching clauses to protect their participation in the SPV.

On the other hand, it may well be a case of the lack of commitment on the part of the managers of the fund to take full and sole responsibility for their actions when operational, hence attempting to sneak liability onto the entire republic, via the back door.

Such suspect clauses should never have been allowed to find space in any considerations for the deal if the entire transaction is to be considered one with genuine intents ab initio.

Another fundamental element which hints of suspicious intentions was the said provision in the Agreement which makes it impossible to replace top Executive positions such as the Board and Chief Executive.

Now that’s a provision that must be immediately corrected if the government wants anyone to take the SPV seriously. If the intention was to establish tenure security for the top management and board, so as to prevent incessant political interference which may destabilize steady management of the fund, there are better ways to go about it without essentially providing some people with jobs for life; whether they perform or not.

There’s the other thorny issue of the SPV being proposed as one with perpetual succession, despite only one-time capital contribution by potential share purchasers. But government officials claim this concern, among others, have been addressed when they were raised by the Attorney General.

It’s however very important to re-emphasize the need for government to limit the SPV to its tenure of 15yrs, based on the current valuations; since anything contrary would amount to Ghana going to exchange our gold royalties for bottles of schnapps all over again; and thus would raise key questions of vision and providence, or the lack of it thereof, regarding the structuring of the transaction.

If the SPV would go beyond the initial 15yrs, then it would be crucial for Analysts and CSOs to not only look at the value Ghana is about to give out in terms of the $2.5mill to $3.5mill, but rather the value of Gold as the most stable store of value at a time when the global economic powers are at each other’s throats, the destabilizing effect of COVID-19 on the global order of commerce, and the fact that the global economy is currently in a flux; essentially being tilted off its old axis.

These events are not to be seen as one for which a State should be in a hurry to make a few hundred million dollars, while giving shares in gold backed royalties (what would be the most sought-after source of value in these times) over a very long term.

The reason why government’s approach, unless the contract has been revised otherwise, remains imprudent is that; $500mill is no worthwhile amount for which Ghana must go giving significant stakes in an SPV, backed by the most stable and steady long term store of value, for decades; stakes most likely to be gobbled up from the LSE by Market Makers who care not about the future of Ghana, its economy, nor the welfare of its citizens.

The Pros and Cons of the Agyapa Deal As Currently Structured

Considerations for the Transaction – The Need for Financial Inclusion:

According to the Government of Ghana’ National Financial Inclusion and Development Strategy document, Fifty-Eight per cent (58%) of Ghanaians had access to formal financial services in 2015, an increase from 41% in 2010.

Although banks retain 36% of the 58% access, they only contributed 2% out of the 17 percentage-point increases between 2010 and 2015. Conversely, mobile money alone accounted for 7% of the increase, and NBFIs (Non-Banking Financial Instruments) such as regulated MFIs, insurance companies, etc. together accounted for the remaining 8 percentage-point increase.

Notwithstanding the dwindling, or rather stalling, role of banks in driving financial inclusion since 2010; the financial sector would be hit by the recent Banking and Financial Sector

Reforms by the government, leading to a major erosion of confidence in the formal financial system among citizens. A wide-ranging blow was dealt to the already inchoate investment culture in the country, with the plight further worsened by investors losing their money via Ponzi schemes such as Menzgold, amidst the general financial sector crisis.

It’s therefore fair to say that trust in our financial system is at an all-time low, and local investor confidence has been negatively affected correspondingly.

It’s clear something needs to be done about this, and Government is best positioned to lead the innovation and change required in revitalizing our savings, investment and wealth creation culture; behaviours our Government should promote through arrangements such as the Agyapa Royalties transaction.

It would appear that it was in line with this prognosis that the Minister of Finance, Ken Ofori Atta, signed off on a working document which sought to improve the level of financial participation among citizens; which can be found in the National Financial Inclusion and Development Strategy (NFIDS) 2018– 2023.

To turn around the doldrums of our financial sector, it’s important to put in innovate approaches beyond the traditional utilization of services of universal banks by the people, and encourage long-existing but less patronized financial channels, especially ones that will resuscitate our almost dormant stock market.

