Ghanaians are not satisfied with the government’s intervention in fuel prices as they face another transport fare increment by commercial drivers in the coming days.

The Finance Minister, Ken Ofori-Atta, announced a 15 pesewas slash on petroleum margins on Thursday, 24 March, but it fell short of the expectation of consumers.

“For the next three months, the government has decided to reduce margins in petroleum price build-up by a total of 15 pesewas per litre with effect from 1 April,” Mr Ofori-Atta stated.

“These reductions in margins are expected to reduce prices of petrol by 1.6% and diesel by 1.4%. We anticipate that the measures taken to strengthen the currency will help further stabilise the prices at the pump,” he explained.

In reaction, some Ghanaians took to social media to suggest that the cut was paltry, considering the fact that fuel prices had jumped to GHC 11 from the previous GHC8 in the last pricing window.

At the same time, the Ghana Private Road Transport Union (GPRTU) has said that the government’s move will not stop transport fare increments because the reduction will not decrease fuel prices below GHC8.8 per litre.

Samuel Amoah, a member of the National GPRTU Communication team, explained that at the last meeting held with the Ministry of Transport, it was agreed that fares would be increased if fuel price increments crossed 10%.

At the time of the agreement, the fuel prices were GHC7.99 on the average at the pumps.

“Now Shell sells at about GHC10.6 and Goil is about GHC 10.4. Some pumps sell as high as GHC11.

“If you remove GHC15 pesewas, it will not come down below GHC8.8.

“It is not significant enough,” Mr Amoah told Joy News.

According to him, so far as the new reductions will not take the prices below GHC8.8, it would affect their businesses; hence they are likely to still push for a fare hike.

The Spokesperson of the GPRTU, Imoro Abass, agrees with the submission as he maintained that: “The ¢0.15 is woefully inadequate, so we’d have to meet and decide on which way we are going to move”.

This is supported by other driver unions such as the Concerned Drivers Association of Ghana, the Committed Drivers Association and the True Drivers Union.

While the Chamber of Petroleum Consumers (COPEC) has criticised the government for failing to scrap taxes which builds up to the cost of fuel in Ghana, the Minority in Parliament says the Finance Minister has lost touch with reality.

Even though supply bottlenecks have caused a surge in prices on the international market due to ongoing conflicts between Russia and Ukraine, the situation has been compounded by the depreciation of the Ghana Cedi against other major currencies.

According to Mr Ofori-Atta, the cedi has seen a 14% depreciation against the US dollar this year which has affected the cost of the product.

Crude oil on the international market shot up as high as $130 per barrel following the Russia-Ukraine conflict.

At the beginning of 2022, petrol and diesel traded at an average GHS6.30 per litre at the pumps.

By March 2022, fuel prices crossed the GHC 8 per litre mark but are now being sold as high as GHC 11, causing a surge beyond 18 per cent in the second pricing window of March.

The Institute of Energy Security (IES) said fuel prices at the pumps have already witnessed a net increase of GH¢1.8 per litre (27%) for both petrol and diesel since the start of the year and for five consecutive pricing windows.

Compared to March 2021, the report also revealed that the price of petrol and diesel has surged by roughly GH¢3.33 per litre, suggesting a 65% increment.

What can be done to address the situation?

Despite the country producing oil in large quantities, the lack of refineries has prevented the country from enjoying lower prices of finished products.

As of September 2020, crude oil production capacity in Ghana was 196,000 barrels per day.

However, Ghanaians continue to buy fuel at exorbitant prices due to importation and taxes slapped on the commodity.

COPEC-Ghana Executive Secretary, Duncan Amoah, told The Ghana Report:

“We have a local refinery that we could have leveraged to get some fuel security at lower prices, but unfortunately, we don’t think there is a political will to refurbish the Tema Oil Refinery”.

Mr Amoah observed a fully functional refinery would cut the logistical cost, which adds to the price build-up by exporting crude to Europe to be refined before importing back to Ghana.

“They need to get TOR back on stream, and the need for political interference to be stopped holds the key for all for us,” he underscored.

Additionally, he cited the failure of BOST in executing its mandate.

Mr Amoah explained that BOST is supposed to store huge volumes of fuel and release to the market to level prices and check shortages “without overstretching the already burdened Ghanaian taxpayer”.

However, “we do not see that function of BOST, and they are now focusing on trading…which was not the purpose of the BOST Act but to hold strategic stock”.

Additionally, Mr Amoah wants the government to scrap taxes that add up to the fuel cost on the market.

This is because there are about 12 different taxes and levies on petroleum products, which adds up to almost 40% of the fuel price.

These taxes include the Energy Debt Recovery Levy, Road Fund Levy, Energy Fund Levy, Price Stabilisation and Recovery Levy, Sanitation and Pollution Levy, Energy Sector Recovery Levy, Special Petroleum Tax and Primary Distribution Margin, BOST Margin, Fuel Marking Margin, Marketers’ Margin and Dealers (Retailers/Operators) Margin.

Mr Amoah wants parliament to place a ceiling on fuel taxes because no legislation specifies what is permissible.

Consequently, “any Finance Minister can slap any amount of fuel taxes and if parliament goes ahead to accept without scrutiny Ghanaians will be doomed”.

The legislation would cap fuel taxes, and finance ministers would be compelled to look for revenue from other sources once the threshold is triggered.

“Consumers should not be taxed beyond 25 per cent of the cost of fuel products,” he said.

