Oil Prices Are Rising on Renewed Optimism Over Chinese Demand

Oil prices are on the rise again, this time driven by renewed optimism over Chinese crude demand.

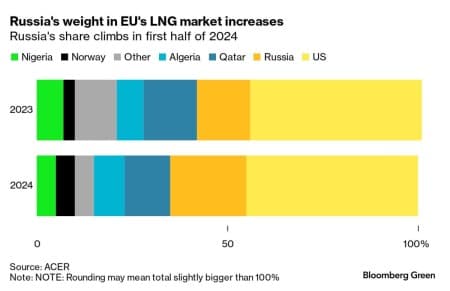

– Europe is considering its options to tighten sanctions vis-à-vis Russian LNG imports into Europe, having banned LNG transshipment operations from 2025 onwards, whilst gas importers keep on buying more.

– Thanks to higher utilization rates and the recent (surreptitious) launch of Arctic LNG 2, Russia increased its total LNG exports by 5% year-over-year in January-September 2024, to 24.4 million tonnes.

– The share of Russian LNG in the European Union’s total LNG imports rose ton 20% in the first half of 2024 compared to 14% a year earlier, with France becoming the main destination country for Yamal LNG flows.

– TotalEnergies, the national oil firm of France, holds a 20% stake in Yamal LNG which it did not relinquish as opposed to its stake in Arctic LNG2 and its membership in the board of directors of Novatek.

– According to Kpler data, France-bound flows are almost guaranteed to reach an all-time high this year, with only 7 more cargoes required to surpass 5.27 million tonnes from 2022.

Market Movers

– Norway’s state oil firm Equinor (NYSE:EQNR) has shut production from its Sleipner B gas platform due to a smoke alert in its power supply unit, although it said it would produce more from other fields to keep Europe-bound flows intact.

– UK oil major BP (NYSE:BP) is reportedly considering selling a minority stake in its offshore wind business, seeking to reduce the financing needs of its upcoming projects as it refocuses on the high-margin oil segment.

– US oil major ExxonMobil (NYSE:XOM) saw its proposed $1.28 billion sale of Nigerian onshore assets to local producer Seplat Energy finally approved by Nigeria’s oil regulator, formalizing its departure.

Tuesday, October 22, 2024

Oil prices were rising on Tuesday morning, even though Israel’s retaliation against Iran is yet to materialize. Hopes of a recovery in Chinese demand for crude have been pushing prices higher, with ICE Brent trading at over $75 per barrel. In the coming week, a combination of geopolitics and new macroeconomic data will likely decide where crude goes next.

Saudi Aramco Pins Hopes on Chinese Recovery. Amin Nasser, the top executive of Saudi Aramco (TADAWUL:2222), reiterated his belief in the strength of the Chinese market, saying Aramco still wants to increase its liquids-to-chemicals capacity to 4 million b/d, with a focus on China.

Canada’s CNR Takes on More TMX Exposure. Canada’s largest oil producer Canadian Natural Resources (TSO:CNQ) has reportedly taken over the 20-year term contract of PetroChina to ship oil via the 590,000 b/d TMX pipeline, increasing its total allocation by about 75% to 164,000 b/d.

Industry Warns of Delays in Next Wave of LNG Supply. French energy firm TotalEnergies (NYSE:TTE) predicted that the next wave of LNG supply would only come online from 2027, later than the earlier forecast of 2025, due to project delays, including its very own Papua LNG project.

IEA Expects Southeast Asian Demand to Soar. Despite a bearish outlook on global oil demand in general, the International Energy Agency expects Southeast Asia’s consumption to increase from 5 million b/d to 7 million b/d by 2050, second only to India in contributing to global energy growth.

Maduro Arrests Oil Minister on Treason Charges. Venezuela’s President Nicolas Maduro arrested Pedro Tellechea, the former oil minister of the country, after an ’exhaustive probe’ for serious crimes against the country’s highest interests.

Sudan Ready to Resume Exports After Repairs. The government of Sudan expressed its readiness to resume exports of South Sudan’s heavy sweet Dar Blend crude, shut in since February 2024 after clashes between government forces and the RSF militias damaged and ruptured the 100,000 b/d Petrodar pipeline.

India Expands LNG Import Capacity. India’s Hindustan Petroleum (NSE:HINDPETRO) is reportedly in the market to buy the first-ever cargo for its soon-to-be-commissioned 5 mtpa capacity LNG import terminal in Chhara, western India, as previous attempts to launch it earlier failed due to bad weather.

Port Workers’ Strike Threaten to Disrupt Brazilian Ports. Brazil’s National Federation of Dockworkers, Repair Workers, and Port Security launched a nationwide strike to protest against recent changes to the country’s labor law, delaying operations at both export and import terminals.

Future of US Hydrogen Hinges on Tax Credits. Darren Woods, the CEO of US oil major ExxonMobil (NYSE:XOM), stated that the company would scrapped its flagship Baytown hydrogen and ammonia plant in Texas is US federal hydrogen tax credits are not implemented in a technology-neutral way.

China Builds Inventory When It Shouldn’t. As China’s refinery runs posted the sixth consecutive year-on-year decline, averaging 14.29 million b/d, the Asian nation’s refiners have started to build inventory as the pace of imports and domestic production exceeded demand by 930,000 b/d.

Argentina Builds Oil Pipeline to Chile. Amidst continuously increasing Argentinian oil production from its shale Vaca Muerta play, the country’s leading producer YPF (NYSE:YPF) completed a 160,000 b/d pipeline to Chile that would feed ENAP’s Bio Bio refinery on the Pacific Coast with light crude.

Cuba Restoring Power After Multi-Day Blackout. Electricity supply across all of Cuba has been heavily restricted after the island country entered its third day of widespread blackouts, as Tropical Storm Oscar damaged power lines and lowered generation capacity to just 700 MW, a quarter of a day’s demand.

Hybrids Come to Dominate European Car Sales. Hybrids surpassed petrol-powered automobiles in EU new car sales for the first time on record last month, accounting for 32.8% of the 809,163 vehicles sold in September, benefitting from a 6% year-over-year decline in total registrations.