Doing so will broaden fairly safe investment options for citizens, encourage our financial development and inclusion of a wide range of Ghanaians within different earning brackets. But the fundamental practical consideration is, does the Agyapa Royalties deal in its current form meet these requirements?

Consequences of the Agyapa Deal – Does It Engender Financial Inclusion?:

Financial inclusion is a measure of the proportions of individuals and firms that use formal financial services. As a nation that is still building the foundation that will help us reach the point of reducing economic vulnerability and income inequality, some of the policies and initiatives our Government adopts can either hinder or improve our progress. The aim of our Government in using our assets for any such Agyapa type of transaction must be to serve and empower the citizens, and the primary lever for such empowerment is economic. Ghanaians need greater access to financial products and services that would enable them to generate income, build assets, manage

financial risks, and become economically empowered. Currently, our MSMEs and individual investors lack the conducive financial space to achieve such aims as mentioned above.

If Ghana is to leapfrog our economic development and take millions of our people out of poverty, then raising capital locally is the steadiest and most effective way to do this. It stands to reason that, the source of capital would be the recipient of interests and the ultimate beneficiary of dividends from the capital.

As such, a deeper focus on domestic means of raising capital and in turn creating dividends for our people would go to solve the multiple challenges we face when trying to raise this same capital in the international markets.

Our domestic bond and capital markets, if well developed, are meant to serve as an important tool to raise funds without the added risk and exposure that our Government receives when attempting to raise money from international markets.

However, with the decline in our stock and bond market capitalization in recent times, it is judicious for our Ministry of Finance to cease and create opportunities to develop this area in our financial sector, so as to further enhance economic participation by the populace.

The Menzgold, Bitcoin and other Ponzi scheme debacles in recent times have proven that Ghanaians are eager to place their money in financial instruments to increase their wealth.

The government must help create safe avenues where such investments can be directed. Because a well-functioning stock market boosts the incentive to investigate firms and thus produce valuable information with positive implications for capital allocation and growth.

Through small denomination instruments, stock markets can also provide opportunities for households to diversify their portfolios.

Shareholders can also monitor a manager’s performance and exert pressure to improve corporate governance.

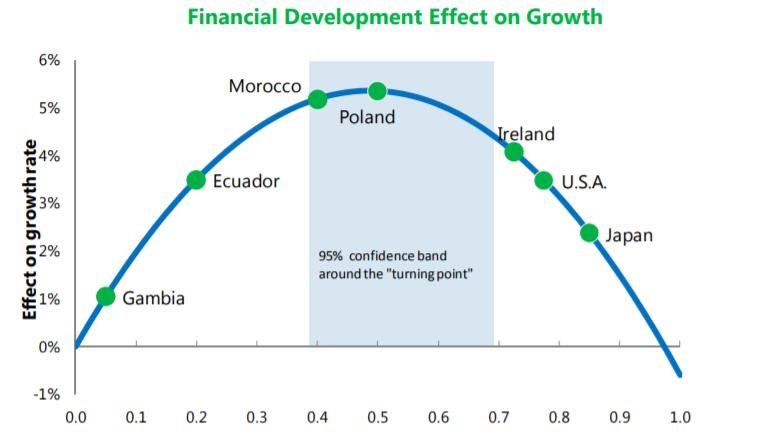

Stock markets may improve risk-sharing and create liquidity and, therefore, encourage financing for illiquid investments in our market; and in the end, contribute significantly to GDP growth.

A dynamic stock market has the potential of boosting Ghana’s GDP quite meaningfully. The graph above shows the effect on growth rate in a well-functioning stock market. The Graph shows that a country can add up to 5.5% to its GDP growth rate with a dynamic stock market.

In light of Ghana Governments’ stated commitment in the NFIDS to improve financial inclusiveness and enhance the macroeconomic stability; one strategy should be to develop our stock market, by increasing the number of appealing firm listings (supply-side) and hence attracting investment from Ghanaians (demand side).