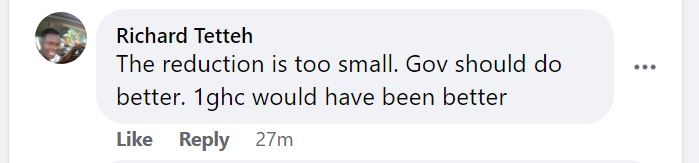

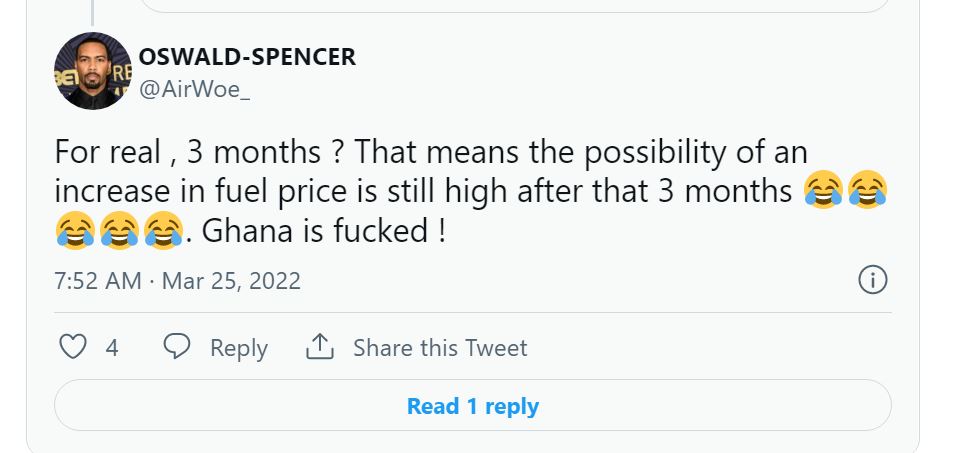

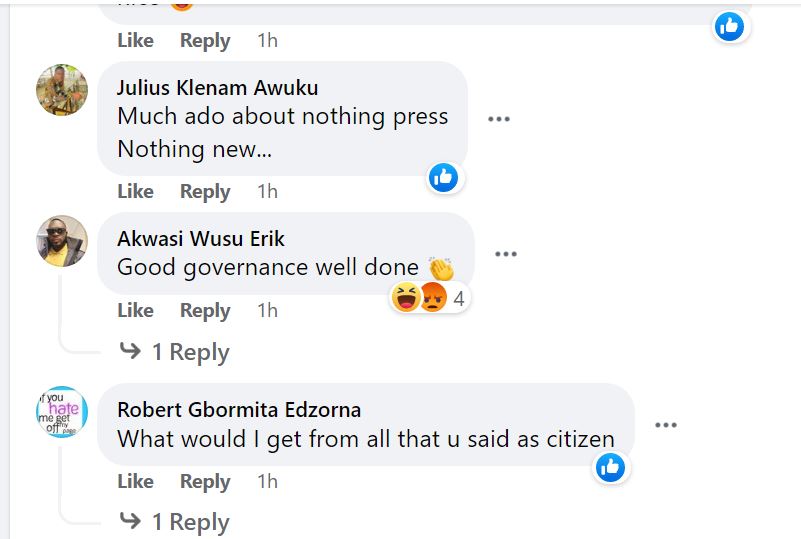

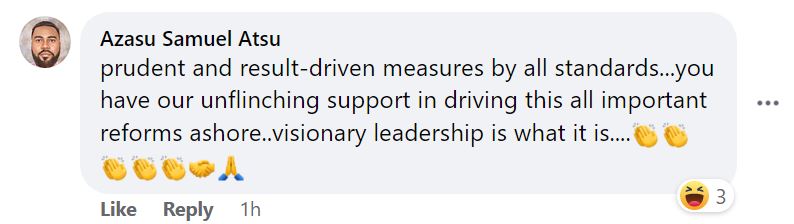

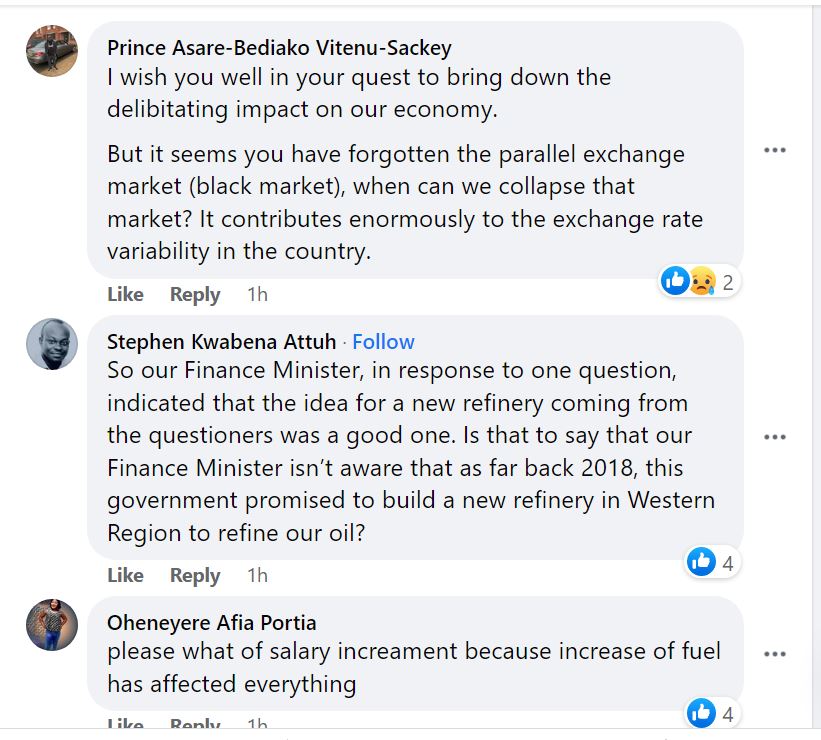

Below are some reactions by Ghanaians on social media over the latest development: