24-hour economy in the era of digital currency adoption: Implications on economy in 2025 and beyond

In our previous article, “Economic Evolution – Can a 24-Hour Economy Be the Solution to Our Structural Challenges?” published in Business and Financial Times and myjoyonline.com on October 8th, 2024 earlier this year, we explored the potential of a 24-hour economy as a transformative solution to some of the persistent structural challenges faced by Ghana.

The idea of a 24-hour economy is not new, but its relevance has gained new momentum, particularly as countries worldwide continue to adopt innovative solutions to foster growth. As we approach 2025, the landscape of global trade, finance, and economic interaction is changing rapidly, driven by digital technology. One such innovation that is altering the economic framework is the rapid adoption of digital currencies.

The convergence of a 24-hour economy and the adoption of digital currencies provides a compelling opportunity for Ghana to reshape its economic future. The 24-hour economy, where businesses and economic activities operate beyond the typical nine-to-five cycle, offers the potential to tap into untapped revenue streams, optimize productivity, and create jobs.

Crucially, the widespread use of digital currencies could further accelerate this transformation. Cryptocurrencies, in particular, have emerged as one of the most dynamic components of this new economic landscape. In enabling faster, borderless, and more secure transactions, digital currencies are not only enhancing financial inclusion but also creating a robust mechanism to fuel continuous, global economic engagement.

Globally, the shift toward digital currencies is not just theoretical; it’s already happening. Transactions involving cryptocurrencies have surged, with estimates showing that more than $10 trillion in digital assets were traded in 2021 alone (Blockchain.com). However, a significant portion of these transactions occurs without tax compliance, leading to substantial losses for governments worldwide. In many jurisdictions, including Ghana, the tax revenue from this booming market remains largely untapped, posing a major opportunity cost. According to the International Monetary Fund (IMF), digital currencies present an opportunity to enhance tax collection by bringing previously unreported transactions into the formal economy.

Ethiopia, for instance, has successfully capitalized on cryptocurrency mining, generating a staggering $55 million in 2022 (Africa News). This success highlights the revenue-generating potential of digital currencies, which could significantly bolster Ghana’s economy, especially considering the country’s challenges with energy supply. Meanwhile, Nigeria has made strides with its e-Naira initiative, the first digital currency issued by a central bank in Africa, while Ghana is actively developing its own digital currency, the e-Cedi, under the leadership of the Bank of Ghana. This push aligns with the Bank of Ghana’s ongoing solicitation for recommendations on the adoption and testing of digital assets, as the country aims to keep pace with the growing demand for digital financial services.

Furthermore, the BRICS economic bloc, consisting of Brazil, Russia, India, China, and South Africa, is nearing the completion of its plans to implement a digital currency, marking a monumental shift in the global financial system. As the BRICS nations prepare to adopt digital assets, the ripple effect could significantly alter the global balance of power in terms of currency usage, trade agreements, and economic alliances. The momentum behind digital currency adoption is undeniable, and it is critical for Ghana to embrace these advancements to harness the potential benefits.

However, as Ghana embarks on this transformative journey, it faces a daunting challenge: its energy deficit and rising national debt. With Ghana’s total public debt surpassing 100% of its GDP (Bank of Ghana), the country has limited fiscal space to fund extensive infrastructure projects or subsidize energy production. Despite these financial constraints, the integration of digital currencies into the economy can create new revenue streams, providing an innovative solution to the fiscal challenges. This, in turn, could support the expansion of a 24-hour economy, fueling economic growth and job creation even as the country contends with its energy and debt-related issues.

The path forward for Ghana involves harnessing the power of digital currencies to overcome these limitations. In tapping into this emerging market, Ghana can unlock new economic opportunities, attract foreign investment, and drive technological innovation. However, for the country to thrive in this new digital economy, it must prioritize the development of robust energy solutions, regulatory frameworks, and policies that facilitate the seamless integration of digital currencies into the national economy. The next step is to examine how Ghana can benefit from embracing both the 24-hour economy and digital currencies in greater detail.

Understanding the 24-Hour Economy

A 24-hour economy refers to a system where business and economic activities are not confined to a typical 9-to-5 working day but continue around the clock, allowing for the uninterrupted flow of goods, services, and financial transactions. Through extending operational hours across various sectors, a 24-hour economy enables a more competitive and efficient use of resources, fostering innovation and boosting overall productivity. The key sectors that benefit from this model include retail, financial services, transportation, entertainment, and, increasingly, digital infrastructure, all of which can operate continuously, allowing businesses to serve customers across different time zones and markets.

Countries that have successfully embraced the 24-hour economy include Japan, where technology and a culture of hard work contribute to round-the-clock industrial and service activity. Similarly, South Korea has leveraged this approach in sectors like logistics, e-commerce, and digital finance, which operate non-stop, creating a global competitive edge. These economies highlight the profound impact of extended business hours on national GDP, enabling them to remain connected to the world’s largest markets and respond dynamically to global economic shifts.

For Ghana, shifting towards a 24-hour economy would bring significant economic benefits, but it requires overcoming key challenges such as erratic energy supply and inadequate infrastructure. Ghana’s energy sector is facing persistent deficits, with electricity outages and power surges hindering the continuous operation of businesses. To fully capitalize on a 24-hour economy, Ghana would need to invest in renewable energy, enhance grid capacity, and secure more stable power sources to support industries that depend on uninterrupted operations, such as manufacturing and digital services.

The energy challenge is particularly critical as Ghana moves towards integrating more digital services. In a 24-hour economy, the continued operation of digital payment systems, e-commerce platforms, and financial services is paramount. Digital currencies, like the e-Cedi and cryptocurrencies, can act as key enablers of this transformation by facilitating seamless transactions that operate beyond traditional banking hours. Cryptocurrencies and digital assets allow businesses to engage in cross-border transactions and access global capital without being constrained by time zones or operating hours, making them essential for Ghana’s economic shift.

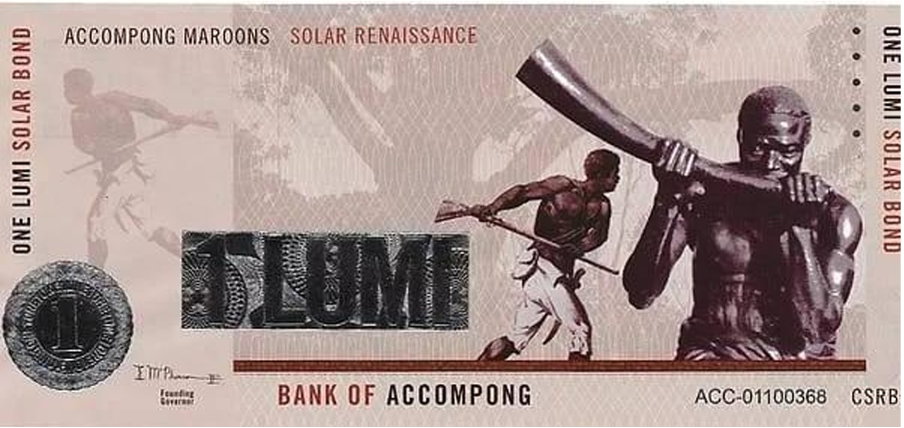

Globally, the increasing use of digital currencies, including Bitcoin, Ethereum, and emerging assets like Africa Kingdoms Lumi (AKL), highlights the growing importance of digital assets in a globalized economy. In 2022, Ethiopia raised $55 million through cryptocurrency mining, demonstrating how African nations can tap into digital currencies as a revenue-generating tool (Africa News). Nigeria’s adoption of the e-Naira and Ghana’s ongoing efforts with the e-Cedi further illustrate the growing interest in central bank digital currencies (CBDCs) and the recognition of their potential to modernize economies.

For Ghana, embracing a 24-hour economy integrated with digital currencies could be a game-changer. It would not only open new channels for revenue generation but also offer a solution to the country’s fiscal constraints, exacerbated by high energy debts, recurring public servant salaries, and maturing government bonds. The current state of Ghana’s debt—which has reached over 100% of GDP—along with the financial obligations tied to international loans, makes it difficult for the country to operate within its fiscal space. As the IMF and World Bank continue to provide limited solutions, Ghana must look beyond traditional methods and explore innovative financial strategies, such as leveraging digital currencies, to stimulate economic growth.

This paradigm shift would also help alleviate the financial burden on the government by enabling tax collection from digital transactions that are currently outside the formal tax system. With platforms like Binance and Hanypay facilitating trillions of dollars in annual cryptocurrency transactions, a significant portion of these funds could be brought into the taxable ecosystem, reducing the tax gap and increasing revenue streams (Blockchain.com). Moreover, adopting digital currencies would position Ghana as a leader in the African digital economy, providing the groundwork for the integration of various sectors into the 24-hour operational model.

