Gold Surges to New Highs Amidst ‘Trump Trade’ Momentum

Inflation expectations are rising, causing concern among investors and impacting market trends.

The US presidential election is becoming a focal point for the market, with prediction markets favoring Trump.

Gold and Bitcoin are performing strongly, driven by inflation concerns and a potential shift in global liquidity.

‘Soft’ Survey data today (from Philly and Richmond Feds) were better than expected BUT – and it’s a big but – inflation expectations are surging once again…

Source: Bloomberg

…and current and expected spending on software and equipment (cough AI cough) is plunging?

Source: Bloomberg

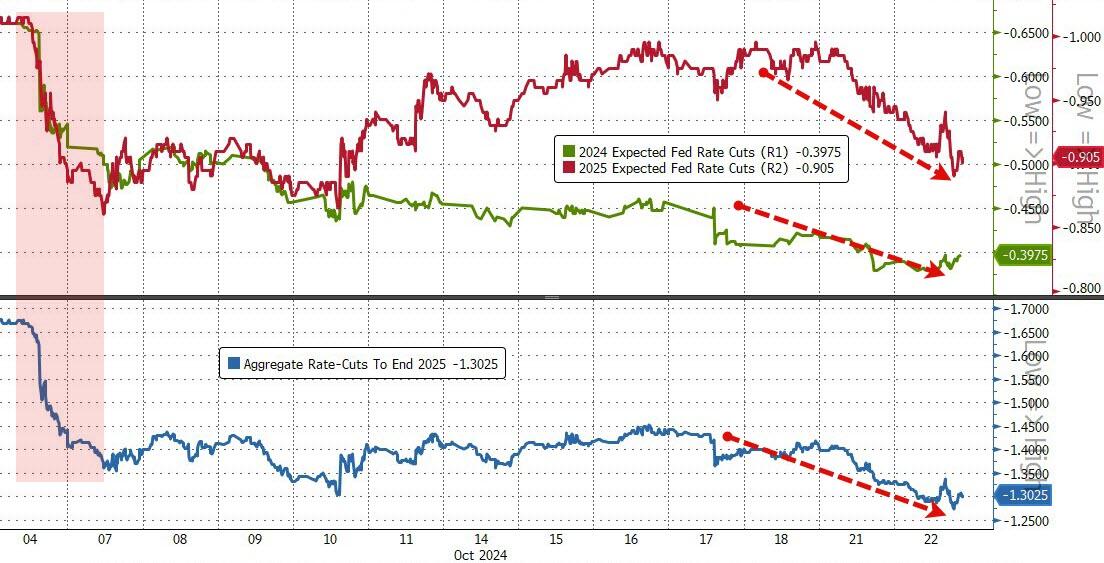

The surge in Prices Paid and Received dominated the downside in capex from the surveys and sent rate-cut expectations (hawkishly) lower again on the day…

Source: Bloomberg

So with all that said – and ignored – the market is now transfixed on the election… and the bets are one-way… on Trump…

Source: Bloomberg

Prediction markets are soaring in Trump’s favor and even the polls are swinging higher now…

Source: Bloomberg

Overall the majors spent most of the day under-water but an afternoon drift higher lifted Nasdaq and The Dow into the green for the day but a very late-day selloff spoiled the party…

Mega-Cap tech saved the day (with a new record high for the basket) from being really ugly…

Source: Bloomberg

Treasuries were mixed to flat today with none of the curve ending more than 1bps different close to close (the long-end was slightly more bid)…

Source: Bloomberg

The dollar continued its charge higher – albeit only modestly today…

Source: Bloomberg

Another day, another record high for gold, trading within pennies of $2750…

Source: Bloomberg

Silver also continues to outperform gold…

Source: Bloomberg

Crypto went nowhere fast today, with Bitcoin chopping around $67,000…

Source: Bloomberg

Crude prices rallied on the day, with WTI back above $70…

Source: Bloomberg

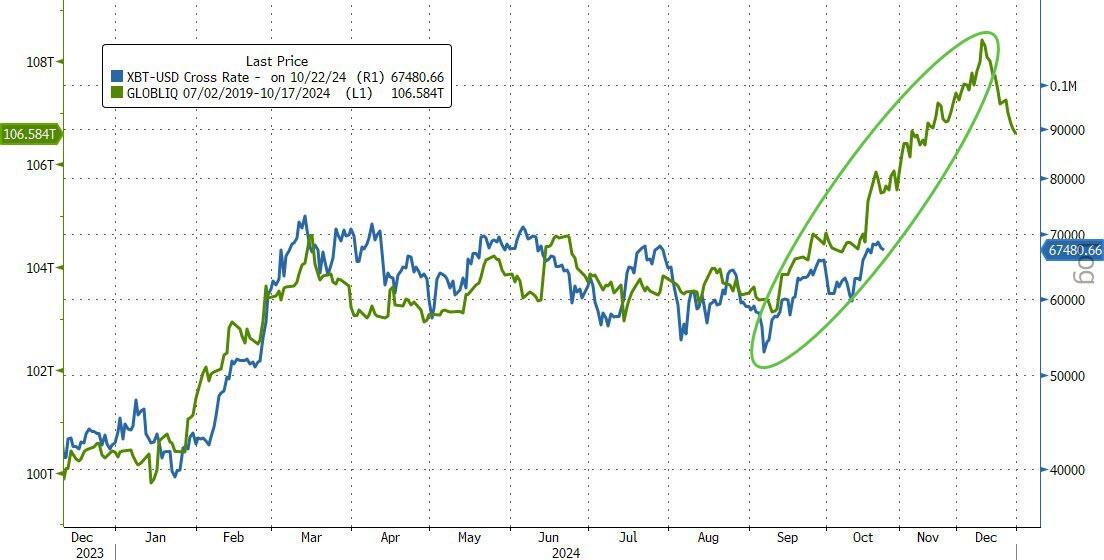

Finally, as gold accelerates, global liquidity (proxied by global M2) has turned down…

Source: Bloomberg

…but bitcoin has only just started to catch up with the tsunami…

Source: Bloomberg

We agree with PTJ on this one – not seeing either as an election trade, but as an inflation trade…”I think all roads lead to inflation. I’m long gold. I’m long Bitcoin. I think commodities are so ridiculously under-owned, so I’m long commodities…”