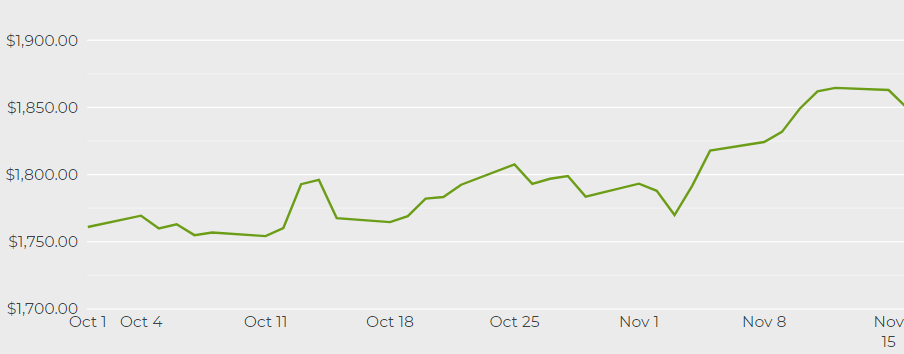

Gold price holds near 5-month high

Gold prices bounced back on Wednesday, holding near their highest levels since June, as inflation worries continue to push investors toward the safe-haven metal.

Spot gold rose 0.8% to $1,865.18/oz by 11:30 a.m. ET, erasing its losses from the previous session. US gold futures gained 0.7%, trading at $1,867.30/oz in New York.

“The underlying support for gold and silver remains the inflationary pressures we continue to see in the market,” said David Meger, director of metals trading at High Ridge Futures, in a Reuters report.

Gold prices jumped by more than $50/oz following the latest US inflation data, which showed a sharply higher CPI for the month of October with a headline rate of 6.2%, the highest in over three decades.

Bullion’s latest rally comes despite a stronger dollar, which was fueled by bets for early interest hikes by the US Federal Reserve.

The dollar – which contends with gold as a safe store of value – touched its highest since July 2020 this week, also bolstered by better-than-expected retail data.

If Fed speakers, in the near term, signal asset purchase reductions may be speeded up to fight inflation or if the market believes rates would rise sooner-than-anticipated, bullion could come under some “light pressure,” Meger added.

The US central bank began phasing out its bond buying this month and expects to end purchases altogether by mid-2022.

“Rate hikes remain a potential risk for gold and only a clear break above $1,875 may drive further gains,” Carlo Alberto De Casa, external analyst at Kinesis Money said.

Analysts at UBS see risks of further strength in CPI in early 2022, which “could stoke even stronger demand for gold.”

As such, the Swiss investment bank has raised its March-end gold price target to $1,800/oz, up from $1,700/oz, as well as its 2022 year-end target to $1,650/oz (from $1,600/oz).