This is where transactions like the Ayapaa Royalty IPO, from a credible state-owned enterprise, can bolster market development. The government could retain control at the early stages, but enough shares should be available to the public to encourage liquidity, as stated.

As such, theoretically, the Agyapa transaction is to be seen as a good step to increase participation in our economy; but in practice, this would be hindered by the character and form of the SPV as is being pursued by the promoters.

In the current arrangement, Government is essentially proposing that Ghana dedicate 75% of our gold royalties to form an SPV to be mainly listed on the London Stock Exchange (LSE), headquartered in the tax haven of Jersey, and with only a subsidiary in Ghana.

First of all, it must be noted that, with the Parent company being located in Jersey and the subsidiary in Ghana, it simply means whatever assets may be accrued through investments made by Ghanaians in purchasing stocks in this subsidiary would substantively go to register as assets on the books of the entity domiciled in Jersey.

As such, the activities of major market players who may buy into the stocks on the LSE(which are likely to be further securitised), hence in the Parent company in Jersey, are tied to the modest investments that may be made by ordinary Ghanaians seeking to invest whatever savings they may have made in the Agypa stocks on the GSE.

What this means is, when a major multi-million decision made involving the Parent Company in Jersey go awry, the humble investments of hard-working Ghanaians are essentially up for grabs to clean up the mess.

This becomes more so depending on the nature of the corporate governance structure of the SPV; that’s why it’s very important for such information as the governance structure and its dynamics be shared with stakeholders beforehand, so as to enable Ghanaians to make an informed decision regarding this whole transaction; not only at the policy level but even from the individual investment decision-making point.

Now, without availing details of who qualifies to purchase stocks in this SPV, it stands fair to interpretation that apart from windfall taxes that government may evade from paying to the UK Government by locating this SPV in Jersey, it’s difficult to see any other upsides that come to profit Ghanaians, by way of direct optimum benefits for developing our financial market.

This is because, with the current arrangement, where the amount required is comparatively low for matured exchanges like the LSE, it’s only natural that 49% of this SPV would go to enrich some alien and already wealthy investors; most of whom may have nothing to do with Ghana’s domestic economic survival nor development.

On the other hand, if this gold-backed SPV were to be reserved for Ghanaians, and located in Ghana, it implies that apart from benefits that would be derived from the SPV’s returns to support infrastructure growth, the State stands to benefit from its tax obligations, as well as stamp duties for each share purchased, most of which will now go to benefit the UK government.

The counter-argument that could be made is that the SPV has a subsidiary in Ghana, which could provide similar benefits to interested local investors. But for an IPO which seeks to raise only $500mill on an exchange like the LSE, where major capital holders play, how much of that $500mill will be reserved to be raised on the Ghana Stock Exchange by way of shares? Would that be enough to significantly stimulate our market in any way and bring about the benefits due to Ghanaians?

If the Agyapa SPV were to involve any other commodity, say Oil for instance, with relatively high rates of volatility, one would appreciate why the government would seek to spread the risk widely; and not laden itself and its citizens solely with it.

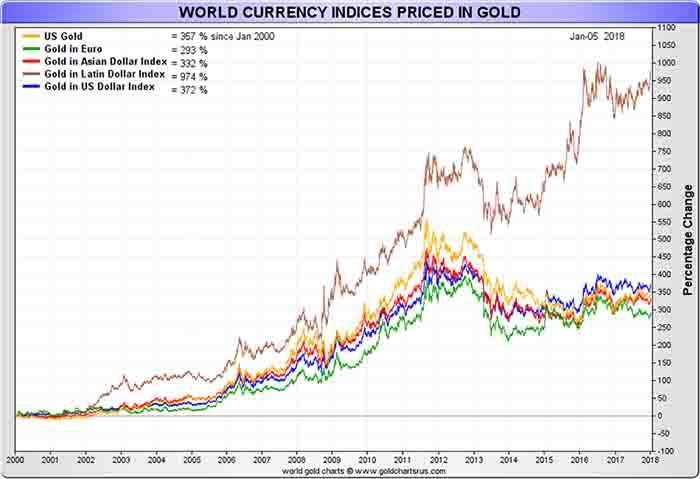

But Gold is known to be the best store of value over the long term, and in these uncertain times, if a government truly seeks to stimulate its local exchange and stabilize its economy, a State-led gold-backed investment arrangement must certainly be one of the investment options to be reserved for its citizens; rather than leaving it up for grabs by already satiated players on the international stock market, especially when the initial amount required to be raised by the SPV can be obtained locally.

