The Budget Statement for the 2024 fiscal year which has been scheduled to be presented on November 15, 2023, will highlight the Economic Policy of the government for next year.

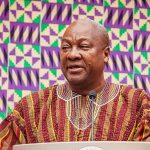

The Speaker of Parliament, Alban Sumana Kingsford Bagbin on Tuesday, October 31 charged legislators saying “As our oversight responsibility requires, we will have to scrutinize the budget to ensure that it serves the needs of all Ghanaians.

“I believe this House will adopt a consultative and consensus-building approach throughout this process,” he added.

As part of the preparation for the presentation of the 2024 budget and in line with Section 21(1) of the Public Financial Act 2016 (Act 921), the Ministry of Finance requested that labour unions and identifiable groups submit inputs for consideration in the 2024 Budget and Economic Policy.

The Key areas

–The 2024 Budget should outdoor programmes and initiatives that will address the high cost of doing business in the country. It’s very important that looking at where we are as a country, everything must be done to support the private sector to help them play a critical role in the recovery of the economy. In terms of focus, the 2024 budget should prioritise how to get the private sector back “into a stable” position. The private sector needs to be supported to help the managers of the economy to create jobs.

–The budget should address concerns of “high and many taxes” affecting the private and local businesses. Relevant stakeholders and unions have expressed worry over high and “nuisance” taxes that have engulfed the sector. Stakeholders like the Association of Ghana Industries(AGI), the Ghana National Chamber of Commerce and Industry(GNCCI), and the Ghana Union of Traders Association(GUTA) have spoken against issues about taxes. These burdensome taxes have hindered economic growth, stifled business development, and placed an unfair burden on hardworking Ghanaians and the effective operation of industries. The government must take immediate action to alleviate these challenges and foster a more conducive environment for businesses and workers. These taxes, often excessive and unnecessary, have impeded the growth and competitiveness of local businesses, stifling Innovation, investment, and job creation. The burden they impose on businesses is detrimental to their sustainability and ability to contribute to the economic development of Ghana. It is time for the government to acknowledge the adverse effects of these taxes and take decisive action to address them.

– The budget should implement programmes that will help in the expansion of the economy and sustain the recent recovery. The IMF expected Ghana to average about 1.5% growth, but they have already indicated that they will be reviewing that projection going forward. The budget should be committed to instituting programmes that will help sustain the recovery when it comes to growth in the expansion of the economy.

– Job creation should be considered an urgent necessity in the 2024 budget. The government must seize this opportunity to demonstrate its commitment to the welfare of Ghanaians by creating job opportunities, especially for the youth who have resorted to other means of surviving and enhancing the standard of living of the citizenry as a whole.

–Businesses and individuals want the government to scrap the E-levy. They also expect a review of the COVID-19 levy, petroleum levy and the growth and sustainability levy which was recently introduced as part of the government’s conditions to access the IMF bailout.

They are of the view that abolishing some of these taxes or lowering the tax rates may initially reduce tax revenue, but are likely to positively impact consumption and expenditure and thus, ultimately enhance tax revenue.

–The Ghana Federation of Labour (GFL) expects the 2024 Budget to be devoted to job creation in both the private and public sectors and reiterates the need for the government to take pragmatic steps to shore up the economy.

It has called for the implementation of sound economic policies that will ensure revenue mobilisation, job creation, and private sector development while appealing to the government to ensure a reduction in the cost of living and remove taxes that undermine the growth of businesses – small, medium, and large companies.

– A review of the current tax regimes on mining concessions to ensure an increase in government revenue. According to the Ghana Federation of Labor, a proper fiscal assessment of the natural resource sector will offer better insight into what opportunities exist for the government to leverage to mobilise the required revenue to prosecute government business.

– The government must be committed to the review of its flagship programmes, such as the Free SHS, Planting for Food and Jobs, One-District, One-Factory, Infrastructure for Poverty Eradication Programme, Ghana School Feeding Programme, Railways Development, Agenda 111, and Coastal Fish Landing Sites in the 2024 budget.

A critical assessment conducted on these programmes would determine the viability of these projects concerning the size of the resources invested and the corresponding short-term benefit to the state.

The outcome of such a comprehensive assessment should offer some suggestions on protecting the vulnerable in society, creating jobs, and promoting a sound economic and fiscal outlook.