While there is plenty to be bullish about in oil markets today, rising concerns over Chinese demand are weighing on oil prices.

Friday, July 19th, 2024

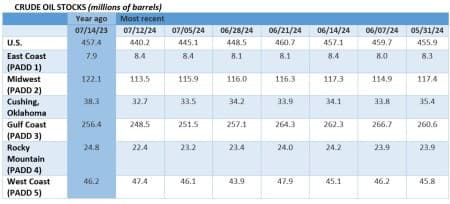

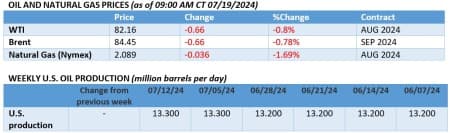

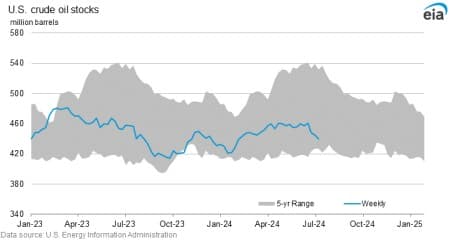

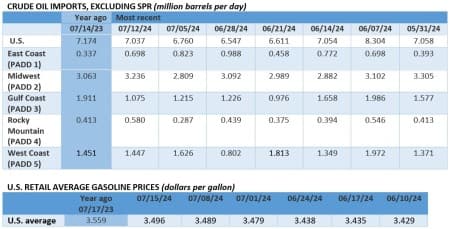

The consistent stream of positive news for oil from the United States, crowned by a largely unexpected 5-million-barrel drop in US crude stocks, has been offset by disappointment in China’s future outlook. The Third Plenum of China’s Central Committee barely saw any tangible pledges, with the lack of constructive takeaways reverberating across commodities. With Friday trading disrupted by the global IT outage, ICE Brent is set to close the week around $85 per barrel.

Tight Cushing Stocks Widen WTI Backwardation. The premium of front-month US crude futures over the M2 contract widened to its highest since October 2023 this week, as high as $1.60 per barrel, as shrinking stocks in the delivery point of WTI in Cushing fell to their lowest reading in three months.

Freeport LNG Cancels Cargoes as Restart Lags. The Freeport LNG export terminal has canceled planned loadings across the third quarter of July as damage from Hurricane Beryl seems to be more impactful than initially thought, with incoming feedgas flows still a fifth of their usual level of 2 BCf per day.

Exxon-Chevron Arbitration Hinges on Interpretation of Control. ExxonMobil’s (NYSE:XOM) legal bid to stop its US peer Chevron (NYSE:CVX) from taking over 30% of the Stabroek block under the $53 billion acquisition of Hess Energy rests on whether the transaction would involve a ‘change of control’ in the Guyanese subsidiary.

Two Tankers Ablaze Off Singapore Coast. Singapore’s maritime authorities are carrying out a search and rescue operation after reports of two vessels catching fire Friday, possibly indicating that the naphtha-carrying Hafnia Mile and the Iranian oil-carrying Ceres I VLCC tanker have collided in the night.

Australia’s Largest Oil Project Delayed Again. Australia’s leading upstream firm Santos (ASX:STO) has delayed the Dorado oil project again with an FID now expected for 2025, with the delay potentially linked to a revised project scope which would see peak production lower from the original 100,000 b/d plan.

US SAF Capacity Sees Rocket Growth This Year. The EIA predicts that production of sustainable aviation fuel in the United States could rise by a whopping 1400% this year if all announced capacity additions start up on time, increasing from 2,000 b/d last year to 30,000 b/d in 2024.

Suez Canal Revenue Plunges as Houthis Attack. The annual revenue of the Suez Canal Authority dropped by almost a quarter in its latest financial year to $7.2 billion as Houthi missile strikes in the Red Sea have prompted most Western shippers to avoid the world’s largest manmade canal.

Kinder Morgan Bets on Southeast US Gas Demand. US midstream major Kinder Morgan (NYSE:KMI) announced a large-scale expansion of its 6,900-mile Southern Natural Gas pipeline, adding 1.2 Bcf/day of capacity to the existing 4.4 Bcf/day, saying rising power demand and LNG exports provide ‘jaw-dropping’ opportunities.

UAE Mulls Construction of Second Nuclear Plant. The United Arab Emirates is considering building a second nuclear plant to meet soaring electricity demand in the country, with rumors suggesting a tender for a four-reactor plant could be announced as soon as this year.

Germanium Prices Soar to Records Amidst China Buying. Prices of germanium, a rare metal required for chipmaking, have hit record highs of ¥13,250 per kg ($1,830/kg) this week amidst market speculation that Beijing is boosting its strategic stockpiles by buying around 100 metric tonnes.

Turbine Collapse Sparks US Wind Debate. The Vineyard Wind offshore wind project developed by Denmark’s CIP and Avangrid was shut down until further notice after a turbine blade failure caused debris to wash up across the beaches of Nantucket, sending shares of GE Vernova (NYSE:GEV) down almost 10% on Wednesday.

Nigeria’s Onshore Exodus Turns Nasty. French oil major TotalEnergies (NYSE:TTE) sold its minority share in onshore SPDC joint venture project to a largely unknown Maurities-based investor Chappal Energies for $860 million, only months after Shell sold its 30% stake to a Nigerian consortium for $2.4 billion.

Lack of Chinese Stimulus Depresses Copper. Three-month copper prices on the London Metal Exchange dropped to their lowest in three months this week, at $9,329 per metric tonne, after China’s Central Committee meeting this week failed to provide any tangible details on economic stimulus measures.