Expect new taxes in 2019 Mid-year Review

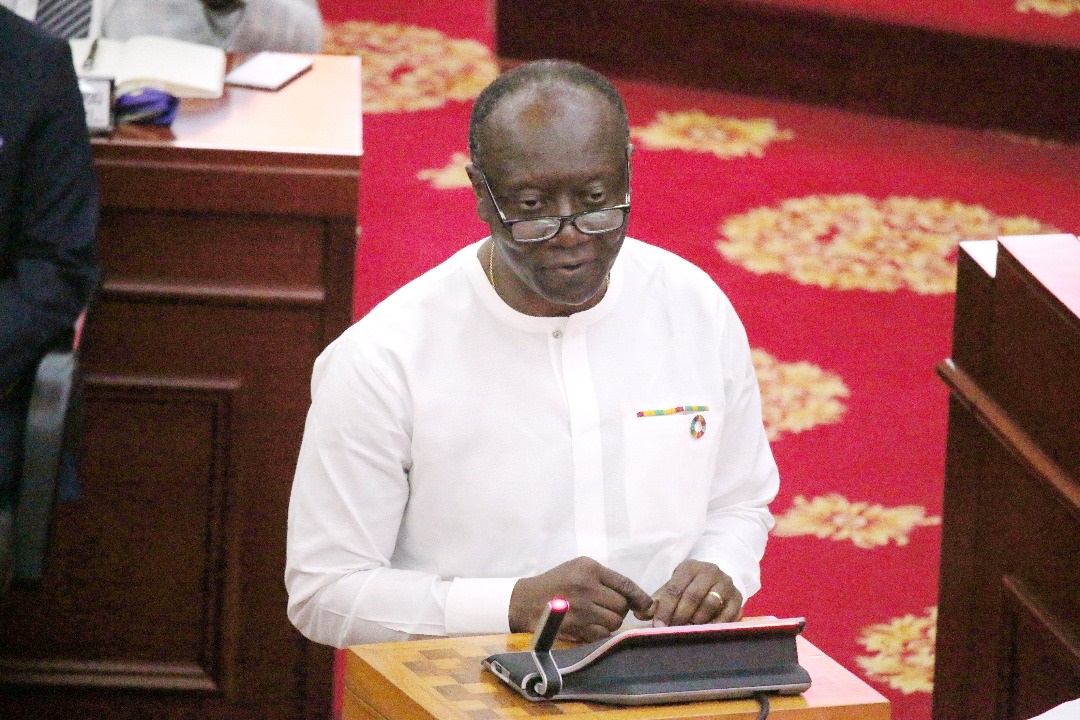

Finance Minister Ken Ofori-Atta, will announce new taxes in the Mid-Year Review and Supplementary Budget presentation today.

A Deputy Finance Minister, Kweku Kwarteng, who disclosed this to Joy Business in an exclusive interview said that the move is part of plans to put the economy on a strong footing while helping to improve the livelihood of Ghanaians.

“These new measures have been carefully considered and these are specific interventions to achieve specific fiscal objectives,” he told Joy Business.

The Deputy Minister also stated that “these modifications to the various taxes are in line with the 2019 Budget objectives which are aimed at promoting economic growth, generate jobs and promote prosperity.”

These broad themes would guide the plane tax and revenue measures.

Today’s Mid-Year Review

According to a statement issued by the Finance Ministry, Ken Ofori-Atta is expected to appear before Parliament at 10 am on Monday 29 July for the Mid-year Review presentation which is a constitutional requirement.

This year’s presentation will have a particular focus on issues affecting the energy sector, alongside their planned reforms.

Another major area expected to be addressed is the financial sector’s performance.

Ghana’s debt situation, domestic revenue mobilisation and the review of the Luxury Vehicle Tax will also be highlighted.

In a nutshell, the review will focus on the following:

– a brief overview of the macroeconomic developments (2018 & 2019);

– analysis of revenue, expenditure, and financing performance for 2019;

– a revised fiscal outlook for the unexpired term of the financial year; and

– overview of the implementation of the annual budget

Justification of the proposed tax measures

The current administration, since it assumed the helm of the state affairs 2017, has argued that it wants to focus on production rather than taxation.

Why is the government working to introduce some new taxes?

The Deputy Minister of Finance, Kweku Kwarteng, has argued that even though it still stands by this policy, the government is confident the new taxes in a bid to stabilise the economy.

Mr Kwarteng added that the government’s focus is still aimed at improving tax compliance despite the new taxes in the offing.

“If you take our tax measures in total since, the beginning of this administration and the reliefs taken, you would realise that it’s a government that is working to lessen the tax burden as a means of promoting growth,” he said.

The Deputy Minister was of the view that the government was also working to stabilise the economy so that businesses can thrive to pay the required taxes.

What is Joy Business picking up on these taxes?

Joy Business is learning that these taxes are likely to target the communication and energy sectors.

On the energy sector, it could be placed as a levy on some of the produces consumed by the public.

However, judging from previous instances in the presentation of the budget, some last-minute adjustment or even changes could occur.

Deputy Minister of Finance on the Luxury Taxes on Vehicles

The Minister noted that the tax on Luxury Vehicles will not be scrapped but rather some amendment would be made to it.

He revealed the amendments are based on some stakeholder engagements and government’s broad tax policy measures such as:

Government’s Revenue Policy Measures in the 2019 Budget

Government’s strategy for revenue mobilisation is to continue the agenda of improving revenue performance through the implementation of the following tax policy measures among others in 2019:

– Support for the textile industry: In order to curtail smuggling and counterfeiting in the textile industry, it is proposed that the tax stamp policy be extended to the textile industry. Government proposes to zero-rate VAT on the supply of locally made textiles for a period of three years.

– Review of the Income Tax Band: Government to give further relief to Ghanaians, proposes to review this band to impact monthly incomes above GH¢20,000 at a rate of 30 per cent.

– Tax Identification Number: The government will begin to apply sanctions to state and private entities that fail to enforce TIN requirements. Additionally, citizens will be required to have a TIN to access social services and benefits provided by the state.

– Deployment of Nation Builder’s Corps (NABCo): The GRA has been assigned 10,000 officers from the NABCo who will be deployed to identify and register potential taxpayers and follow up on arrears. The data will be used to update the Ghana Revenue Authority (GRA) taxpayer database.