Can Green Finance lead the electrification of rural Ghana?

The electrification of rural Ghana remains crucial for economic development and social equity in the country. Despite significant progress in making energy accessible in urban areas, energy poverty persists in rural communities, where reliable and affordable electricity is still a distant dream.

As we continue to explore avenues to bridge this energy gap, green finance has emerged as a promising solution to the financing leg of this multi-faced problem.

This article delves into the strategic role of sustainable finance in addressing the current state of energy poverty in parts of rural Ghana.

The Current State of Energy Poverty in Rural Ghana

About 30% of people living in rural areas according to World Bank data are not connected to electricity services. This deficiency affects economic development, education opportunities and healthcare access in these parts of the country. Kerosene lamps and firewood are still the major sources of light and energy used by the majority of people residing in rural communities thereby posing health risks and environmental challenges.

Closing the energy gap entails several steps among them:

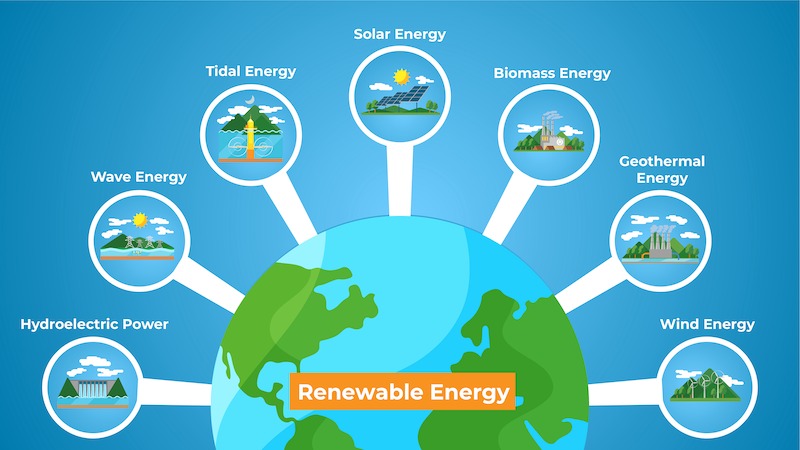

Renewable Energy investments such as Solar, wind, and mini-hydro projects that are custom-made for rural needs can provide a dependable power source over time.

Renewable energy represents a more cost-effective solution than conventional fossil fuels, particularly within areas where extending the national grid system is not commercially viable.

Eliminating energy poverty requires developing infrastructure which ensures all communities get affordable electricity. Innovative infrastructure like off-grid and mini-grid renewable power systems such as solar or wind could offer some access to power.

Furthermore, improved infrastructure would facilitate uninterrupted supply reducing blackouts besides maintaining constant electricity.

Equipping local technicians and entrepreneurs with renewable energy technologies could lead to innovation in the installation, operation, and maintenance of renewable energy systems, communities become capable of ensuring their Indigenous knowledge leads to less reliance on external expertise, reduced maintenance costs and promotes community-based service provision as well as resilience which eventually increases reliability and excess of power in these parts of the country.

Public-private partnerships (PPPs) can significantly reduce energy poverty in Ghana by leveraging the combined resources, expertise, and innovative solutions of government, private sector, and non-governmental organizations.

These collaborations can attract investments, drive down costs, and expedite the deployment of renewable energy projects in rural areas.

PPPs also facilitate the sharing of risks and responsibilities, ensuring more efficient and sustainable electrification initiatives that provide reliable and affordable energy access to underserved communities.

The Strategic Role of Sustainable Finance

Green finance has a strategic position in bringing electricity to rural Ghana through instruments designed for financially supporting sustainable projects.

These financial tools include green bonds, concessional loans as well as grants that could aid in raising the capital required for renewables.

Such will help attract investments towards sustainable development through leveraging such financial instruments.

For instance, large-scale solar farms, and wind projects can be funded by green bonds, while microfinance schemes can assist small-scale renewable energy enterprises in rural areas.

Furthermore, international climate funds and development banks are paying more attention to clean energy projects that minimize carbon emissions hence providing a big opening for Ghana to take advantage of these resources.

Challenges

There are several barriers to effective green finance which must be addressed if this approach is to contribute significantly towards improving energy accessibility.

One major challenge to sustainable finance initiatives is the high start-up costs of renewable energy projects and the perceived financial risks associated with them.

A stronger grassroots campaign is also required, through public awareness campaigns and training targeted at community members and businesses about opportunities in green finance.

Policy Implications and Recommendations

To harness the full potential of green finance for rural electrification, the following policy recommendations are essential:

Government policies should be simplified aiming at creating a conducive environment for investors in green finance including tax rebates and subsidies that benefit renewable energy projects.

Strengthening regulatory frameworks helps create an enabling environment for Ghana’s Green Finance investments.

This is needed to reduce financial risks and barriers, making it more feasible and attractive to invest in sustainable energy solutions so it speeds up the development, and deployment of renewable projects; therefore reducing energy poverty while enhancing long-term sustainability.

Public-private partnerships may also facilitate the creation of green financing instruments. Public-private partnerships can facilitate the mobilisation of resources as well as the specialisation required by sustainable energy projects.

Herein the Government taps into private sector innovation, funding, and technical know-how while leveraging public sector support and regulatory frameworks to accelerate this synergy thus implementing renewable projects faster, rationalising resource utilisation efficiency and improving scalability as well as the sustainability of energy solutions.

Moreover, financial institutions may engage in financial innovations such as “green bonds”, “green loans” or “impact investment funds” that could provide alternative investment routes so that investors can support renewable energy programmes more easily.

Most likely there would be an increase in the number of capital flows channelled towards clean energies hence leading to more project development or deployment support for long-term economic benefits along with environmental conservation.

It can further lead through capacity-building efforts aimed at understanding how different stakeholders stand to gain on matters related to climate finance.

For any understanding and knowledge about how green financing operates, people would be more involved in the green energy option selection as well as its promotion.

Additionally, this helps to build local expertise and encourages local innovation and investment.

Furthermore, Electrification project policies should focus on inclusive schemes, enabling marginalized groups to benefit from them.

Policies that take into account marginalised communities such as women are necessary for achieving inclusive initiatives on electrification.

Inclusivity ensures social justice and maximizes the impact of sustainable energy interventions by including those most affected by energy poverty.

To effectively drive sustainable development & better standard of living away from urban areas, green finance can help bridge the energy gap in Ghana when rightly applied.