As Ghana continues its path toward integrating digital currencies, the pressing issue of energy deficits remains. A robust and sustainable energy infrastructure must be built to ensure that businesses can operate smoothly around the clock, supporting the digital economy. Without this, the full potential of a 24-hour economy cannot be realized. Furthermore, the incoming government must take radical steps to reform fiscal policy, including addressing the energy challenge, restructuring the debt, and adopting innovative digital financial solutions to reset the economy. In the face of looming economic challenges, Ghana cannot afford to rely solely on traditional financial institutions like the IMF or World Bank. The fiscal pressures from servicing debt, paying public sector salaries, and other statutory payments demand a creative and urgent response. A digital currency-powered 24-hour economy could help break this cycle, providing a platform for long-term economic sustainability and growth.

The Role of Africa Kingdoms Lumi (AKL) in Shaping the Future

Africa Kingdoms Lumi (AKL) represents a pivotal moment in the development of digital currencies, particularly for the African continent. Unlike many traditional cryptocurrencies, AKL is backed by solar energy and gold, providing it with inherent stability and a secure foundation. Pegged at $15.96 per AKL for the next four decades, this fixed value ensures long-term predictability and security, making it an ideal asset for long-term investment. This feature, alongside its connection to sustainable energy sources, positions AKL as a reliable tool for both investors and nations looking to modernize and diversify their economies, especially in the face of challenges such as inflation and unstable global markets.

AKL’s creation is closely linked to the Eco-6 initiative, established under the Abuja Treaty in August 2019. This initiative aims to foster economic integration across African nations, streamlining trade and financial transactions while promoting technological advancement. Through AKL, Eco-6 offers African nations a digital currency that facilitates intra-Africa trade and enhances global financial inclusion. AKL serves as both a tool for economic growth and a symbol of Africa’s ability to innovate and integrate into the global digital economy.

One of the most impactful projects connected to AKL is the $9 billion IPADA Africa initiative, which includes the construction of six luxury cruise ships to be used in Africa and the Caribbean. Of these, four will be built in Nigeria, and two in the Caribbean, requiring over 1.5 million metric tons of steel. This massive project is expected to significantly boost the tourism sector, generating employment, attracting investment, and stimulating regional economic growth. In utilizing AKL as the primary currency for these transactions, this initiative integrates digital currency into high-impact, real-world projects, demonstrating AKL’s practical applications and potential.

In addition to tourism, the IPADA framework also focuses on the development of Geo-terminal energy projects in Rwanda and Vanuatu, aimed at harnessing volcanic eruptions to generate sustainable energy. These projects are designed to make Rwanda and Vanuatu major energy exporters, leveraging their natural geothermal resources. The financing of these energy projects, as well as the cruise ship initiative, is being facilitated through the AKL Stimulus Act by Eco-6. These projects not only contribute to sustainable energy generation but also enhance economic resilience, positioning Rwanda and Vanuatu as global leaders in renewable energy. These projects are part of the broader efforts to create a more sustainable and diversified economy under the IPADA framework, demonstrating the potential of AKL in driving infrastructure development and economic growth.

The AI training program in Rwanda is another key component of the IPADA Africa initiative. In December 2023, an MoU was signed at the La Campagne Tropicana Beach Resort in Lagos between Rwanda, Vanuatu, and the African Diaspora Central Bank. The MoU outlined plans for a 3 million-person AI training program to begin in 2025, aimed at equipping Africans with the skills necessary to thrive in the digital age. This program is part of a broader effort to develop the continent’s technological capabilities and prepare its workforce for the 4th Industrial Revolution. Rwanda, known for its abundance of gorillas, also offers unique opportunities for tourism development, making it a prime location for integrating AI and sustainable tourism as part of the larger economic strategy.

For Ghana, similar projects under the IPADA framework could provide a pathway for economic growth without straining public debt. The country could leverage its own natural resources, such as the potential for sustainable energy projects and tourism development, to stimulate job creation, economic diversification, and infrastructure growth. These projects, if financed through initiatives like AKL, would not only reduce the reliance on traditional debt mechanisms but also provide a more sustainable, long-term solution to the country’s economic challenges.

