$100 Oil? Traders Bet on Middle East Disruption

For months, oil traders shrugged off any threat of a supply shock in the Middle East, betting on softening demand from China and the West, along with hopes of increased production from OPEC+.

Bearish sentiment dominated the global market in late summer and early fall. But this week, the oil market faced a rude awakening after Iran launched several waves of ballistic and hypersonic missiles against Israel, sending bears scrambling and prices jumping above $75/bbl.

The broadening war in the Middle East comes as Israel has vowed a “painful” response to Iran’s attack early in the week. Brent prices rose 4.5% in the last three days, with further gains likely ahead as Prime Minister Benjamin Netanyahu could use stealth fighter jets to neutralize the Islamic Republic’s oil infrastructure export capabilities.

On Tuesday, Helima Croft, head of the global commodity strategy at RBC Capital Markets, joined CNBC’s “The Exchange,” informing hosts and audience, “There has been a lot of complacency about this war,” adding, “We do need to think about a scenario where Iranian oil supplies are at risk.

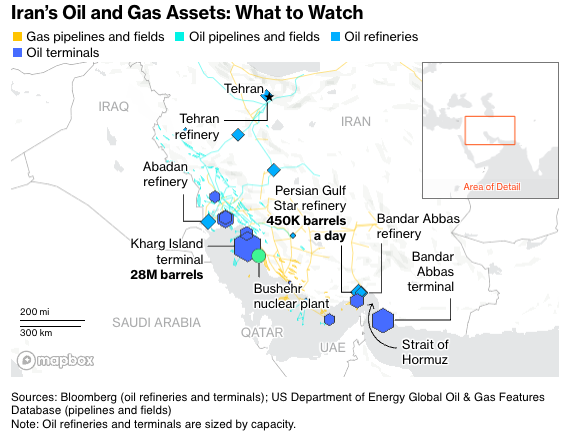

Citigroup analyst Francesco Martoccia told clients that any IDF strike on Iran’s export capacity could reduce 1.5 million barrels of crude per day from the global market overnight. He said a minor attack on energy infrastructure, such as downstream assets, could remove 300,000 to 450,000 barrels of daily output.

For energy research desks, it is unclear how the IDF will respond to Iran. Scenarios include hitting energy infrastructure to high-value military assets and nuclear sites.

Bloomberg provided readers on Thursday morning with a detailed map showing Iran’s major energy installations, including oil and gas fields, pipelines, refineries and storage terminals:

We tend to agree with Ross Schaapp, head of research at GeoQuant, who told CNBC’s “Squawk Box” on Wednesday that Israel might try to cripple Iran’s ability to export oil. As the saying goes, ‘follow the money’… and if Israel wants to neutralize Iran, in terms of paralyzing financial networks, start with crude export abilities.

GeoQuant’s Schaapp noted that any IDF attack on Iranian energy infrastructure would send Brent prices higher “dramatically.”

This week, Brent’s implied volatility gauge climbed to its highest level in nearly a year. In options markets, a surge in Brent call options shows traders forecasting $100/bbl.

Bloomberg noted on Wednesday, “The equivalent of almost 27 million barrels of Brent December $100 calls traded by 11:20 am in New York while more than 7 million barrels worth of US crude December calls changed hands.”

Meanwhile, Bloomberg Intelligence analyst Henik Fung told Terminal users, “Traders unwinding short bets could push crude prices higher on a wider war-risk premium,” adding, “WTI could retest $80 in the short term.”

Scott Shelton, an energy specialist at TP ICAP Group Plc., noted, “The odds are against a material loss in production, but when it comes to geopolitics, it’s always a hard call.”

The world awaits Israel’s response. One top energy research desk emphasized to us on Wednseday that it’s almost guaranteed Israel will make a retaliatory strike against Iran. The big question is, what will IDF stealth jets strike?