The government will stay within the estimated GH¢ 111.3 billion expenditure for the year 2021, and introduce no new taxes, the Finance Minister, Ken Ofori-Atta, says.

The minister said this while acknowledging that the long stay of the third wave of the COVID-19 pandemic, could adversely affect the country’s economic recovery and transformation.

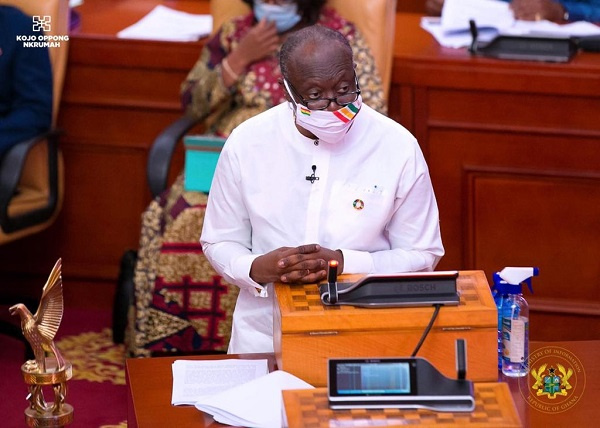

“I am not here today to ask for more money, not come to ask for more taxes, but simply, update you on the performance of the economy for the first half of 2021, and our plans for the unexpired term of the year. Our focus on taxes is to collect what is due the Republic,” Mr Ofori-Atta said.

He said this on the floor of Parliament in Accra when he delivered the government’s 2021 Mid-year budget statement and economic policy to Parliament on Thursday, July 29, 2021.

He quickly warned that “should the virus continue to linger for the rest of the year, the effect on the economy will be dire.”

Having said that, the minister indicated that the country could risk returning to another lockdown.

The minister, therefore, urged all Ghanaians to strictly observe the various safety protocols, especially the wearing of the mask.

“At a time when the economy is on the rebound, and business activities picking up, we must do everything possible to contain this outbreak. We cannot afford to return to the days of partial lockdowns, which brought considerable hardships and difficulties for all of us,” he stated.

The minister then pledged the government’s commitment to safeguarding the taxpayers’ money, saying, “I recognise the historic nature of this second term and I commit to protecting the public purse.”

Meanwhile, the government has already spent GH¢50.6 billion within the first six months of 2021 against the GH¢55.1 billion targeted expenditure.

There has been a revenue shortfall of GH¢4.1 billion. It has, as at the end of the first half of the year, raked in GH¢28.3 billion as against the target of GH¢32.4 billion.

New taxes introduced in 2021 budget

As part of measures to mitigate the impact of the COVID-19 pandemic on the economy, the government in the 2021 budget introduced a number of taxes and levies to shore up revenue.

This includes the COVID-19 Health Recovery Levy, which saw a one percentage point increase in the National Health Insurance Levy (NHIL), and a one percentage point increase in the VAT Flat Rate to support expenditures related to COVID-19.

Sanitation and Pollution Levy (SPL) of 10 pesewas on the price per litre of petrol/diesel under the Energy Sector Levies Act (ESLA); and a further Energy Sector Recovery Levy of 20 pesewas per litre on petrol/diesel under the ESLA.

There was also the financial sector clean-up levy of 5% on profit-before-tax of banks to help defray outstanding commitments stemming from the financial sector clean-up.

Additionally, it added there reviewed existing road tolls, and aligned them with the current market rates as part of the framework for promoting burden-sharing as the country seeks to transform the road and infrastructure sector amid the COVID-19.

The 2021 budget also saw the introduction of a gaming policy, which is aimed at supporting the government’s revenue mobilisation effort.

Nonetheless, the finance minister, in the mid-year budget review did not announce additional taxes, rather, said, the government would tighten its revenue collection mechanisms.

Second phase of Ghana CARES to revitalise and transform the private sector

On the GH¢100 billion Ghana CARES “Obaatanpa” programme, he said, the government, following the execution of the stabilisation measures in Phase I, would continue with the Phase to further strengthen the economy, and spur its transformation.

The policy, programmes and projects in this phase is primarily aimed at enhancing the quality of life of the Ghanaian people and further advancing the government’s transformation agenda.

READ ALSO: GH¢520million Disbursed To Protect 740,000 Jobs

To this end, he said, the government would continue to implement its flagship programmes to enhance the quality of life of the people. The programmes include Free Senior High School (free SHS), Planting for Food and Jobs (PFJ), and the One District-One factory (1D1F).

“Our strategy to place the private sector at the heart of this endeavour is to accelerate competitive import substitution and export expansion to generate sustainable jobs for our teeming youth (under 35 years), who make up about 71% of the population,” Mr Ofori-Atta said.

Making a pledge to this effect, he said, “I stand before this august house today to assure the nation that our transformation agenda is very much on course.”

He however said it is important to stress that the economy is only “a beginning that requires our collective sense of responsibility and action as citizens to guide, protect and participate in the recovery efforts.”