An Accra High Court has set July 10, 2024, to decide whether Nana Appiah Mensah will walk free or be compelled to open his defence.

Mr Mensah, popularly known as NAM 1 and his companies — Menzgold Ghana Limited and Brew Marketing Consult Ghana Limited — have been charged with 39 counts.

The charges comprise selling gold without a license, operating a deposit-taking business, inducement to invest, defrauding by false pretence, fraudulent breach of trust and money laundering.

On Wednesday, July 10, the court will determine whether the prosecution has sufficiently proven the offences he has been charged with after calling nine witnesses to the stand.

It was the case of the prosecution that the accused and his associates (NAM 1) induced people to invest in breach of the Company’s Act.

Additionally, the prosecution said the monies deposited into NAM 1’s company accounts were withdrawn, some of which went into his account.

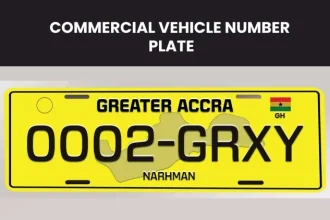

According to the prosecution, the Brew Marketing Consult, (the third accused), “is unknown to the Minerals Commission as a company licensed by the government of Ghana to purchase and import gold.”

The Director of Public Prosecution (DPP), Mrs Yvonne Attakora Obuobisa, further stated that evidence has been provided regarding celebrity endorsement.

“We have led evidence that customers who came to this court to testify invested because they saw advertisements and the adverts were to persuade these customers to enter into a gold deal with NAM1 and Menzgold.

“They (accused persons) did the adverts giving the impression they were licensed to do the business they claim to do and it was not in a vacuum and our evidence is that people responded and invested. The witnesses we brought to this court stated that they went to Menzgold because of the advert they saw,” she submitted.

Despite the witnesses hauled before the court and the evidence provided, Kwame Boafo Akuffo, counsel for NAM 1, insists the prosecution has no case and subsequently filed a submission of no case.

The defence team stressed that the prosecution had not provided sufficient evidence against their client.

Mr Akuffo argued that only nine alleged victims had testified, which he claimed was insufficient to substantiate the accusations of widespread fraud.

He also contended that the charges of money laundering and defrauding by false pretences were mutually exclusive and that NAM1 had paid taxes during his business operations, suggesting legitimacy.

Furthermore, he argued that the prosecution had not proven that NAM1 lacked a license to sell gold.

NAM 1, currently on a GH¢500 million bail with four sureties, has pleaded not guilty to all charges.

The court’s decision on July 10 will be pivotal in determining the next steps in this high-profile case.