Oil Prices Unmoved By Large Crude Inventory Build

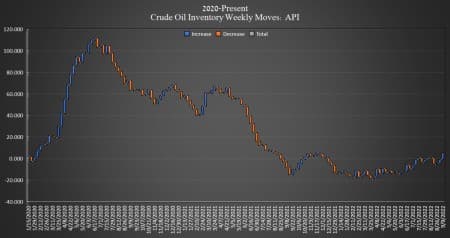

The American Petroleum Institute (API) reported a build this week for crude oil of 6.035 million barrels, while analysts predicted a draw of 200,000 barrels.

The build comes as the Department of Energy released a record-setting 8.4 million barrels from the Strategic Petroleum Reserves in the week ending September 9, leaving the SPR with just 434.1 million barrels.

In the week prior, the API reported a surprise build in crude oil inventories of 3.645 million barrels after analysts had predicted a draw of 733,000 barrels.

WTI fell on Wednesday prior to the data release, with inflation figures in the United States coming in higher than expected, serving as a threat to oil demand. At 12:50 p.m. ET, WTI was trading down $1.34 (-1.53%) on the day at $86.44 per barrel—a roughly $4 per barrel increase on the week. Brent crude was trading down $1.69 (-1.80%) on the day at $92.31—a $4 increase on the week.

U.S. crude oil production data for the week ending September 2 stayed the same at 12.1 million bpd, according to the latest weekly EIA data.

The API reported a draw in gasoline inventories this week of 3.23 million barrels for the week ending September 9, on top of the previous week’s 836,000-barrel draw.

Distillate stocks saw a build of 1.75 million barrels for the week, on top of last week’s 1.833-million-barrel increase.

Cushing inventories were up by 101,000 barrels this week. Last week, the API saw a Cushing decrease of 772,000 barrels. Official EIA Cushing inventory for the week ending September 2 was 24.783 million barrels, down from 25.284 million barrels in the prior week.

Oil prices were still down after the release, with WTI trading at $87.61 (-0.19%) and Brent trading at $93.42 (-0.62%).