The synergy between the cruise ship initiative, energy projects, and AI training programs showcases the far-reaching potential of AKL. In supporting these projects, AKL offers an innovative way to drive economic growth and technological advancement while ensuring that the benefits are widely distributed. Through these strategic partnerships, Eco-6 and the African Diaspora Central Bank are helping to shape a new era of digital economy growth, creating jobs, improving infrastructure, and fostering a sustainable future for Africa

The Current Digital Currency Landscape and Its Economic Impact

The rise of digital currencies is fundamentally transforming the global financial landscape. Cryptocurrencies, central bank digital currencies (CBDCs), and emerging digital assets are rapidly reshaping how value is exchanged and stored. In particular, digital currencies have the potential to revolutionize economies by enabling faster, more secure transactions, reducing costs, and increasing financial inclusion. However, the most significant impact is seen in the ability to facilitate cross-border trade and investment without the limitations of traditional banking systems or the restrictions imposed by local currencies.

As of 2023, over $10 trillion in digital assets were transacted globally, with cryptocurrencies accounting for a substantial portion of this value (Blockchain.com). Despite the impressive growth in the digital asset market, a major concern remains the lack of tax compliance and regulation in many jurisdictions, especially in Africa. The unreported transactions on platforms like Binance, for example, have resulted in significant revenue losses for governments worldwide. For countries like Ghana, this represents a major opportunity to tap into a growing market that is largely untaxed, thus creating an avenue for increased government revenue. In adopting digital currencies and integrating them into the national financial system, Ghana can secure these untapped revenues and enhance its fiscal capacity.

The impact of digital currencies is already being felt in countries like Ethiopia, which raised $55 million in 2022 through cryptocurrency mining, showing the potential for African nations to generate substantial income through digital assets (Africa News). Furthermore, Nigeria’s e-Naira and Ghana’s e-cedi are both examples of central bank digital currencies (CBDCs) aimed at modernizing the financial systems of their respective countries. These initiatives are designed to increase the efficiency of financial transactions and reduce the dependency on cash, while also addressing issues such as inflation and financial exclusion. Ghana, under the leadership of the Bank of Ghana, is actively testing and promoting the e-cedi, making strides toward adopting a fully digital currency system that could drive the country’s economic transformation.

However, the rise of digital currencies, including those backed by government institutions like the e-cedi, does not come without its challenges. Many African countries, including Ghana, face energy deficits that can impede the smooth operation of a 24-hour economy powered by digital technologies. The energy crisis in Ghana, compounded by rising national debt, makes it increasingly difficult to provide the necessary infrastructure for digital financial systems to thrive. Digital currency systems require reliable energy sources to function continuously, as they depend on secure, always-on servers and blockchain technologies to process transactions.

At the same time, BRICS countries—Brazil, Russia, India, China, and South Africa—are moving closer to completing their digital currency adoption plans, further emphasizing the global trend towards digital assets. The shift toward digital currencies by BRICS will likely have a profound impact on global finance, potentially diminishing the dominance of the US dollar in international trade. As digital assets grow in importance, nations that adopt these technologies early, like Ghana, stand to gain both economically and strategically by integrating digital currencies into their economies.

Moreover, digital currencies can help countries like Ghana avoid over-reliance on traditional financial institutions like the International Monetary Fund (IMF) or the World Bank. These institutions often impose stringent conditions on loans, which can exacerbate existing financial pressures. With Ghana’s debt levels reaching critical thresholds, innovative strategies such as leveraging digital currencies and decentralized finance could offer an alternative path to economic revitalization. By adopting digital currencies like the e-Cedi and AKL, Ghana can avoid the burden of new loans while gaining access to a growing pool of international capital, enabling it to finance critical infrastructure projects without exacerbating its debt issues.

In this context, the adoption of digital currencies offers not only a financial solution but also an opportunity for economic sovereignty. The potential benefits extend beyond revenue generation and fiscal management; the shift toward digital currencies also aligns with broader global trends towards decentralization, economic diversification, and sustainability. In a world where traditional financial systems are increasingly being challenged by new technologies, countries that embrace digital currencies will likely be better positioned to participate in the global economy of the future

BRICS Nations and the Digital Currency Revolution

The BRICS bloc, composed of Brazil, Russia, India, China, and South Africa, is playing a pivotal role in the global shift toward digital currencies. These emerging economies are leading the way in adopting digital currencies, driven by the desire to reduce their dependency on the US dollar, enhance financial inclusion, and create more efficient monetary systems. As the BRICS nations move closer to completing their digital currency adoption plans, their influence on the global financial system is becoming more pronounced, signalling a monumental shift in how currencies are used in international trade and investment.