As such, instead of running out there and throwing out our inheritance in the international markets, we must rather encourage and educate our citizens to store and get appreciated value for their savings via gold, while the State simultaneously uses the accumulated capital thereof to generate returns by investing in our economy via the SPV, towards the provision of infrastructure to benefit all – this scenario presents a closed indigenous cycle of wealth creation and augmentation, a win-win for Ghana.

I see this as a better approach than jetting off to London, to present this golden opportunity on a silver platter to the world, whereas our people continue to be starved of worthwhile investment options while losing surplus earnings to quack investors and Ponzi schemes.

After all, if the returns from this SPV are to be dedicated to infrastructure development, as government posits, then the only high side I see to listing on the LSE must be one determined by our projections of FX requirements that would arise when we embark on the particular infrastructure projects in question – which government is still yet to determine or share with Ghanaians. Having these requirements in mind, the State may raise such amounts and even more on the LSE, once the sales of shares are reserved for Ghanaians, whether at home or in the diaspora.

All that said, if the said SPV were structured such that only Ghanaians, at home and in the diaspora, can purchase shares, then it will go to make sense that giving 49% of such shares out to Ghanaians( and transferable only to Ghanaians), while the State holds 51%, essentially retains full benefits to Ghana; and as such, whatever gains may be made from gold, as the world continues to totter on its foundations, would inure to the benefit of Ghanaians and generations to follow who would inherit or purchase such investments from their forebears.

If in any event, Gold prices plummet, it’s a matter of Ghanaians bearing the collective risk, without angling for the sales of their own national assets.

But a mere cursory study of the markets shows you that gold is the surest thing in terms of value over the long haul. To appreciate this dynamic, please see below the long-term charts of world currency indices priced in gold.

To further bring home the point that it’s needless for Ghana to present this golden opportunity to the world simply because of $500mill, it’s important we dissuade ourselves from the misconception that has beguiled our leaders for ages, hence preventing them from ever creating indigenous wealth, for and among our people.

This stems from the misguided perception that Ghanaians do not have enough to enable the State to raise the amounts it needs. Nothing can be further from the truth. Let’s take for instance the said need for $500mill, for which reason we’re in a hurry to sell out the small amount we have left of our gold inheritance for a song.

All it would take is 1.5million individual Ghanaians willing to invest $350 dollars to enable our government to raise $525million dollars. In fact, even with a minimum individual investment of a $100 per person, a campaign to get 5million Ghanaians around the globe to purchase shares for government to get its much needed $500mill shouldn’t be unachievable.

Definitely, in practice, it will not require as many as 1.5million or 5million Ghanaians in order to raise the $500mill required by the State, since Ghanaians locally and abroad are capable of investing far more than $100 or $350, if the opportunity was presented; not to talk of institutional investors in the country.

Hence, raising such an amount shouldn’t be a basis for giving out a good chunk of shares to just any faceless investor in any such SPV.

Yet, if the government were minded to adopt the approach of reserving shares in this SPV to only Ghanaians, a limit could be placed on the maximum amount of shares that can be purchased by an individual, so as to ensure that as many Ghanaians as possible participate in benefiting from our royalties.

This is a very democratic way of nationalizing our share of inflows in gold revenue, to ensure that it goes to benefit as many Ghanaians as possible; both through the infrastructure that will be realized from the share purchases, as well as the dividends in the future.

Furthermore, putting a limit on the number of shares that may be purchased would prevent some unscrupulous Ghanaian individuals or institutions from being used as a façade by some profit thirsty investment juggernauts elsewhere to still cash in on this gold-backed SPV via the back door.

While at it, we must note that the proposition to reserve participation in some stock and commercial interests for citizens is nothing new. Such investment restrictions have been a major approach adopted by the ASEAN Countries to ward off the domineering effect of capital from developed economies, so as to enable them to develop their indigenous markets.

It’s no surprise then that they have succeeded in lifting their economies from poverty over the past half-century, while we continue to languish in abject need and penury. Brunei, for instance, has restrictions on foreign investment in its natural resources; mainly oil & gas and fisheries.

The Indonesian Investment Law has in place different levels of control and restrictions and puts limits on permissible shares of foreign investments in diverse sectors.

Malaysia, on the other hand, restricts foreign investment in financial services, where they are subject to equity limits, whereas Singapore restricts Foreign Investments in telecommunications, media, banking, and land ownership.

In a nutshell, to go list on the LSE with an SPV tucked off in a tax haven and sell shares without limits nor restrictions, shares most likely to be swallowed by persons with deep pockets, who may be already super-rich Ghanaians or foreign billionaires who care not if Ghana burns, is just a witless way of giving away what may be derived from the little left of the gold revenue that trickles down to us.

A classic reminiscence of how our forebears were infamously purported to have handed out our gold with reckless abandon, just because trivial goodies such as schnapps were dangled before them.

Taking A Stake On Destiny:

While the current initial amount to be raised, for which the Agyapa SPV is being justified by government raises concerns, it must be stated that listing on the LSE and seeking international capital participation in our development may well be given a fair consideration if the vision were commensurate with a bold and audacious plan.

For instance, it would be clearly appreciated if such a transaction were tied to the Ghana Infrastructure Plan (GIP) 2018 – 2047; which seeks to invest a total of $1.1 trillion over the next three decades; with an annual investment requirement of $2.3billion.

If the government were minded to come up with a clear long term financing strategy, with immediate and medium-term plans to finance the GIP by even leveraging our gold and part of some other natural resource royalties, which will mean an expedited delivery of necessary infrastructure with indicators of returns on investment over the medium to long term, I believe the debate would have taken a different course.

Since Ghana requires billions of dollars in a relatively short period to meet our infrastructure needs in an accelerated manner, it’s clear that our local financial market would not be capable of supporting this need by and on its own.

Here, a case could be made that our gold royalties may well be committed to a Strategic Development Sovereign Wealth Fund towards that end.

As such, major international players in the capital markets may be called in to participate, while still reserving the portion of shares that can be absorbed by our local market for Ghanaians.

In order to ensure that foreign participation doesn’t upend Ghana’s involvement in such massive capital requirements within a relatively short time, something in the form of the so-called B-shares can also encourage more listings that will raise more capital if we decide to proceed with the path of dispensing with equities.

B-shares are lesser or nonvoting shares and hence would not threaten the control of the State. Again, buyback clause and other such mechanisms may be put in place to enable Ghana gradually take over such a fund as our economic fortunes improve into the future.

Conclusion

To end, while it’s important that we relook at how best to optimize the revenues that accrue to the State, not only from gold but other commodities and resources.

In doing so, it’s crucial to structure the transactions in a manner that would not end up being counter-productive to our fundamental need to develop the local financial market; so as to systematically alleviate the extreme financial vulnerability of the Ghanaian State.

In that regard, the Agyapa transaction in its current form doesn’t stand to help us achieve that significantly.

In a country with a very weak currency where youth and the general citizenry have no safe nor stable means of getting decent returns on their savings to invest productively to support themselves and their compatriots, it’s only practical that we would reserve such opportunities, as presented in the Agyapa transaction for our people and our market.

However, it seems our financial decision-makers appear to be still caught up in the glamour and high falutin allure of the high fliers and satiated money bags of London, New York, Tokyo, and elsewhere.

As such, they seem quick to run to and present the little we have left of our gold revenues and other such monetary opportunities to them. As I have said repeatedly, it’s of central importance and vital urgency that we rethink how we consider development and wealth creation in this country.

Because, sadly, we continue to rob ourselves in order to enrich others in exchange for a pittance. This must stop, and we must use discussions around the current Agyapa SPV to reconsider these things.