Surprise fall in inflation paves way for interest rate cuts

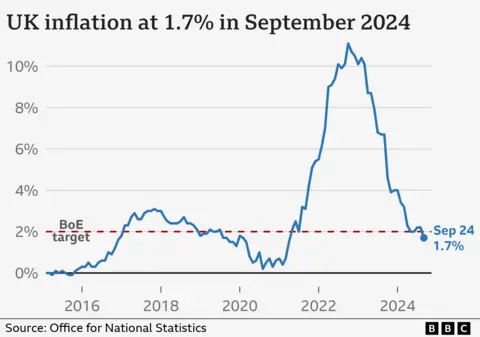

UK inflation fell unexpectedly to 1.7% in the year to September, the lowest rate in three-and-a-half years.

It means the annual rate prices are rising at is now below the Bank of England’s 2% target, paving the way for further interest rate cuts.

Lower airfares and petrol prices were the main drivers behind the surprise slowdown, official figures showed.

Separately, September’s inflation figure is also normally used to set how much many benefits will rise by next April.

UK interest rates are currently at 5%. The Bank made a first cut in August but decided to hold them last month.

It is already widely expected that they will be cut in November.

But the lower-than-expected inflation rate has also opened the door for a December cut too, according to Susannah Streeter, of investment firm Hargreaves Lansdown.

November rate cut ‘nailed on’

Danni Hewson, head of financial analysis at AJ Bell, said a 0.25 percentage point cut was “pretty much nailed on” for November and expectations of a second cut in December had “jumped up”.

Yael Selfin, chief economist at KPMG UK, warned that although the Bank would be likely to drop rates next month, inflation is likely to rise again with household energy bills increasing this month by around 10%.

The Bank’s base interest rate heavily influences the rates High Street banks and other money lenders charge customers for loans, as well as credit cards.

The higher level has meant people are paying more to borrow money for things like mortgages, but savers have also received better returns. Increased mortgage repayments for landlords can also result higher rents.

The cost of living has surged in recent years, with inflation peaking at 11% in 2022 – way above the Bank of England’s 2% target, partly due to the increase in energy prices following Russia’s invasion of Ukraine.

To try to slow price rises, the Bank increased rates to encourage people to spend less, and bring inflation down.

While the rate has dropped, falling inflation does not mean the goods and services are coming down in price overall, it is just that they are rising at a slower pace.

‘I’ve got to prioritise food and heating’

Maria says supermarket prices have gone ‘right up’

Maria is a helper at a St Andrew’s Community Network foodbank in Liverpool where people pay £3.50 a week to get fresh groceries and tinned goods worth about £25.

She also uses the foodbank, and says life would be “really difficult” without it.

Maria is able to take her kids out “once in a blue moon” when she has money left over, “but I’ve got to prioritise food, heating, gas, lecky”.

“I’ve noticed the prices in Asda and Aldi’s gone right up,” she said. “You don’t get enough money to cover it.”

The surprise fall in inflation last month to 1.7, down from 2.2% in August, was mainly driven by airfares and fuel.

Petrol and diesel prices were significantly lower, dropping by 10.4% in September compared with the same month a year earlier.

Airfare prices for domestic, European and long-haul flights normally fall after the summer rush, but they fell more than normal last month.

However, food and non-alcoholic drink prices rose, with costs jumping for milk, cheese, eggs, soft drinks and fruit.

This was the first time food price inflation has risen March last year.

Chief secretary to the Treasury, Darren Jones, said the drop in the pace of price rises overall would be “welcome news for millions of families”.

He added that the government is “focused on bringing back growth and restoring economic stability to deliver on the promise of change”.

The surprise fall in the UK’s inflation rate comes ahead of this month’s Budget, with Chancellor Rachel Reeves looking to make tax rises and spending cuts to the value of £40bn.

Reeves, who is finalising details of her first Budget on 30 October, warned ministers there would be “difficult decisions on spending, welfare, and tax”.

She is drawing up plans to find £40bn to avoid real-terms cuts to government departments, sources have said.

Benefits rise

September’s inflation data is normally used to calculate how much many benefits go up in April.

This includes the biggest: universal credit, which goes up at the government’s discretion.

All the main disability benefits – personal independence payment, attendance allowance and disability living allowance – as well as carer’s allowance, go up by at least September’s inflation rate by law.

The government has said it wants to shrink the UK’s annual disability and incapacity benefits bill.

A rise of 1.7% for benefits would be less than April’s expected rise in the state pension of 4.1%, which is determined by the so-called triple lock.