The digital currency initiatives within BRICS are not just about adopting cryptocurrencies like Bitcoin or Ethereum. Rather, the focus is on developing Central Bank Digital Currencies (CBDCs)—government-backed digital assets that can be used for everyday transactions, cross-border trade, and financial inclusion. China, for instance, has been a frontrunner in this regard, with its Digital Yuan already in circulation in select regions. Russia and India are also advancing their CBDC programs, with pilot projects underway, while Brazil and South Africa are exploring the potential benefits of digital currencies in their economies.

The implications of BRICS countries fully implementing digital currencies are profound. As the bloc collectively reduces its reliance on the US dollar, it could challenge the dollar’s dominance in global trade. This shift has the potential to reshape the global financial order, providing new opportunities for countries to engage in trade and investment without being subject to the fluctuations and restrictions of a single dominant currency. For African nations like Ghana, this presents a unique opportunity to diversify their foreign exchange reserves and become part of a more multipolar currency system, one that could provide greater economic stability and flexibility.

For Ghana, the adoption of digital currencies, particularly AKL, could position the country as a key player in this new global financial order. As BRICS countries embrace digital assets and create alternative financial systems, Ghana can use its membership in the Eco-6 initiative to integrate digital currencies into its economy, leveraging them for trade, investment, and economic diversification. By embracing AKL as a regional currency, Ghana could tap into the growing digital economy and access new markets while avoiding the volatility of traditional cryptocurrencies.

Moreover, the rise of BRICS digital currencies highlights the importance of blockchain technology and decentralized finance (DeFi) in creating more efficient, transparent, and secure financial systems. These technologies have the potential to revolutionize banking, payments, and trade, reducing costs and eliminating inefficiencies that have long plagued traditional financial systems. For Ghana, investing in digital infrastructure and blockchain technology could unlock significant opportunities for growth, innovation, and financial inclusion.

The adoption of digital currencies within BRICS is also an indication of the broader global trend towards greater digitization and decentralization of financial systems. As more countries explore the potential of digital currencies and CBDCs, Ghana must remain proactive in adopting these technologies to ensure it is not left behind. The introduction of AKL as a regional digital currency offers an ideal opportunity for Ghana to stay ahead of the curve, attracting investment and fostering economic growth in the process.

The potential benefits of digital currencies go beyond economic growth. By embracing these technologies, countries like Ghana can also improve financial inclusion, providing access to banking services for the unbanked and underbanked populations. With over 50% of Africa’s population still without access to formal banking services, the adoption of digital currencies could be a game-changer in bridging this gap and fostering inclusive economic development.

The Bank of Ghana’s Progress on Digital Currency Adoption

The Bank of Ghana (BoG) has been making significant strides toward the adoption of digital currencies, particularly the e-Cedi, as part of its broader vision to modernize Ghana’s financial system. Recognizing the transformative potential of digital currencies, the BoG has been actively exploring and testing innovative solutions to enhance financial transaction efficiency, security, and accessibility. These efforts aim not only to position Ghana as a leader in Africa’s digital economy but also to ensure that the country is well-prepared for the future of global finance.

On February 1, 2024, theEco-6 West Africa Secretariat, led by its trading partner, the Vanuatu Trade Commissioner to Ghana, paid a courtesy call to the President of Ghana to discuss the integration of the AKL digital currency into the central bank’s financial framework. This landmark meeting underscored the strategic importance of digital currencies for Ghana’s economic transformation. Following these discussions, the President directed the Ministry of Finance to work with relevant agencies, including the BoG, to develop a robust implementation plan for integrating digital currencies into the financial system.

Building on this momentum, on July 31, 2024, the Eco-6 Chairman visited Ghana and paid a courtesy call to the Deputy Minister of Finance. During this meeting, all necessary documentation to support the integration and implementation of digital currencies was officially submitted. This marked a crucial step toward operationalizing digital currencies within Ghana’s financial ecosystem, laying the groundwork for a seamless rollout.