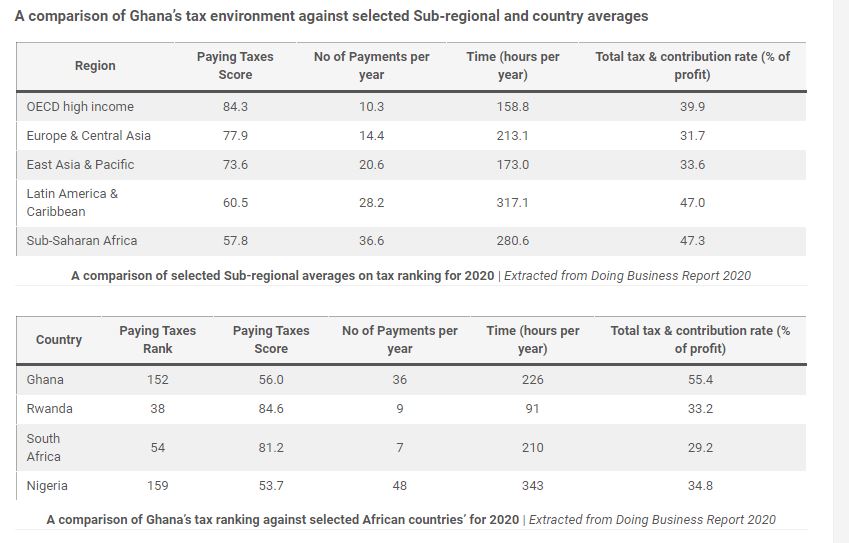

Ghana’s score of 56 on the Paying Taxes indicator in the last Doing Business Report is lower than the average 57.8 for Sub-Saharan Africa.

With the score, Ghana ranks 152 out of 190 countries on the Paying Taxes indicator which compares tax regimes and other regulatory payments regimes across the world.

Ghana ranked 122 with a score of 62.9 in 2017.

Data contained in the last report published in 2020, show also that taxes and other statutory and regulatory payments may cost up to 55 per cent of profits as against a regional average of 47.3.

For the entire report, Ghana ranked 118 on business environment in 2020 dropping from 108 in 2017.

The Doing Business Report published by the World Bank compares business regulation in countries across the world.

The Paying Taxes Indicator in the report compares the taxes and mandatory contributions that a medium-size company must have paid or withheld in a given year, as well as the administrative burden of paying taxes and contributions in an economy.

The report entails also all those processes that occur after a firm complies with its regular tax obligations. These include tax refunds, tax audits and tax appeals.

“In particular, Doing Business measures the time it takes to get a value added tax (VAT) refund, deal with a simple mistake on a corporate income tax return that can potentially trigger an audit and good practices in administrative appeal processes,” the report says.

A business entity located in Ghana has to make 36 kinds of payment each year, spending a total of 226 hours to meet those obligations, the report has said.

In South Africa which ranks 54, a business has to make 7 payments spending 210 hours and may cost up to 29.2 per cent of profits.

Nigeria ranks 159 with 48 times payments each year costing businesses 38.4 per cent of profits, and spending 343 hours.

A business in Rwanda is required to pay 9 times costing it 91 hours and 33.2 per cent of profits.

Mr. Charles Idun, Manager of Jabez Hotel in Swedru and Chairman of Ghana Hotels Association in the Central Region told the Ghana News Agency that the cost build-up for running a hotel or a guest house business in the country was precisely high.

The range of taxes and levies in the leisure and hospitality industry include National Health Insurance levy, VAT, Ghana Education Trust Fund levy, COVID-19 levy, Ghana Tourism Authority levy, Environmental Protection Agency levy, and Food and Drugs Authority levy.

Then there are various levies imposed by MMDAs, Fire Service levy, one per cent tourism levy, and mandatory Social Security contributions for staff.

In the Cape Coast Metropolis and the Komenda-Edina-Eguafo-Abrem Municipality, Mr. Idun said the property rates had gone up about 500 per cent.

“The property rate of a hotel in Elmina has increased from GHC700 to GHC27,000 and from GHC800 to GHC20,000. This is unheard of.

“As I’m talking to you, big and small hotels alike are owing so much. Fees that we used to pay at less than GH¢3,000 weekly or monthly, are now paying twice that value leading to workers’ layoff,” he said.

“We have appealed for special utility tariffs regime and payment plans for the sector as well as the scrapping of some duplicate taxes but to no avail,” he explained.

Although there is tax-free regime for certain items imported for use in the hotel and hospitality industry, such as bedding, towels, cutlery, plates, and utensils, that policy existed on paper, he said. The procedure to access the benefit was very cumbersome, thereby making it virtually non-existent, Mr. Idun added.

Some economists have called for the country to introduce a number of measures to improve its domestic revenue mobilsation and tax

administration regime.

According to the Ghana Revenue Authority’s (GRA) 2022 Annual Report, the country’s tax-to-GDP ratio was 13.1 per cent, “considering a

non-oil GDP of GH¢577,282.96 million, for that fiscal year.”

Ghana’s debt stood at GHS575.5 billion in June, representing 71.9 per cent of Gross Domestic Product (GDP) as of the first half of 2023, according to the Summary of Economic and Financial Data published by the Bank of Ghana (BoG).

The external component of the debt was GHS315.8bn in January, representing 39.4 per cent of GDP, but reached GHS328.6bn in June, which is 41 per cent of GDP.

The Government introduced debt exchange programmes as a means to manage the public debt as one of a number of measures towards

achieving economic stability, a condition for an International Monetary Fund (IMF) programme.

As of 2023, Government is implementing a three-year US$3bn IMF loan-support programme, aimed at making the country’s debt sustainable.

As part of the deal, Government is required to improve domestic revenue mobilisation.

In pursuit of that responsibility, the Government, through the Ghana Revenue Authority announced new tax compliance measures intended to raise the needed revenue for national development.

However, some trade associations expressed their reservations over the new measures. The Traders Advocacy Group Ghana (TAGG) said, raising GH¢181.5 million through the monitoring activities of a taskforce was an indictment on the operations of GRA and Custom systems at the ports.

TAGG said it was unfortunate that the GRA was allegedly misleading the public into believing that the traders did not follow tax regulations and engaged in unlawful activities such as smuggling, under declaration, misdescription and concealment.

TAGG asked the Authority to acknowledge and investigate issues of extortion and bribery levelled against some members of the Taskforce.

Meanwhile, GRA has told the Ghanaian business community and the public in general that it was delivering on its mandate excellently. It declared in March 2023 that it had exceeded its revenue targets in sterling performance over three years under its Commissioner-General Rev. Dr. Ammishaddai Owusu-Amoah.

It said it generated GH¢ 178.16 billion between 2020 and 2022 against a combined target of GH¢171.66 billion, exceeding its target by GH¢6.5 billion, representing 3.79 per cent in excess.