Liquidate assets of Menzgold to pay customers – Charles Mensah

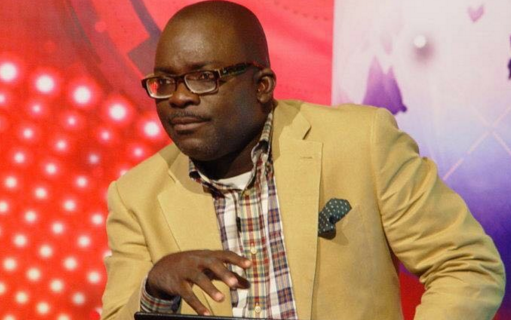

A Financial consultant Charles Mensah has called for the liquidation of the assets of gold dealership firm, Menzgold to pay aggrieved customers.

The financial advisor believes that it the surest way to get funds to settle customers who have been demonstrating for their investments to be paid.

But for the timely intervention by the police, Monday there would have been a mass suicide by Menzgold clients on one of Accra’s major highways (N1 Highway).

Police had been deployed to the headquarters of Menzgold to offer protection to property as well as persons, after customers whose funds are locked up with the firm, massed up to protest the failure of the company to pay back their funds.

Director of Operations at the Accra Regional Police Command, Supt. Kwesi Ofori, told Joy News the angry Menzgold customers rushed onto the road to carry out their plan, defying the high-speed at which vehicles were approaching.

Speaking in an interview with Evans Mensah on Newsnite on Joy FM, Mr Charles Mensah said the right action to take now is to request for the liquidation of the company because of what is happening.

“The Registrar General can request for liquidation of the company by virtue of what is happening,” he said and added that, “they can have a class action [approach] the court to ensure that there is a compulsory liquidation to the extent that the liabilities of the company cannot be met so they can liquidate.”

He explained that when that happens the “assets of Menzgold, the directors’ personal assets they can lift the veil of incorporation and sell those assets and then they begin to distribute to…those who have invested.

He cautioned that it was a high-risk venture because as long as one is earning high returns, the downside is that there is a high-risk venture and “they’ve lost.”

Mr Charles Mensah wondered how the government would come in and help salvage the situation.

In a country where there are regulations, the Financial consultant noted, “anybody who invests in a venture where they are not regulated in itself is a challenge and I was thinking that it was a signal for people to pull out” but that did not happen.

Thousands of customers of the gold dealership firm have for months now, are unable to access their investments after the Securities and Exchange Commission (SEC) ordered its closure, due to its unregulated business model.

Menzgold had earlier in the month, asked its staff to proceed on leave following increasing threats to its properties as well as staff of the company.

The December 4 statement also added that the company has been advised by the authorities to halt both online and offline trading to enable the authorities to assess the system and present a final say to the public and the company.

But SEC has said its directives to the company do not in any way stop it from paying monies they had taken from the clients.

Source: Myjoyonline