Ukraine’s incursion into Russia’s Kursk region earlier this month rattled the European natural gas market, pushing prices above 40 euros per megawatt-hour amid concerns that Russian natural gas supplies to the EU might be severed.

However, prices have since receded, with Goldman’s Samantha Dart telling clients Monday that the price rally is mostly “overdone.”

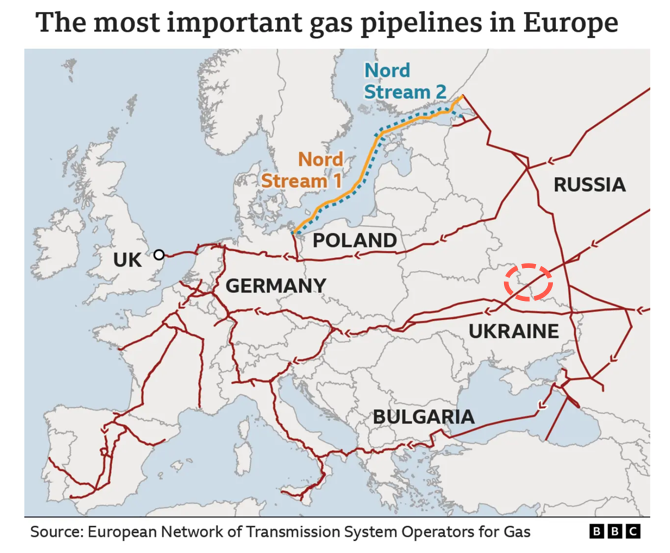

Last week, Ukraine’s president claimed that troops have control over the Russian town of Sudzha, about six miles inside Russian territory. Within the town is a critical gas measuring station where NatGas flows from West Siberian gas fields through pipelines that pass through Sudzha and cross into Ukraine and then into utilities in Austria, Slovakia, and Hungary.

Despite the fierce fighting and alleged Ukrainian control of Sudzha and the metering station, Russian state-owned energy giant Gazprom recently said NatGas flows into Ukraine from Sudzha have not been disrupted. Network operators in Austria and Hungary have also confirmed no disruptions.

Given this, Goldman’s Dart believes the price rally that surged from 30-35 EUR/MW to the 40 EUR/MW level on the pipeline supply fears has largely run its course.

“In our view this gas price rally is overdone for three main reasons,” she told clients.

Here are the three main reasons:

First, since Russian gas has continued to flow through the Ukraine, there has been no actual physical tightening of the balance, and we maintain our view that these flows will only halt from Jan25, when the existing Ukraine gas transit agreement with Russia expires.

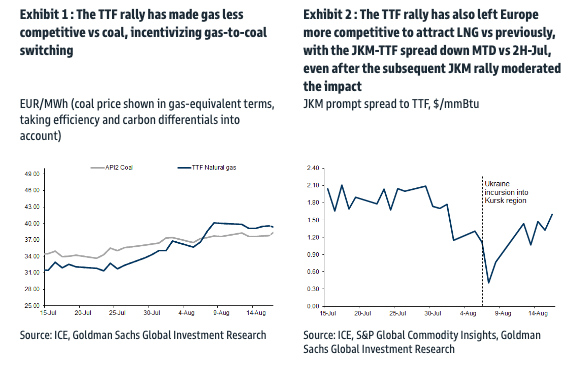

Second, while there has been no loss of pipeline supply, the longer these higher European gas prices are sustained relative to European coal and Asia LNG prices (Exhibit 1 and Exhibit 2), the lower the gas demand (owing to gas-to-coal switching) and the higher (potentially) European LNG imports, especially if the ongoing heat wave in Northeast Asia ebbs, helping soften the forward balance outlook for European gas.

Third, even if the current Ukraine flows were interrupted, we would not expect that to translate into a 1:1 tightening of the NW European balance. This is because other suppliers can step in to help offset the lost gas, such as higher Algeria flows to Italy, as we have seen during a previous interruption to the region, and higher gas flows to Hungary via Turkey, consistent with a gas trade deal announced earlier this year. From Jan25, when the Russian gas transit deal through the Ukraine expires, we expect German pipeline exports to Central/Eastern Europe to rise by 16 mcm/d on average as a result, which is already embedded in our balances.

Looking ahead, Dart forecasts Europe’s NatGas storage will be at a “comfortable 95% full” by the end of October.

She concluded:

That said, the TTF rally illustrates how sensitive the market remains to any tightening risks into this winter, and we agree that winter TTF price risks remain skewed to the upside relative to our 35 EUR/MWh forecast.

Austria, Hungary, and Slovakia still import NatGas from the Russian pipeline. The looming threat is if war persists and Moscow weaponizes energy flows to Europe in the dead of winter.